5-Min Weekly Macro, Crypto & AI: 26th May

Sovereign Debt Circus Continues, Gold consolidating here, Bitcoin’s Coronation Moment

Hey!!!! Welcome to another fantastic week!

I spend hours reading, researching, and talking to the smartest founders and investors in macro, crypto, and AI every week. This is my attempt to give you a short 5-10 minute summary on how I am thinking about the macro, AI and crypto markets and what lies ahead. Hundreds of hours summarized, so you don't have to.

For live updates, you can join our Telegram channel or listen to the experts that we bring on our podcast, 'Greed is Good' - soon starting season 5

"The most certain sign of wisdom is cheerfulness."

- Writer and philosopher Michel de Montaigne

Or in simpler words - “If you are so smart, why are you not happy?”

I've been on the road a bit since our quarterly report a few weeks ago, which explains the pause in the weekly updates. Things should be back to a regular rhythm from here on. Hope you didn’t miss me too much :)

TL;DR

Markets on the Edge, AI in the Arena, and Bitcoin Still Flirting with Euphoria

Macro: Bond markets are throwing a tantrum. U.S. 30-year and Japan’s 40-year yields just hit multi-decade highs—think Reagan-era levels. The long end isn’t whispering, it’s screaming: “This debt load isn’t free anymore.”

Stocks/Bonds/FX: Trump’s Plan A (cut taxes, hope for magic) is toast. Plan B? Debt monetisation dressed up as monetary finesse. Liquidity is dripping back in—great for risk assets, unless bond vigilantes decide to flip the table.

Crypto: Bitcoin’s pumping, but we’re not in full-blown euphoria yet. Eyes on $115K–$120K with one hand on the champagne and the other on the eject button—especially if bond yields spike or leveraged longs get too frisky.

AI: OpenAI just teamed up with Jony Ive and billions in SoftBank cash to build the iPhone of AI. It's Apple vs the A-team. Peace-time CEOs (Tim, Sundar, Satya) are now facing war-time killers (Sam, Elon). Game on.

The Macro Zeitgeist

Pandas Replace Tariff-fying Godzilla

What once looked like a cinematic clash between economic titans—Trump’s U.S. and Xi’s China—has now softened into something more akin to two pandas politely debating bamboo recipes. Yes, the infamous tariff tantrum has mellowed into a tariff tug-of-war, and markets are taking note. A 20–30% tariff range is being floated, but like a magician who keeps pulling new rabbits from the hat, Trump continues to surprise. First China, then Europe, then Apple—it’s a tariff roulette, and investors are spinning the wheel daily.

While the media obsesses over tariffs, the real story is quietly playing out in bond markets. Yields are rising in both the U.S. and Japan, and that’s where smart money is now paying close attention. Ignore them at your peril. It’s time to stop watching pandas bicker and start watching bond yields climb.

Massive Debt-oxing on back of Rising Defi-shits

The bond market isn’t just whispering concerns anymore—it’s practically setting off fire alarms. From record-breaking Japanese 40-year yields to another surge in U.S. long-dated treasuries, the global debt machine is groaning under its own weight. This isn’t just about interest rates anymore—it’s about structural stress, investor confidence, and the sustainability of the entire financial architecture.

Debt-Laden and Yield-Ridden: America's towering debt levels and fiscal sprawl aren’t just lifting U.S. yields—they’re causing ripples across the globe. Even Japan’s 40-year bonds are breaking yield records, reminding us that no corner of the bond market is immune. Think of it as global financial Jenga—the higher the stack, the shakier the base. Japan's 30-year government bond yield jumped to 2.96% on Monday, the highest level in almost 25 YEARS as supply of bonds exceeds demand. 40-year yield hit 3.45%, the highest since its debut in 2007. Japan's debt-to-GDP ratio is over 250%

Ripple Effects Across US Treasuries: The Bank of Japan is the largest holder of the U.S. Treasuries. Should yields continue to surge, Japan may be forced to unwind foreign asset holdings to defend its domestic markets and currency—causing ripple effects across the USD, U.S. bond yields, and global risk assets. Trump’s attempt to shrink the deficit with DOGE-style austerity and turbocharge revenue via trade wars didn’t quite stick the landing. Now, we’re back at square one—with rising debt, surging interest costs, and very few rabbits left in the policy hat

