The Rising - Quarterly Macro & Crypto Outlook - Q2’ 2025

Paradigm Shifts, US Assets Firesale, Rise of Gold, Next is Bitcoin and Family

“If you‘re smartest person in the room, then you are in the wrong room.”

- Confucius

TL;DR

MACRO - Paradigm Shifts & Rush out of US Assets to Gold

The markets are undergoing a seismic paradigm shift—shifting from buying US tech stocks, bonds, and the USD, to dumping all three in just six weeks. This is a mass exodus, almost reminiscent of emerging market behavior. Trust has been shattered, with global pension funds dumping US stocks, bonds, and dollars in large volumes, day in and day out.

Tariff negotiations? Still stuck in limbo, with no signs of easing.

In the midst of this chaos, gold is shining bright like the North Star. Historically, gold tends to move first, sensing debasement early—this is its "wisdom." Bitcoin follows suit, but with more volatility and unpredictable swings.

CRYPTO - Bitcoin is next after Gold

Amidst the macro madness, Bitcoin and gold are standing strong like the last sober person at a wild frat party. Everything else in crypto? Still searching for its killer app. But the setup? It's looking pretty damn good. Regulatory clarity is slowly taking shape, like a turtle with a briefcase, and it's paving the way for what could become a long-term bull run.

Before we go any further, customary Disclaimers first:

DISCLAIMER: DYOR & NFA

Don’t follow us blindly. All views, education and trades are my personal views and should not form the basis for making investment or trading decisions, nor be construed as a recommendation or advice to engage in investment or trading transactions. Not Financial Advice (“NFA”). Do your own research (“DYOR”). These are my free thoughts gained from years of experience in banking and crypto. Build your own view and trade accordingly

If you want to read more of what we write, you can follow below:

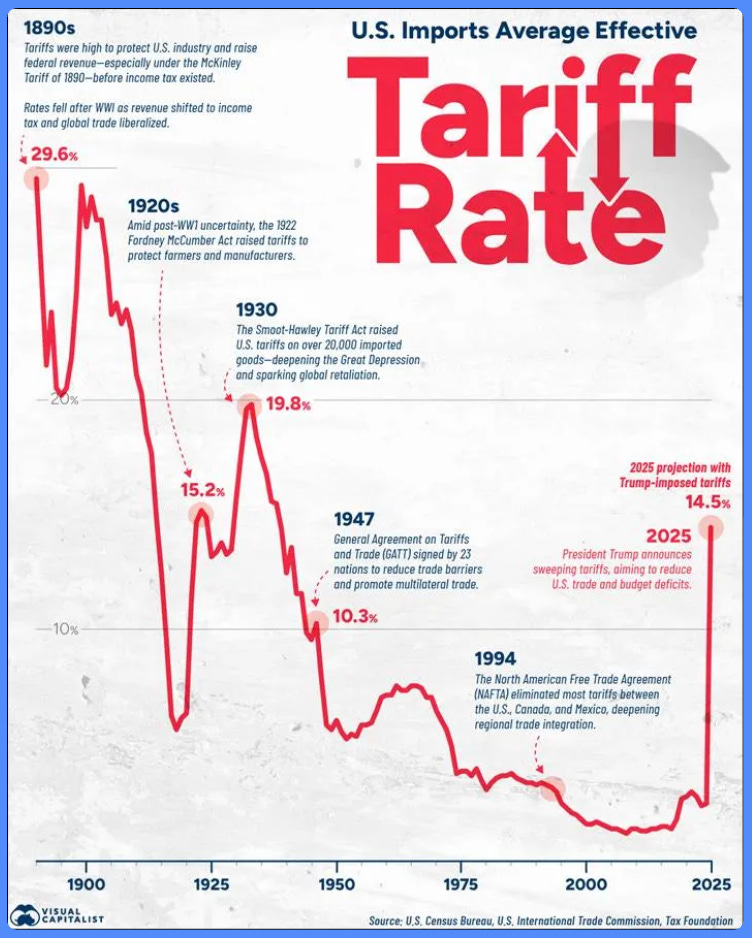

Macro - Tariff-fying

2025 kicked the door in. US Voters, tired of fiscal clown cars and economic whiplash, brought back Trump—not just for the greatest hits tour, but to slam the brakes on the spending fiesta and try to duct-tape the gap between Wall Street and Main Street. “Enough with the fiscal buffet. We’re going keto.” At least that is what they (and the world hoped for)

