Hashtalk: 5-Min Monday Macro, Crypto & AI: 7th October 2024 - Delayed

China stimulus, Meta's impressive Connect, RISK ON sentiment

Apologies we are late this week. Been busy mentoring some founders and some youth.

I spend hours reading, researching and talking to the smartest founders and investors every week. This is my attempt to give you a short 5-10 minutes summary on how I am thinking about Macro, Crypto & AI markets, and what lies ahead. Hundreds of hours summarised, so you don't have to.

For live updates, you can join our Telegram Channel or listen to the experts that we bring on our our podcast “Greed is Good”

“Fit Body, Calm Mind and a House Full of Joy

—Naval Ravikant, my all time favorite

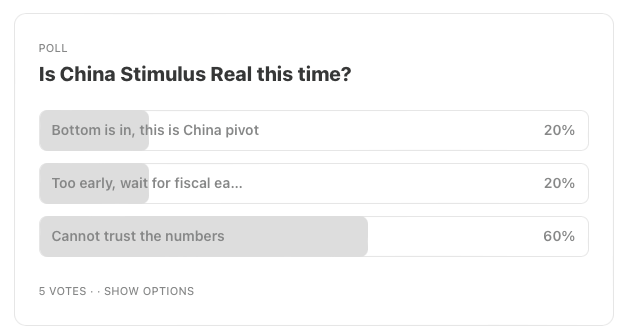

Weekly Hashtalk Poll

Last Weeks Poll Results - You still don’t trust Xi and PBoC? Start trusting. More bazookas coming IMO.

THE MACRO ZEITGEIST

Real Liquidity - US Economic Data vs Chinese Data Structural Issues

The past few weeks have felt like an eternity, with the markets spinning from one headline to the next. It’s been a whirlwind of central bank moves, global power plays, and of course, crypto waiting for its turn at the party.

The Fed, Liquidity, and Rate Cuts: A Global Boost

At the start of the month, we predicted the Fed would be pushed into a 50 bps rate cut. You can catch up on our earlier points here. Since then, the data has been promising, and now we think the Fed might tap the brakes a little, going for a more modest 25 bps cut when they meet right after the elections but everything depends on CPI numbers this Thursday.

That initial 50 bps cut sent markets into celebration mode, like kids who just found out recess was extended. Meanwhile, China, watching from the sidelines, waited for its moment and then dropped its own massive stimulus measures. Markets in Hong Kong and Shanghai lit up like a firework show, to say the least.

But just as things were heating up, Iran decided to bring actual bazookas to the party—now everyone’s holding their breath, waiting to see how Israel will respond.

Crypto? Still lingering by the punch bowl, taking baby steps toward a new all-time high, hoping for its moment to shine.

The US Economic Data: Strong, Resilient, and Defying the Bears

The US economic picture remains robust. For months now, we’ve been saying—there’s no recession coming, folks! And so far, the data supports that. Unemployment’s at 4.1%, inflation is cooling, and the jobs market is holding strong. While some doomsayers try to spin a different story, the numbers are painting a different picture. Don’t listen to the bears when it comes to US macro; the economy is chugging along nicely, for now at least.

China’s Stimulus Wave and Structural Problems

Over in China, the markets were on pause last week for the Golden Week holidays, but the Chinese are back in full force. Traders and brokers are buzzing with excitement over new stimulus and the promise of more reforms. But let’s be real—China’s economic issues are like trying to fix a leaky faucet with duct tape. Stimulus helps, but it’s not the long-term solution.

Still, here’s the kicker: the stock market isn’t the same thing as the economy. Stocks can keep soaring as long as the People’s Bank of China (PBoC) and the government keep pumping out good news and monetary stimulus. That confidence trickles down fast. Retail investors open accounts, start buying stocks, traders jump in, hedge funds on the sidelines can’t resist, and before you know it, the indices are rebalancing and pushing everything higher. It’s like a market-wide game of FOMO (fear of missing out).

Sure, the real economic problems haven’t magically disappeared. But for now, the market sentiment has done a complete 180, and that’s fueling this rally. We’ll see corrections along the way, but there’s an implicit “put” under Chinese stocks for now—they’re riding the liquidity wave.

The Bottom Line

In the short term, liquidity reigns supreme. As long as the Fed, the PBoC, and other central banks keep turning on the liquidity taps, risky assets, including crypto, stand to benefit. But for China, the long-term story is far from over. Stimulus will keep things afloat for now, but those structural issues aren’t going away anytime soon.

Meanwhile, keep an eye on US data. It’s been the bedrock of market confidence, and as long as it holds steady, it should continue to support risk assets. And don’t forget about Iran’s bazookas; geopolitical tensions could throw a wrench into the works at any time.