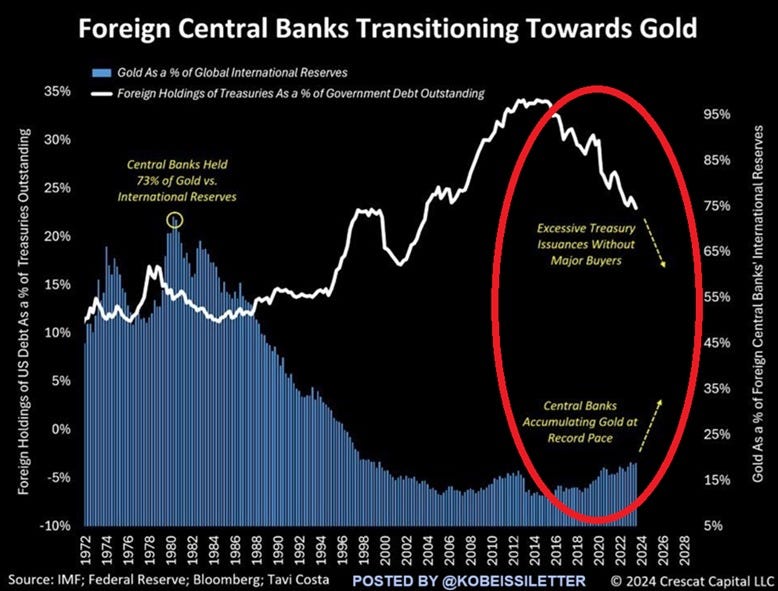

The Long End Is Flashing Red: Yields on 10Y and 30Y treasuries are spiking again—not from optimism, but fear. Concerns over soaring deficits, massive Treasury issuance, and softening demand at auctions are driving this move. It’s not technical noise—it’s a warning shot. The bond market is flashing yellow on debt sustainability. Consequently, foreigners are fleeing US Assets

Liquidity Is Back, and the Dollar’s on a Diet: The game-changer? A weaker dollar and growing global liquidity. This duo has created a supportive tailwind for risk assets—sending Bitcoin and Gold to all-time highs, just as outlined in our Rising Macro and Crypto Quarterly (yes, the one you hopefully read and acted on).

Debt Refinancing Headache Ahead: Who's Buying Uncle Sam's Next Round? The U.S. Treasury is gearing up to unleash a wave of new bond issuance to refill its coffers at the Fed (a.k.a. the Treasury General Account, or TGA). But here’s the kicker: someone actually has to buy all that debt. The problem? The usual safety net is vanishing as

RRP Buffer Is Running Dry: The once-mighty $2 trillion reverse repo (RRP) cushion is evaporating quickly. What was once a deep pool of excess liquidity is now more of a drying puddle.

Supply Surge Meets Demand Doubt: Issuing more Treasuries into a market already saturated with debt is like trying to sell lemonade in a monsoon—there might be takers, but they’ll want a deep discount

Enter the Fed (Again?): With liquidity tightening and demand wobbling, the Fed may be forced to roll out some monetary gymnastics—possibly rate tweaks or balance sheet maneuvers—to avoid a Treasury market tantrum.