The Big Picture Problem - Ballooning Debt, and Obscene Fiscal Spending

Trump administration knows that the real problem is the Mount Everest of $35 trillion of U.S. debt and Debt-to-GDP is brushing up against 100%, which is the economic version of living paycheck to paycheck while financing your lifestyle with twelve AmEx cards. And the interest on that bad boy? $1.3 trillion. That’s not just a budget line item—it’s now America’s #1 expense, beating out even the military industrial complex. Yes, America is now paying more to exist in debt than to maintain the world’s most expensive collection of flying death machines.

Massive debt + vanishing fiscal discipline = economic hangover

Trump-Bessent Tariff Tango - Haphazardly Executed

Incoming administration’s answer to this debt and spending spiral was two fold:

Raise revenue (hello, tariffs!), and

Cut spending (hello, DOGE austerity mode).

Liberation day tariffs hit the markets hard. Yes, tariffs could bring in a few hundred billions in revenue but what about the almost $10 trillion in wealth destruction since Liberation day? Wall Street reacted like someone had just rage quit in a game of Monopoly—stocks got smacked, yields shot up like espresso on an empty stomach, gold flexed like it was 1979, and the dollar took a nap. If Trump’s tariffs were supposed to “liberate” anything, it sure wasn’t your portfolio. Markets Hate Uncertainty - they don’t mind bad news. What they hate is not knowing whether they should cry, cheer, or buy the dip.

I am not going to go deep into what tariffs and why tariffs as I am sure you are overloaded with that content for last two months. But here is a chronology of tariffs from Goldman Sachs latest piece.

UNCERTAINTY—Now with a Pause Button, Just to Keep Things Spicy - Sure, things are cooling a bit now—as the tariff tantrum has gone from DEFCON 1 to toddler-after-nap-time—but the long-term damage is done & trust is massively diminished.

Consequently, the S&P 500 was down 15.3% on the year on April 8, the 4th worst start to a year in history.

GLOBAL MARKETS

China: Beijing’s Retaliation Counterpunch

While the world seems to have accepted some sort of tariffs as given, China isn’t exactly sipping jasmine tea and turning the other cheek. Despite an economy held together by duct tape and wishful thinking—and a housing market that looks like a Jenga tower after a toddler’s been at it—Beijing isn’t blinking. In true Beijing fashion, the message is clear: “We’ve eaten economic pain for breakfast since the Ming Dynasty. Your people get PTSD if TikTok loads too slowly.”

Geopolitics: The Uninvited Guest at the Market Party

As Q1 of 2025 wrapped up, it became clear that geopolitical shifts are now just as influential on markets as earnings reports or inflation data. Traders, buckle up—here are the three big ones you need to watch:

1. Russia-Ukraine War: The Market’s Uncomfortable Elephant The Russia-Ukraine conflict continues to loom large over markets like that one awkward guest at the party who won’t leave. Energy prices, trade routes, and sentiment are all at its mercy—investors are just hoping it doesn’t spill the punch bowl.

2. U.S.-Russia Relations: The Ice May Be Thawing (Sort of) U.S.-Russia relations are warming up, but it's like two exes reluctantly agreeing to attend a family reunion. It's not going to be pretty, but it might stop things from getting worse—and that matters to markets.

3. U.S.-EU Tensions: The Transatlantic Tug-of-War The U.S. and EU are getting back to their old trade-war ways, with tariffs on European goods reigniting the economic equivalent of a sibling rivalry. It’s like a tug-of-war where no one’s sure who’s winning—and it’s making the euro-dollar pair a real mess.

Europe’s Balancing Act Europe’s new autonomy could be empowering—if it weren’t so risky. With all this turmoil, multinationals are stuck on the tightrope, trying not to fall off.