In short: ride the wave, but keep your eyes wide open—there’s plenty more drama to come.

The China Beta Trades: A Tale of Copper & AUD

When China awakens, so does the market—especially when stimulus is involved. Take Copper and the Australian Dollar (AUD) as prime examples. At first, everything rallied as traders rushed in to grab whatever alpha they could. Copper surged, the AUD strengthened, and it felt like the party was just getting started.

But, as we’ve seen time and time again, all good parties come with a hangover. The RSI (Relative Strength Index) was holding above 90, signaling that these markets were overheated, and a correction was brewing. Sure enough, stocks corrected, and Copper along with the AUD followed suit.

The Longer-Term Outlook: Stimulus vs. Real Demand

While China’s stimulus may continue to buoy stocks for now, the real test lies ahead. If real demand doesn’t return, particularly in key sectors like manufacturing and construction, we could see a pullback in Copper prices, which are highly sensitive to industrial demand. And since Australia’s economy is so deeply tied to China’s appetite for raw materials, especially Copper and Iron Ore, a dip in Copper would likely drag the AUD down with it.

We touched on China’s stimulus and its underlying structural issues last week, but there's more to the story. Things had gotten so dire that, in my opinion, we’re witnessing a coordinated global liquidity push. China, Japan, the US, and possibly the EU, are all in on this. Japan raised rates, the Fed and ECB followed with cuts, and China unleashed a massive stimulus package. It’s like they all got together and decided, “Let’s keep this global engine running, no matter the cost.”

But before we dive into the charts, let’s talk about how bad things have gotten in China.

The Reality in China: Structural Issues Lurking Beneath the Stimulus

China’s economy has been struggling with serious structural problems—real estate issues, debt overhang, and sluggish consumption growth, to name a few. The stimulus helps, but it’s a band-aid on a much deeper wound. Without real demand kicking in, particularly from global trade, the longer-term sustainability of this rally is questionable.

That said, liquidity can keep markets afloat for quite some time. In the near term, we could see more gains, but don't get too comfortable—this is a delicate balancing act. If demand doesn’t recover, Copper and AUD might start feeling the heat again. Stay nimble and watch the data closely; the next move may depend on China’s ability to turn this short-term liquidity wave into real, sustained growth.

Now, let’s take a look at some charts to understand just how deep the cracks run in China.

DATA TO WATCH THIS MONTH

1. $NVDA AI Summit - Monday

2. PepsiCo $PEP Earnings - Tuesday

3. Fed FOMC Minutes - Wednesday

4. U.S. CPI Inflation - Thursday

5. Jobless Claims - Thursday

6. Tesla $TSLA Robotaxi Event - Thursday

7. AMD $AMD AI Event - Thursday

8. JPMorgan Chase $JPM Earnings - Friday

9. U.S. PPI Inflation - Friday

10. U.S. Consumer Sentiment - Friday

MACRO SUMMARY

US stocks are waiting for bullish season to start soon. Perhaps close to elections.

China stimulus has given some firepower to the stocks there but structural problems remain.

Thursday CPI will decide if FED will cut or not and that will decide the direction of yields & the dollar.

I think we remain in a “choposolidation” mode this week.

STOCKS, BONDS & FX

Stocks

It's all about Chinese stocks this week. The Asian dragon has suddenly awakened, and it's stirring the global markets, leaving everyone wide-eyed and restless. The big question on everyone's mind: Is this the real deal, or just another fleeting bubble? Could China be on the brink of a sustainable revival, or is it ultimately destined to follow Japan’s deflationary path?

China has sparked these rallies before, only to fizzle out under pressure from overleveraging, government crackdowns, and a slowing economy. So, while the surge is exciting, there's a looming uncertainty: Will China finally break out of its long-term sluggish cycle, or are we witnessing yet another short-lived rally in a market that might soon face the same fate Japan did post-1990?

Markets are caught between optimism and skepticism, and how this unfolds could ripple far beyond Asia’s borders.

CRYPTO

Macro & Liquidity: The Calm Before the Storm?

The macro and liquidity landscape is looking quite favorable right now. The U.S. is showing signs of recovery, with unemployment hovering at a solid 4.1% and inflation easing off its historic highs. As a result, central banks across the globe seem to be conspiring (in a good way!) to cut interest rates and unleash a fresh wave of liquidity.

To prevent further contractions in manufacturing across major economies like the U.S., EU, and China, we can expect even more rate cuts, boosting global liquidity to new levels. This is great news for risky assets, especially crypto. But crypto has found itself in a bit of a pickle lately.

Crypto's Identity Crisis

Since the start of this year, crypto has been undergoing a significant structural shift.