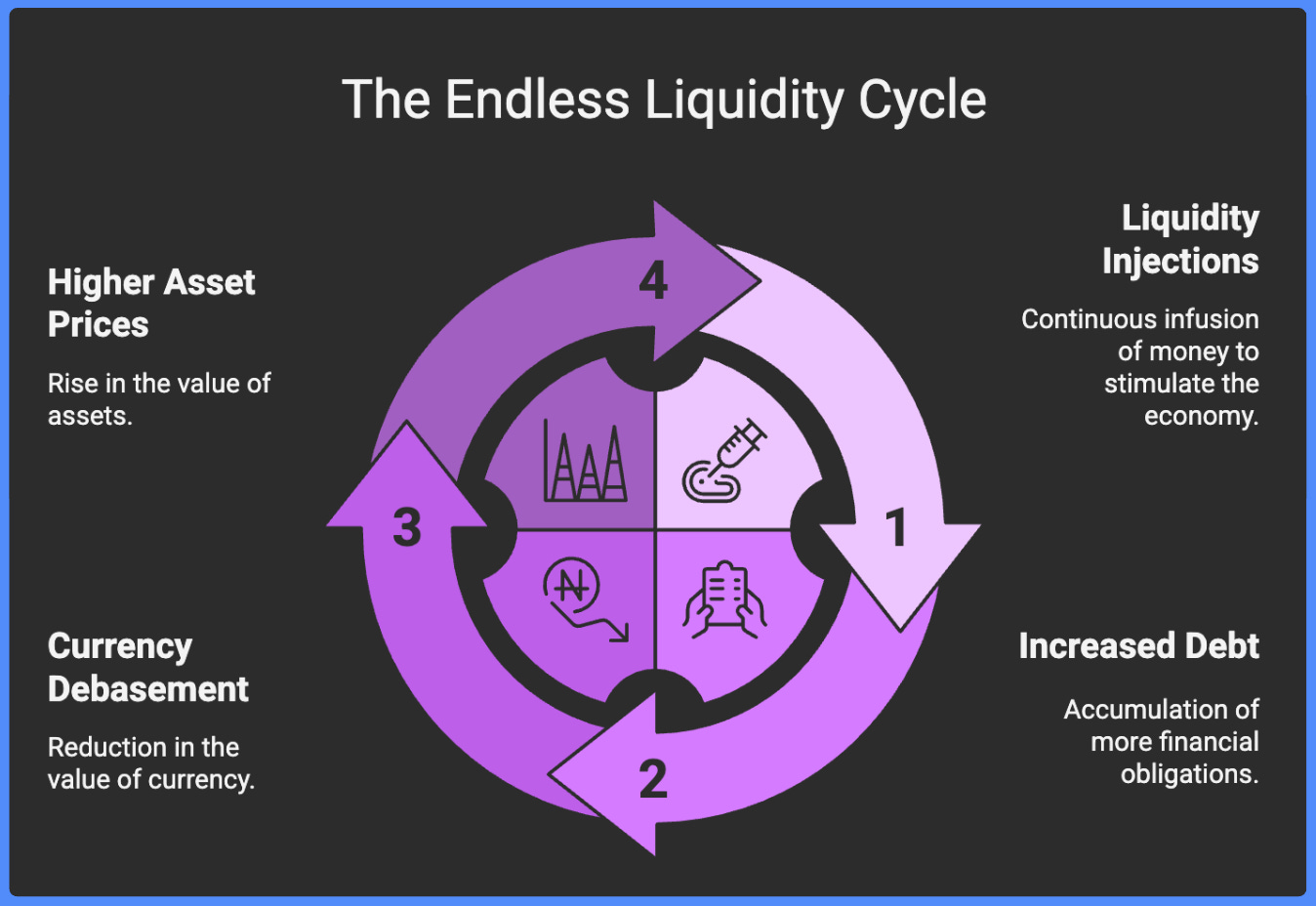

All Roads Lead to Debt Monetization, Bitcoin, and Gold: When the debt party gets out of hand, only the cockroaches survive—and thrive. Bitcoin and Gold may be riding the wave of easing financial conditions, but make no mistake: risk hasn’t vanished—it’s just being repackaged, repriced, and cleverly ignored. The bond market, however, is starting to sober up and ask the uncomfortable question: What happens when the U.S. can’t sustainably fund itself anymore? Here’s where the breadcrumbs are leading:

The Bond Market Is Getting Jittery as explained above…..Toward Monetization: If deficits persist and demand weakens, we’re headed back to the familiar playbook: more QE, more fiscal dominance, and more stealth debasement of the currency. A quiet return to debt monetization, dressed up as “financial stability.”

Bitcoin & Gold: The Cockroaches With Jetpacks

Weekend wobbles may shake out weak hands, but BTC and Gold are the ultimate survivors—think cockroaches in a nuclear bunker, except these ones ride rocket ships. As fiat gets diluted and debt balloons, these assets thrive, not because they’re risk-free, but because they’re no one’s liability.