Final Thought: Keep Your Eyes Wide Open Geopolitics is here to stay—and it’s a bigger market mover than we ever expected. So, grab your popcorn, stay alert, and remember: sometimes the real drama isn’t on Netflix, it’s in the markets.

Q2 Consequences and Macro Outlook - Is US Entering a Recession?

There’s a growing sense of unease that the stock market's slump is the canary in the coal mine for broader economic weakness. The fear? A self-inflicted recession triggered by the ongoing trade wars. Economists are taking notice, with the likelihood of a US recession in the next 12 months climbing to 45%, up from just 22% at the start of the year. Looks like the market is sending us a memo—let’s just hope it’s not a resignation letter.

It is looking to me that we are at the edge of a recession, albeit very mild. Product shortages and supply chain chaos, accompanied by job losses will lead to higher prices, choppy stocks, higher yields, and a shitty sentiment overall. The problem is trust is broken and uncertainty will remain. The base was already low, savings were low, and markets were so over valued. As DOGE cuts kick in and hiring stops, capex stops, business conditions will see more pain in Q2 & Q3.

Key Takeaways from a Dizzying Few Weeks:

Macro uncertainty Remains: Confusion and cha-cha of chaos - Tariffs were on, off, then back on—but only for some items, from certain countries, unless exempted by... someone.

Trust Exodus & Flight Out of US Assets

Foreign confidence is eroding faster than a political promise in election year. The dollar’s slumping, yields are spiking, gold’s on a tear—and Bitcoin’s warming up next. It’s a classic trust unwind, now visibly reflected in global equity outperformance: Europe, Mexico, and China are leaving U.S. markets in the dust. And when trust exits the building? It’s like trying to return a used pair of socks—technically feasible, but no one’s buying it, especially not with that lingering tariff stench. What we’re witnessing is starting to look less like a correction and more like an emerging market-style rout: sell the stocks, dump the bonds, flee the currency. That trifecta rarely hits developed markets all at once—for it to hit the world’s most important capital markets? That’s nothing short of historic.You Can’t Tax Your Way to a Manufacturing Renaissance

Repatriating manufacturing is a noble idea, but taxing the very companies (NVDIA, APPLE et al) you expect to build factories and hire workers is like asking someone to sprint with an anchor tied to their leg. Incentivization got lost in translation.Debt and Deficit: Still Climbing Like a Meme Stock

Despite the noise, the core issues of debt and deficit are not going anywhere. The deficit is expanding, debt is ballooning, and the fiscal outlook is beginning to resemble a teenager's credit card statement—high balance, zero accountability, and a vague plan to “figure it out later.”Cockroach Mode Activated but Oversold Fatigue Kicks In Corporate -

Let’s be honest, not just Corporate America, but global companies are in full-on survival mode right now. You can't invest in the future when you don’t even know what next Tuesday looks like. And having spoken to many corporate leaders last week, it doesn't; look like these plans are getting activated anytime sooner. Corporate America’s gone full cockroach—slashing CapEx, earnings, and jobs amid chaotic policy whiplash, with Q2 set to be choppier than a meme stock chart in a hurricane.

Layoffs are coming—and not in trickles, but in hoards - With CapEx frozen, tariffs tightening the screws, and DOGE-era austerity in full swing, the job market is about to take a hit both wide and deep. For the average American, a job is everything—they’ll juggle two if they have to. But what happens when there are no jobs to juggle? This isn’t just a U.S. story. The ripple effects will hit India, Indonesia, China, and Europe too. That’s why I’m not throwing confetti over rate cuts or tariff rollbacks. Even if policy shifts, the economic bruises are real—and healing won’t be quick or painless. The job market is the heartbeat of the economy, and right now, it’s skipping more than a few beats.

Gold (and Bitcoin) The New Safety Trades - Gold is replacing bonds.

We noted in a prior newsletter that gold has replaced bonds as the safety trade. BTC has held very well and as supply get tighter, I think BCT could be next. The issue with Gold tops is that supply can kick in very fast if demand keeps rising, We don’t have that issue with BTC.