For years, we’ve followed a predictable pattern: Bitcoin rallies, which lifts Ethereum, then the altcoins follow, and eventually, the floodgates open for the riskiest "shitcoins." It was a nice, rhythmic dance that we all knew well.

But this year? The music’s changed. With the introduction of Bitcoin ETFs, much of the money that would normally flow from BTC into the rest of the crypto ecosystem is stuck in those low-cost ETFs. It’s become easier for smart money to park their funds and hold onto BTC without dabbling in the altcoins. And let's be real—those ETF investors aren’t trading meme coins like us degens. As a result, the BTC money isn’t trickling down to the altcoin ecosystem as it used to.

Over the last few months, it feels like we’ve just been recycling the same pot of money—moving from old coins to the newest shiny listings and fresh memes. It’s like we’re all playing musical chairs with tokens. Everyone’s realized that by scooping up top altcoins and memes at discounted prices, you can almost guarantee a return.

A Flood of Supply Looms

One thing that keeps me up at night is the looming tidal wave of new token supply. This year alone, around $100 billion worth of new tokens have hit the market in the altcoin space. Here’s the kicker: $70 billion of that isn’t even circulating yet—it’ll take another 2 to 3 years to fully enter the market. But wait, there’s more! In the next six months, we’re looking at another $20–$30 billion in new tokens, with names like Monad, Berachain, and about 5,000 other projects gearing up to launch. And don’t forget the 10,000 meme tokens that seem to spawn daily.

So, we’re staring down the barrel of $150–$200 billion worth of new supply over the next year. The big question is: who’s buying all this? Where’s the money coming from?

Who’s Got the Wallet?

Smart TradFi money? They’re content lounging in their ETFs or playing arbitrage games with guaranteed returns. Venture capitalists? They’re either locked into long-term vesting periods or sitting on the sidelines, waiting for the right moment. And when their tokens do become available, they’ll face a tough choice: dump their positions or hedge. Either way, it’s going to create a ton of sell pressure.

Add the usual sell pressure from exchange listings, and what you’ve got is a potential recipe for disaster for any new token generation event (TGE).

My friend Arthur wrote a brilliant piece diving deep into this dynamic, and it’s definitely worth a read if you want to explore the details further.

The DApp Drought

To make matters worse, there’s no killer DApp out there that’s driving mass adoption from Web2 users. Without any significant influx of new players, crypto has turned into a PvP (Player vs. Player) game. We’re not seeing new users flock in—it's just the same group of traders moving from one shiny object to the next. Buy, rinse, repeat, sell. The rotation is alive, but it’s a different kind of game now.

Where’s the Opportunity?

This PvP market is highly fragmented. Multiple narratives, projects, and shills are popping up on multiple chains. It’s not 2018/2019 anymore. Just like in Web2, you’ve got to pick your battles. You can’t be everywhere, chasing every new meme coin or shiny new thing.

Take a deep breath, focus, and think strategically. Know your strengths. If you’ve been following my newsletters, you know we were bearish in Q3, but we’re cautiously optimistic for Q4. And with this wave of Chinese liquidity on the horizon, we’re feeling even more bullish. Once the dust from geopolitical tensions settles, we could see a massive rally in altcoins. But remember—it’s still a PvP game. You only need one or two big wins to make it count.

The Game Plan:

Conviction in a short list of assets.

Execution with clear sell targets in mind.

HODL when the time is right.

Sell—don’t get too attached.

Current Market Outlook

Like all markets, crypto seemed to front-run the usual October seasonality, but then Iran threw a wrench into the momentum. As I’ve explained, there’s a ton of uncertainty right now: Iran-Israel tensions, upcoming elections, Fed rate cuts, Chinese stimulus—the list goes on.

But amidst all this uncertainty, there’s a flood of liquidity, and more is expected to come. That’s why I doubt we’ll see a major crash. More likely, we’ll be in a period of "chopsolidation"—a choppy, sideways grind for the next week or two.

The 800-pound gorilla in the room is the U.S. election. The outcome could set crypto’s trajectory for the next phase. A Trump victory would likely mean more institutional money and government support, while a Harris win could lead to an initial sell-off, but a gradual recovery over time.

In this "chopsolidation" period, avoid unnecessary risks and leverage. Keep your altcoin shopping list ready, and buy the dips. Options are another way to take calculated bets. We’re seeing steady demand for December calls, suggesting the market remains bullish towards the end of the year.

With BTC down roughly 5% from last week’s highs, we believe the recent positive macro data supports the long-anticipated "Uptober" trend.

The key risk? Further geopolitical escalations—if Israel decides to retaliate, the impact could be significant.

Summary

Be patient. Buy dips in altcoins. And don’t forget—it’s all about finding those one or two big wins.

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

If you loved this, you may subscribe for immediate notifications on our latest episodes!

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!