Soft Sentiment, Tepid Inflation & a Fed in Flip-Flops: Welcome to the Economic Limbo Dance

Consumer sentiment is squishy, inflation is lukewarm, and the Fed is… basically on a beach chair watching the waves. The latest CPI print came in at 2.3% YoY—warm enough to melt butter, but still cool enough to keep your ice cream from having a meltdown.

Inflation’s Taking a Breather—For Now: CPI is behaving, but let’s not pop the champagne. Port inventories are still cushioning the blow, and once those run out, giants like Walmart and Apple may start passing costs to consumers faster than you can say "shrinkflation."

Economic Data: Currently in Sleep Mode: Until the May jobs report drops on June 6, most data is just background noise. Everyone's asking: will the Fed hike? Can they? Will Trump even let them? And what about the hundreds of SMEs already feeling the rate squeeze

The Fed’s Favorite Move? Doing Nothing (For Now): With consumer data coming in soft and markets bouncing back, the Fed is in no rush. Their best move next meeting? Quite possibly: do absolutely nothing—and that might be the smartest call of all.

Macro Summary - Cautious Optimism for Q2

Q1 was no picnic — it left portfolios bruised and investors paranoid. Q2 is shaping up to be a cocktail of cautious optimism: softening inflation, improving liquidity, a weaker dollar, and easing trade tensions give risk assets a gentle tailwind. But with bond yields creeping higher, and speculative euphoria bubbling under the surface, this isn't full-blown risk-on.

The music’s still playing, but the dance floor’s slippery. So tighten those boots, keep your eyes on the long end, and maybe keep a little Gold or Bitcoin in your pocket — just in case the whole ballroom catches fire.

DATA TO WATCH

May 30 - BTC CME May (BTCK25) Options Expiry

June 11 - U.S. CPI (May)

June 17 - U.S. Retail Sales (May)

June 18 - U.S. FOMC Interest Rate Decision

STOCKS, BONDS, FX

Stocks: Living under the Dark Shadows of Bonds

Risk assets are back on their feet, but it’s less a victory parade and more a cautious limp toward daylight. Stocks and crypto have caught a modest tailwind from easing trade headlines, reacting like Pavlov’s pups every time a new tariff truce drops. But don’t confuse tailwind for takeoff—beneath the bounce lies a market still walking on eggshells.

Think of it less like a recovery and more like a soufflé in a thunderstorm—technically still standing, but one loud noise from collapsing entirely.

What’s Really Going On:

1. Relief ≠ Recovery:

Markets have become addicted to trade-related sugar highs. Every tariff reprieve sparks a dopamine hit, but these are temporary buzzes—like Red Bull in a recession. The structural damage from lingering 35% tariffs hasn’t gone anywhere. These are long-term bruises that won’t heal with a press release.

2. “Bottom Is In” Narrative Feels Premature:

This rally smells more like a technical bounce than a macro resurrection. Without real movement on trade, debt, and yields, we’re dancing on thin ice—just with nicer lighting. History reminds us: even in the 1930s, markets staged fierce rallies during the Great Depression before the next leg down.

3. Main Street Isn’t Buying It:

Consumer sentiment is now clocking its second-lowest reading in years. The S&P might be climbing, but your average household is budgeting like it’s 2009. Wall Street may be tossing confetti, but Main Street is still clipping coupons.

4. Bond Yields Still Loom Like a Storm Cloud:

U.S. and Japanese yields are rising in tandem, casting a long shadow over equity markets. Think of stocks trying to rally while dragging a Steinway grand up a hill—technically doable, but wildly unsustainable. Until yields calm down, risk-on remains a mirage.

5. Tariffs May Cool, But Their Legacy Burns On:

Even if trade tensions ease, the scars they leave won’t vanish overnight. Prolonged uncertainty, disrupted supply chains, and persistent cost inflation are now baked into the cake. Ending the tariff war doesn’t undo the damage—it's like quitting a diet but still dreaming of celery.