Short-Term Bounce, Long-Term Bruises

Markets are oversold and may rebound slightly on sentiment sugar highs and optimistic tweets. But the structural scars—supply chain snags, geopolitical tension, and investor skepticism—are likely to linger. You can’t plug a sinking ship with duct tape and vibes, but it sure makes for good headlines

Bottom Line:

Trump will be forced by markets to pause and pivot. I am currently travelling in the US and there is too much gloom and doom. But there is a long term damage even if pivot works. Market psychology has taken a hit - and it won’t get off the mat that easily.

Yes, the bottom might be near—lurking in a trench coat, whispering, “Buy the dip, you coward.” But don’t get too cozy. The deeper economic issues—uncertainty, eroded trust, and the long tail of a scattershot tariff policy—are still looming. By late Q2 or Q3, those factors could return with a vengeance, capping any meaningful rally and reintroducing gravity to markets high on vibes.

Until then? Buckle up, keep your meme folder charged, and remember: in Q2, volatility isn’t a glitch—it’s the whole damn user manual. Hope you brought a helmet. And a Xanax.

1️⃣ STOCKS - Are we Entering a US Recession?

Q2’s market mood? Chaotic, twitchy, and emotionally unstable—like Elon’s Twitter feed in chart form. Expect stocks to swing with every policy tweet and tariff tease. But here’s the real twist: once Trump swaps his Tariff Terminator cape for the Market Whisperer persona, brace for sharp countertrend rallies—powered more by vibes and fake headlines than fundamentals.

Still, let’s be real—new all-time highs this year? Highly unlikely. Policy flip-flops might spark noise, but not conviction. Until there’s a decisive and sustained reversal in direction, smart money will keep fading the bounce.

2️⃣ THE FEDERAL RESERVE - When Rate Cuts, When Liquidity?

I’ve always seen the Fed like the fire department— they don’t respond to sparks or smoke alarms. They wait until the whole building is ablaze before kicking down the door. They’re not here to protect your stock portfolio—they’re waiting for the economy to shout, “Help! I’m on fire!”. Yes, sentiment is weak, CPI made low prints, we have yearly lows, but things are chugging along, So FED is sitting tight and not pouring rate cuts from its fire hose yet.

Recent low CPI prints and weakening sentiment—both in the U.S. and globally—are reinforcing a disinflationary trend. Markets are now pricing in not just one, but potentially four rate cuts this year, with the first expected in June.

But the real trigger? If credit spreads start blowing out or yields go parabolic, the Fed will have no choice but to ride in like the cavalry. When that moment comes, markets will breathe a collective sigh of relief. That said, don’t expect a parade—growth headwinds will likely keep any rally from turning into a full-blown bull stampede.

The QT taper announced last month was the opening act, but the real signal lies in the dwindling balance of the Fed’s Reverse Repo Facility—now down to just $58 billion from $399 billion at the end of March. That quiet liquidity injection helped stabilize April, but it also signals that the FED’s next move may need to be a bigger one.

3️⃣ BONDS, FX AND THE US DOLLAR

The big picture, like I mentioned above, is the MASSIVE DEBT PROBLEM. I don’t think tariff trade policy is solving that. That means a gradual decay of US as a super power and USD as a global currency. But what about debt and the yields?

The U.S. dollar is down 1.25% over the last year, along the lines of foreigners selling assets. —so yeah, markets are saying Trump’s tariffs are hurting America more than anyone else.

Central banks and pension funds are selling dollars and buying Euros. They just want out. Same is true for USDJPY and Nikkei. JPY Is rallying and so is Nikkei. Odd.

Ultimately, all roads are leading to financial repression, keeping yields artificially low and debasing currency, which continues to underpin our bullish outlook for Bitcoin.

Q2 Macro Summary: Reflexive Markets

In the short term, markets remain glued to Trump’s tariff teleprompter—one tweet away from chaos, one backtrack from bliss. That said, signs this week suggest both the U.S. and China are inching toward the negotiation table, probably over dumplings and damage control.

With equity positioning near record lows, the probability grows that we’ve seen the bottom—or at least a respectable impersonation of one. Gold continues its stately march higher, while Bitcoin has been stuck in neutral: too edgy for the TradFi crowd, too macro for the meme coin mob. Still, with equities stabilizing and the macro tide turning, Bitcoin looks ready to break formation and play catch-up.