Debt & Yields: The Fiscal Fire is Already Smoldering

Trump’s “fiscally responsible” tax bill is the macroeconomic equivalent of ordering a Diet Coke with a triple-fudge sundae. It promises $1.5 trillion in spending cuts while slashing over $4 trillion in tax revenues—a diet plan written by Homer Simpson. The U.S. is now facing structural deficits with all the grace of a hippo on a tightrope.

Moody’s has already cut U.S. credit to AA1, and while bond vigilantes are foaming at the mouth, Treasuries are still—by default—the cleanest dirty shirt in the hamper.

Expect the Fed to step in soon with some interpretive monetary dance: yield-curve yoga, balance-sheet Pilates, and perhaps a “not-QE QE” cleanse to prevent the long end from spiraling out of control.

The Dollar: Tripping Over Its Own Shadow

The dollar, once the colossus astride global markets, now resembles an aging gladiator slipping on a banana peel. The DXY has fallen over 10% from its 2025 highs, now trading below pre-trade war levels—like a former prom king trying to squeeze into his 1980s tux.

This isn’t just a routine correction. It's the slow unwind of capital confidence.

What’s Behind the Slide?

1. Capital Is Quietly Heading for the Exits:

Net foreign flows into U.S. assets have hit their lowest level since late 2023. Global investors are trimming exposure—not with panic, but with precision. It’s a financial fire drill, and no one’s holding the door.

2. Inflation Signals Have Flipped:

Inflation tailwinds are fading. Our inflation tracker just printed its lowest read since 2021, while forward swaps are rising—a classic “someone’s wrong” moment. Either markets are being prematurely optimistic, or something in the model needs recalibrating.

3. Growth Is Losing Momentum:

The economic pulse, once elevated by trade hope and fiscal stimulus, is now as flat as a pancake on a marble countertop. Real-time indicators show a slowdown, and our nowcasting model suggests we’re heading into stall speed.

4. Structural Pressures Are Mounting:

Weaker capital inflows, declining inflation momentum, and stagnating growth all point to a dollar under siege. It’s no longer the world’s safe haven—it’s the melting ice sculpture at the summer wedding: elegant, symbolic, but dripping steadily into irrelevance.

CRYPTO

Bitcoin’s the Financial Rocket Fuel: The King Reclaims His Throne Amid Institutional Fanfare