And just when you think the script couldn’t twist again—Powell might toss in a surprise rate cut in June, tossing gasoline on what could be a smouldering Q2 rally.

But of growth falls off the cliff, and US recession risk gets re-priced, expect wider spreads, weaker equities, and a deeper FED cut cycle than currently assumed, possibly starting with a 50bp move.

Bottom line? We’re not out of the woods yet, but if central banks keep humming and tariffs take a backseat, equities could rally again and Bitcoin might just be the breakout act of the second half—like the quiet kid in class who suddenly drops a chart-topping mixtape.

Crypto - From Revolution to Racket

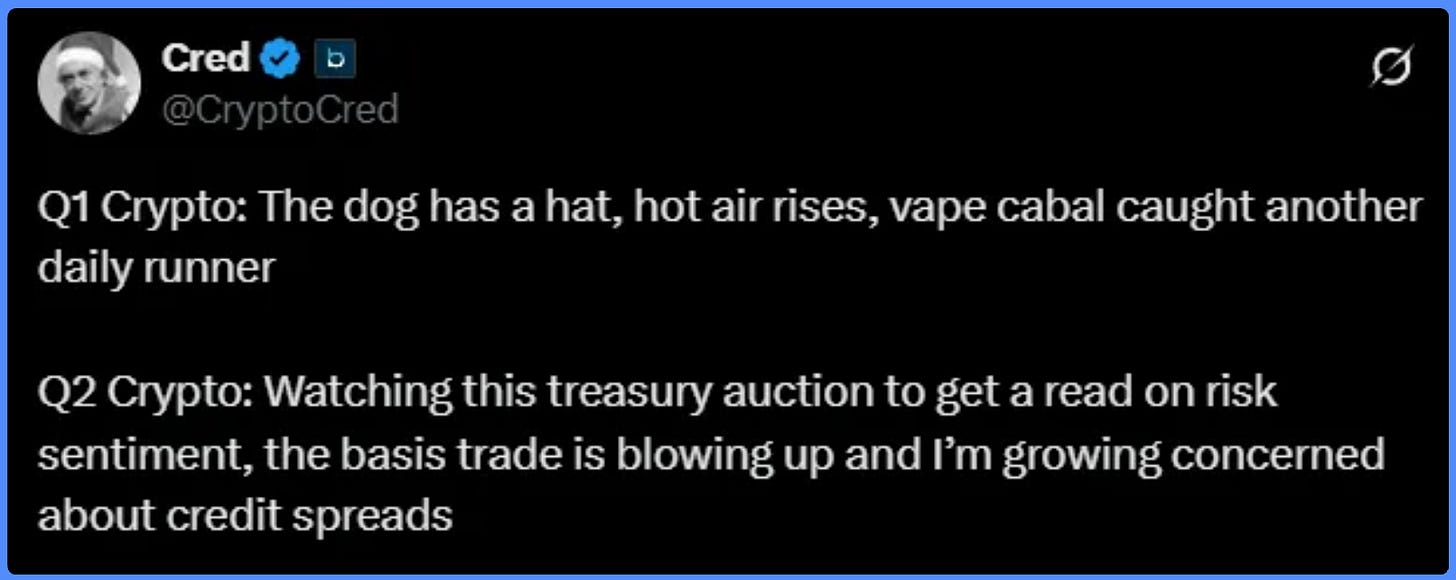

This is a perfect summary of the state of crypto:

Bitcoin’s been tailing QQQ like a diligent intern—matching moves, mirroring moods, and proving it’s still firmly in tech’s orbit. The “digital gold” narrative? Still pending. The messy split with actual gold looks nearly official: the divorce papers are signed, and gold’s walking away with full custody of the “safe haven” label.

Right now, USD and USD-denominated assets are being sold for gold, not for Bitcoin. Not yet. And in my view, that gap is a massive opportunity.

Despite that, Bitcoin’s holding its ground impressively. Since its last dip below $80K, it’s been grinding higher and quietly outperforming equities—though still trailing gold. Think of it as the macro middle child: too unruly for the bond crowd, too unpredictable for the gold bugs.