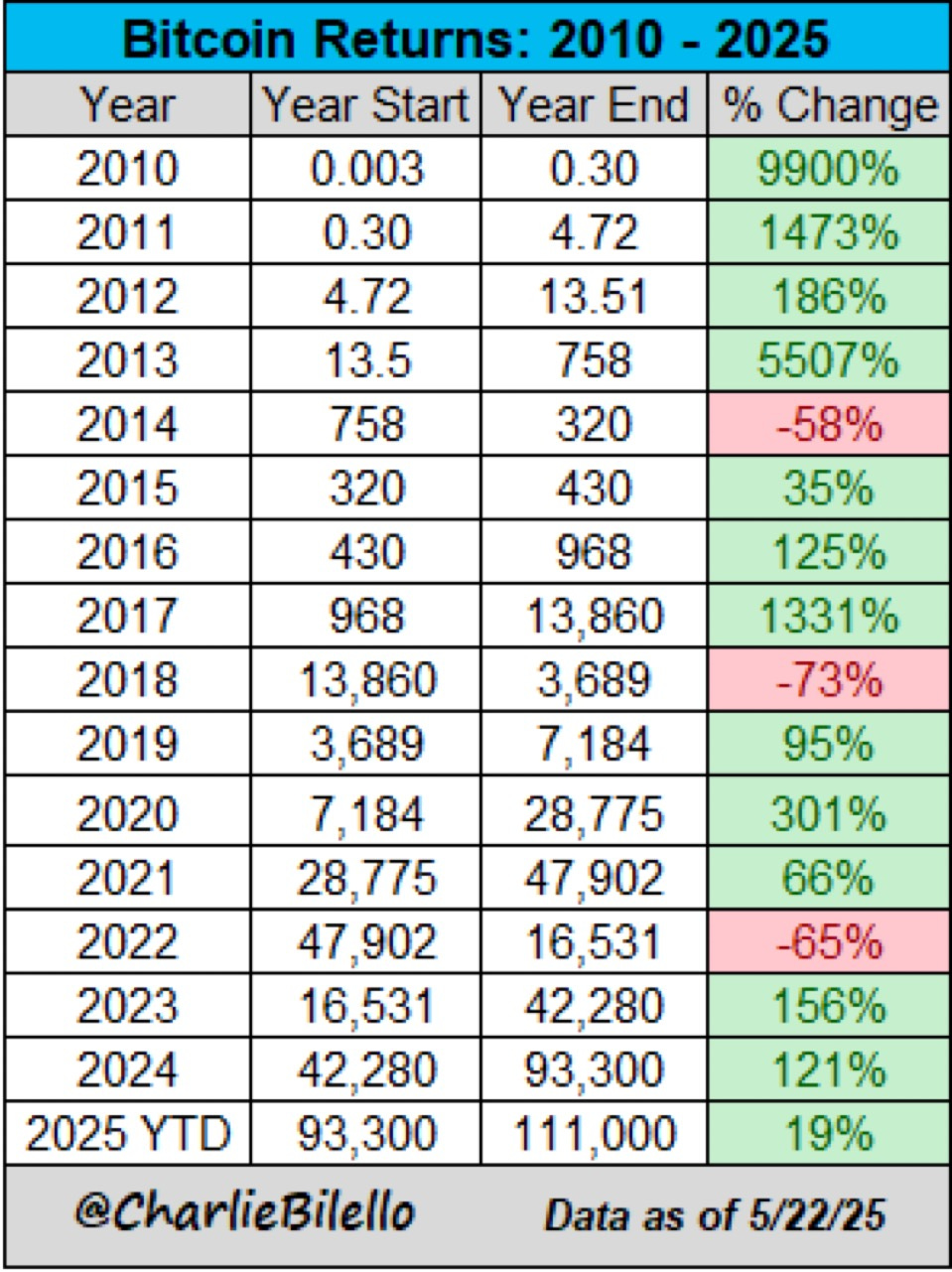

Bitcoin has stormed past the once-fabled $111,000 threshold—not with a whisper, but with the thunderous fanfare of institutional capital and regulatory tailwinds billowing like royal banners. After its April detour below $75,000 (a heart-stopping drop that left even the most seasoned hodlers clutching their pearls), the king has returned to his throne, draped in ETF inflows and sovereign swagger.