But here’s the kicker—Bitcoin isn’t one thing. It’s part tech, part gold, part rebellion. And once tariff tensions cool and risk appetite rebounds, Bitcoin could be the first asset to catch fire.

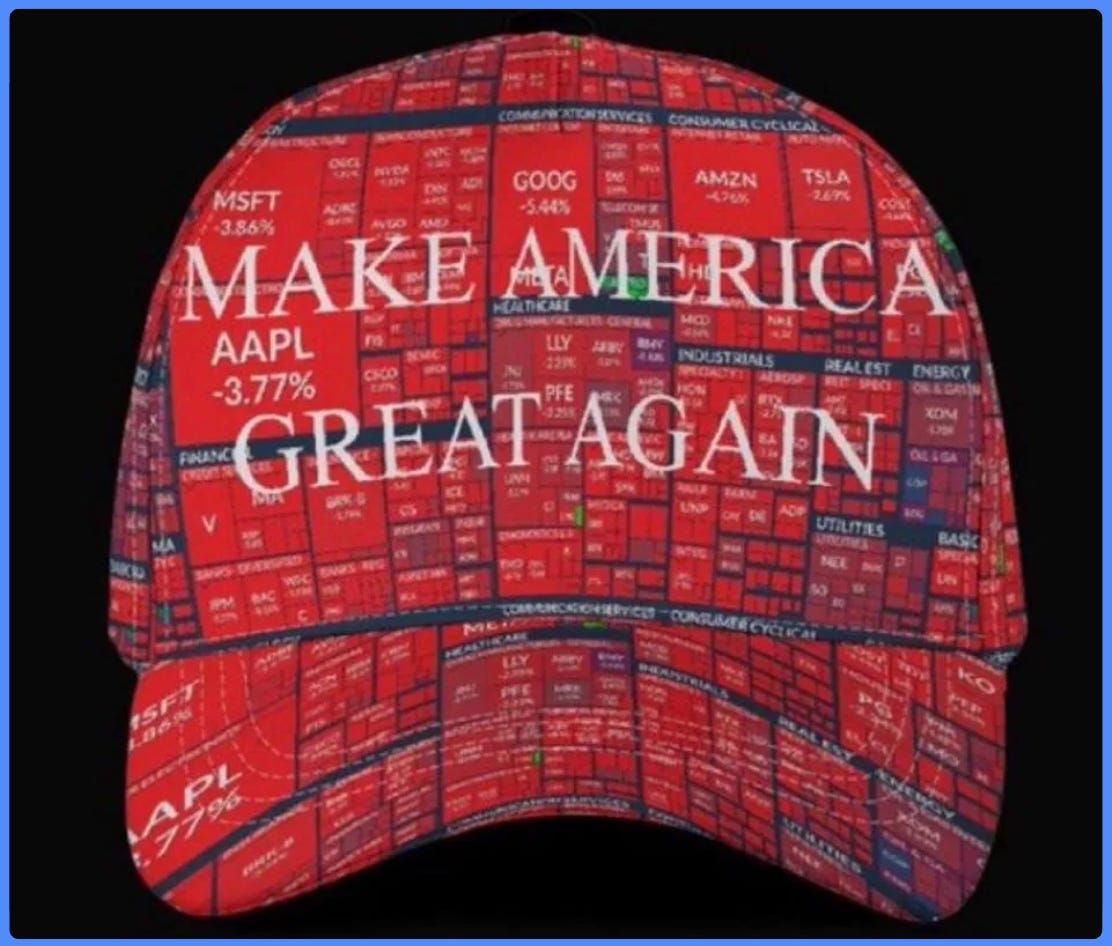

As if $Trump and $Melinia coin led liquidity rug wasn’t enough, bam—the tariff shocks hit in Q1. Markets didn’t just correct, they had a full-blown tantrum. BTC took a nosedive, ETH and SOL? Down 50% and Altcoins got crucified like it was monetary Easter. Everyone is mad at the administration today. But hey—that’s crypto. Come for the decentralization, stay for the circus. And Q2? Well… buckle up, it’s only getting weirder.

Q1 Recap: The Good, The Bad, and the Binance Listings

🪨 The Only Constant? Bitcoin - Not a maxi, but let’s be honest—when the world feels like it’s being run by a Magic 8 Ball, BTC still looks like the least crazy decision you can make. Institutions are quietly piling in like it’s Black Friday at MicroStrategy. The U.S. might not be buying yet, but they’re setting the regulatory dinner table for everyone else to feast.

⚔️ Binance Listings: From Holy Grail to Public Execution - Remember when getting listed on Binance was like finding the golden ticket to Willy Wonka’s Chocolate Factory? Now it’s like being invited to a Game of Thrones wedding—sounds great, ends in blood. Every altcoin that hits Binance lately goes DownOnly faster than your serotonin on a Sunday night. RIP.

📉 Prices and Volumes Collapsed – Blame Macro, Not Magic - Crypto isn’t broken. It’s just been shoved into the same pressure cooker as equities, housing, and your 401(k). Tariffs, uncertainty, and the constant threat of a new Trump tariff have markets acting like a toddler who skipped nap time.

🦅 The Silver Lining: Regulatory Clarity Like Never Before - For the first time in what feels like a decade, we’re getting actual regulatory clarity. Crypto lawyers are smiling. Gary Gensler is… Goon and pro-crypto Paul Atkinsis in. And institutions finally have something they can actually show their compliance teams.

Final Thought?

Q1 was a mess—like a reality show produced by new Trump admin. But beneath the chaos, smart money is positioning, the infrastructure is hardening, regulators are being supportive and the next act is quietly being written. Grab popcorn. And maybe a few more Sats.

I wrote a longer article on where we stand. Give it a read. I am certain you will love it.

Crypto’s New Reality: From Wild West to Wall Street

This isn’t just another crypto cycle—it’s like your favorite underground dive bar getting bought out and turned into a fancy cocktail lounge. The degens and retail gamblers who once ran the place are nursing their wounds, while the big dogs—hedge funds, sovereign wealth funds, and TradFi titans—are rolling in with tailored suits and algorithmic strategi…

Q2 Crypto Playbook

As macro uncertainty persists and the tariff saga drags on unresolved, risk assets remain under pressure. Equities continue to sell off, while Bitcoin hovers indecisively around the $85K–$87K zone. I wouldn’t call it a full decoupling just yet—more like a cautious standoff.

U.S. assets are being rotated into gold as trust fractures and safe haven instincts take over. Gold has surged to new all-time highs around $3,400/oz, firmly reclaiming its title as the global safe haven. With prices soaring, miners will likely ramp up production to capitalize, and it wouldn’t be surprising to see gold take a breather soon—potentially opening the door for a wave of investors to explore “digital gold” instead. The Trump administration, and a growing list of corporates already stacking gold, may well encourage that pivot.

My base case remains unchanged: we’re chopping sideways and soon we will get escape velocity. In longer term scheme of things, Bitcoin will again outperform Gold IMO. Just a matter of time. Meanwhile, Bitcoin—and certainly gold—continue to show relative strength, and I expect a messy but constructive process as the market works to hammer out a durable floor around $80K range.

Based on my macro view (and a little optimism that sanity will return soon), my main crypto focus for Q2 is simple:

1️⃣ Accumulating Sats (Bitcoin) Below $80K

The King of Crypto is still the main focus. Any dip below $80K? I'll be stacking Sats like there’s no tomorrow.

2️⃣ Accumulating My Super Conviction Coins

These are the coins that I believe in with every fiber of my being. I’m in it for the long haul, and Q2 is my chance to add more to the stash.

3️⃣ Accumulating My Secondary Conviction Coins

These are the ones I’m keeping a very close eye on. If they show signs of life towards my targets, I’ll be ready to pounce.

4️⃣ New Narratives? Maybe Later.

I’m not jumping on anything new for now. The narrative landscape is a bit quiet, so I’m sitting tight and waiting for the right moment.

Remember, everyone has their own coin list and strategy. Some will crush it with their picks, others... well, that’s the fun of crypto. My advice? Stick to your own conviction, don't follow anyone blindly (including me!).