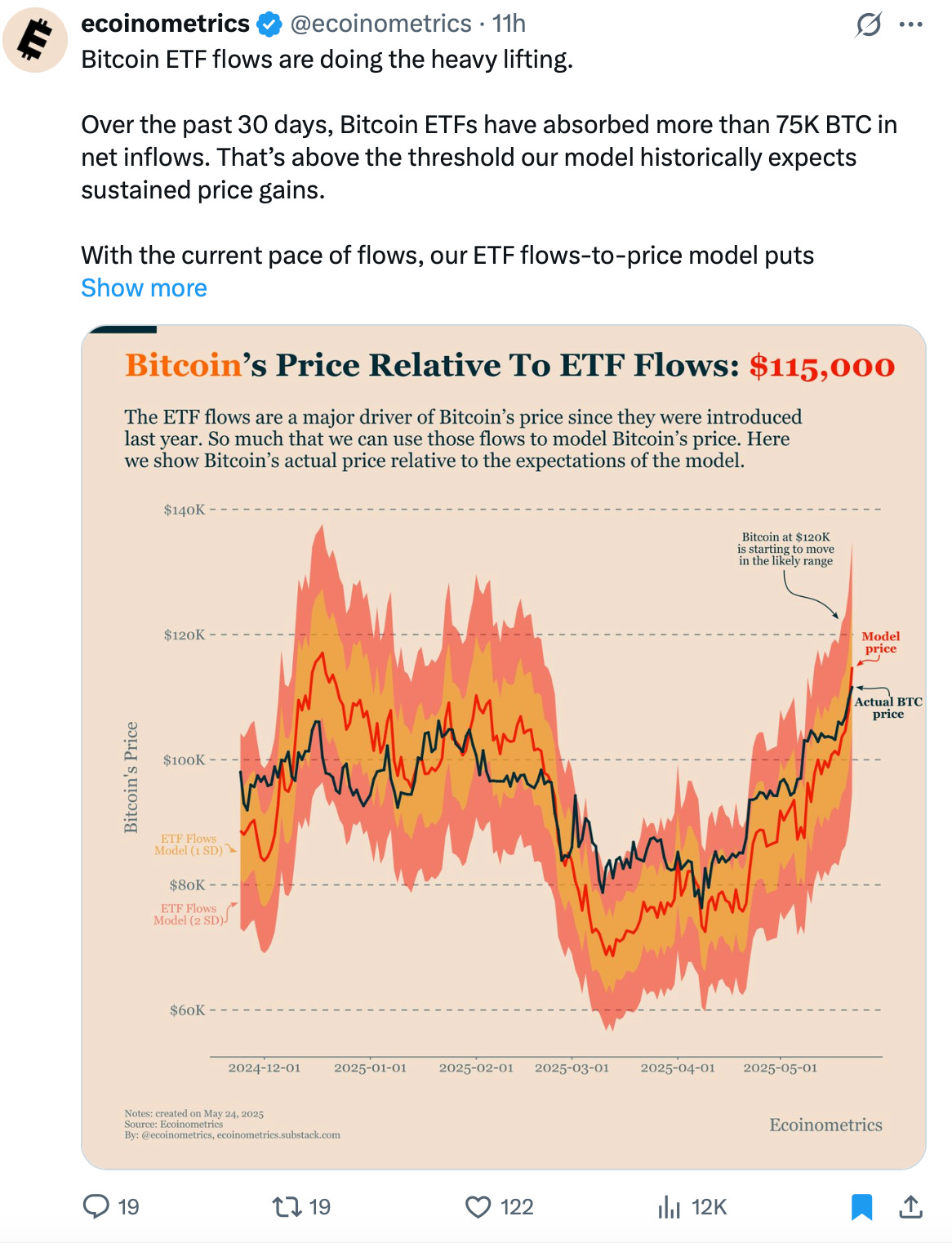

In May alone, Bitcoin ETFs absorbed a jaw-dropping $4.2 billion in net inflows. That’s not a bounce—it’s a full-blown comeback tour. Think less “Dead Cat Bounce,” more “Lazarus with a Bloomberg Terminal.”

So, What’s Fueling This Moonward March?

Macro Tailwinds: Liquidity Is the Lifeblood of Bull Markets: The macro environment is greased and gleaming. Real yields are capped, liquidity is abundant, and risk assets are basking in the same monetary sunshine that lifted everything from tulip bulbs in 1637 to Tesla shares in 2020. Bitcoin, the apex predator of risk assets, is naturally feasting.

Regulatory Renaissance: From Pariah to Policy Darling: In a plot twist worthy of Plutarch, U.S. policymakers have gone from skeptical senators to crypto-curious statesmen. Recent Senate momentum on stablecoin regulation marks a tectonic shift. This isn’t just regulatory clarity—it’s political endorsement. And with one of the most crypto-friendly administrations in U.S. history, the winds have shifted from hostile gales to helpful tailwinds.

The Institutions Have Landed: The list of heavyweight accumulators reads like a Davos dinner party: MicroStrategy, Cantor Fitzgerald, Tether Holdings, SoftBank, and even presidential hopefuls like Vivek Ramaswamy. Bitcoin has graduated from misunderstood rebel to institutional-grade collateral—less “Magic Internet Money,” more “Digital Reserve Asset.” This is not retail hysteria. This is pension funds, family offices, and balance sheets treating BTC like a strategic asset—not a speculation.

Derivatives Frenzy: The Option Traders Are Betting Big: The options market is ablaze with bullish positioning. Open interest in calls has reached new peaks, signaling that sophisticated capital isn’t just dipping a toe—it’s cannonballing into the deep end. Traders are betting on liftoff, not a landing.

ETF Flows: The Liquidity Engine at Full Throttle: ETF inflows are relentless—no speed bumps, no apologies. Outflows? They’re background noise getting flattened by this financial freight train. This isn’t just supportive—it’s confirmation. The inflows are a real-time referendum from capital allocators, flashing a giant neon “Risk On” sign across the asset landscape. But fair warning: should these flows falter, the music could stop quickly. Until then, though, the ETF engine is humming like a V12 Ferrari.

Mania? Not Yet. Just a Very Polite Euphoria

Despite Bitcoin’s gravity-defying climb, the atmosphere feels less “dot-com bubble” and more “pre-party optimism.” Our Sell-Side Risk Ratio—measuring capital inflows versus Realized Cap—remains low and unbothered, lounging like an aristocrat in the Riviera.

This doesn’t smell like a top. Not yet. Here’s why:

Profit-taking is orderly—no signs of panic dumping.

Demand is deep—ETF and institutional flows are providing a steady bid.

Momentum remains strong—we’re in mile 10 of the marathon, not mile 26.

We’re watching $120K closely—that’s the base of our “Topping Cloud” model, a zone where euphoria may begin to flirt with mania. Until then? The vibe is less “crypto rave” and more “garden soirée with excellent champagne.”

Leverage: The Party Animals Have Arrived

Now to the messy part: leverage is rearing its frothy head. Funding rates are climbing fast—long traders are shelling out nearly $10 million daily just to keep their leveraged seats at the table. The degens have replaced the spot buyers, and they’re piling in like it's their first time at the craps table.

This story has played out before:

New highs trigger FOMO.

Leverage floods in.

Market delivers a sneaky pullback.

Overleveraged longs get wiped.

Bears rejoice... briefly.

Smart money buys the dip.

We go again.

Expect a brief, sharp correction—perhaps 5-15%—to wring out the excesses. Think of it as a pressure valve, not a structural failure. The rocket still has fuel; it just needs to shake off the stowaways clinging to the wings.

Q1 Portfolio Review: Brains, Bravado & Bananas

As highlighted in our Rising Quarterly Report, the standout portfolio cocktail was equal parts conviction, chaos, and comedy:

Bitcoin – Still the high-conviction, apex asset.

HYPE – Because attention remains the best-performing asset class.

Gold – The old guard still outperforms when fiat gets funky.

Fartcoin – Yes, even meme tokens moon when the circus rolls into town.

Performance with personality. If you haven’t read the report yet, pour a scotch and fix that immediately.

Crypto Summary: Bitcoin’s Blasting Off, Let’s Hope the Seabed Holds

This is a legitimate breakout, not a head fake. Price sliced through the $100K psychological barrier with conviction, triggering waves of new capital and media buzz. Momentum is strong. Structure is clean. ETF and spot flows are still your best forward indicators—and they remain rock solid.

But speculative leverage is rising. That means we’re due for a cleansing flush—quick, dramatic, and ultimately bullish.

This market’s not overcooked. It’s just heating up.

Final Word:

"History doesn’t repeat itself, but it often rhymes." – Mark Twain

If Twain were alive today, he might say: Bitcoin doesn’t just rhyme—it remixes the whole damn track. Stay hedged, stay humble, and maybe—just maybe—don’t mortgage the farm at $120K.

Happy trading. And if you’ve got feedback, praise, insults, or sandwich recommendations—send them my way. I promise to read them all before the next pump.

The AI Zeitgeist

“Sam’s Bold Move — A Wake-Up Call for Apple”

Apple has long been the titan of innovation, but in the AI race, they’ve been playing catch-up — if not downright snoozing. Over the past few years, I haven’t seen any real sparks of groundbreaking AI innovation from them. Enter Sam’s latest hardware play — a game-changer that could very well send Apple sliding downhill if they don’t respond fast.

That said, I wouldn’t count Apple out just yet. This move is a wake-up call ringing loud and clear. Let’s hope it shakes the tech giant from its slumber and ignites a new era of bold innovation. Because in this race, standing still is the fastest way to fall behind.

May your Monday be filled with coffee & profits.

Stay ahead with our latest insights—catch up on our previous articles below:

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out Our Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!