The Q2 Playbook:

Here’s how the next phase of the crypto saga is likely to unfold:

As the macro dust continues to swirl, Bitcoin creeping from $82K to test $90K will feel like a teenager finally trading Xbox for a gym membership—it’s slow, it’s awkward, but it’s progress. That’s your signal to start rotating into the Majors and Blue Chip Alts. Think of it as moving from a go-kart to a Ferrari. No more toddler tokens—it’s time for the grown-ups to shine.

Around that stage, you’ll notice some early rumblings in the meme-iverse—think Fartcoin starting to puff again. What’s next? Popcat flexing? Who knows. But the low-cap chaos will start peeking out, testing the waters for a full-blown resurrection.

Now, when Bitcoin stretches to $95K and begins flirting with the psychological $100K milestone, buckle up—this is when meme coins and microcaps come crawling out like gremlins after midnight. That’s your cue to start dabbling, strategically. A little mischief is okay, just don’t go full degen at the first whiff of green candles. Discipline matters.

Once BTC breaks its all-time high (likely in Q2), you’ll feel the urge to chase everything shiny on your screen. Don’t. Stay grounded. Remember: Bitcoin is still the protagonist in this story, and when the dust settles, liquidity always circles back to the main character. The market will find its balance—just like the prom after the crown’s been handed out.

With M2 doing the cha-cha and rate cuts inching closer, the backdrop could quickly turn into a full-blown crypto clearance sale. This pullback might be the best shopping window we get for a while—especially for BTC and quality alts.

So stay nimble, stay focused, and whatever you do—don’t be the person buying snacks when the crypto rollercoaster takes off.

Crypto’s Coming Back, Like a Biker Gang in a Western Movie

Bitcoin’s next all-time high? It’ll be TradFi-led, just like Q4 ‘24 and Q1 ‘25. Trump’s unexpectedly pro-crypto stance has flipped the script, and suddenly Wall Street’s giving Bitcoin a bro-hug. ETFs are booming, BlackRock and JPMorgan are in, and sovereigns are hoarding BTC like pandemic toilet paper. Even the EU is finally waving the crypto flag.

Solana and XRP are itching to follow, while U.S. states and Hong Kong throw around ETFs like Halloween candy. The infrastructure’s getting there—once UX smooths out and cross-chain transfers feel like texting your mom, we’ll really cook. And yes, memes and degens will return, powered by TikTok and short attention spans.

Venture capital, though? It's waiting out Trump’s tariff chaos like a cat in a thunderstorm. Risk capital hates uncertainty, and macro right now feels like financial Game of Thrones—minus dragons, plus snowballs.

But don’t count crypto out. Once macro clears up, Bitcoin and a few chosen alts could lead a Q3/Q4 rally like rockstars at a reunion tour. The fear’s likely peaked for H1—so prep your bags, because the crypto train is about to leave the station.

Stay sharp, stay early, and don’t blink.

MY Q2 SUPER CONVICTION LIST

MAJORS - BTC, SOL

Bitcoin (BTC): King of the Hill

Bitcoin remains the institutional favorite, with giants like BlackRock and JPMorgan diving in via ETFs. It's the clear leader in market cap and volume, firmly establishing its role as digital gold. I’m still DCA’ing below $80K, with $75K looking like strong support. MicroStrategy offers higher beta to BTC, so I’ve built a heavy position under $250—plan to generate yield via options once things stabilize. BTC stays in cold storage—no yield is worth losing your keys.No ETH exposure—neutral for now.

Solana (SOL): The Comeback Kid

SOL’s ecosystem is booming, ETF buzz is strong, and memes are bubbling again. We sold above $250, reloaded under $120, and it’s now our #2 position—staked and yielding.

BLUE CHIP ALTS

HYPE - The new kid on the looɔ crypto block - If HYPE were a high school, it’d be that kid who started as a quiet overachiever and is now leading every club and running for class president. HYPE is my top pick in the “Other Major” altcoins, and I’m feeling pretty confident about its future. It's on the cusp of graduating from bluechip to full-on major coin status, and I’m not the only one noticing it.

HYPE is my third largest position. I have been accumulating below $12 publicly and will continue to do so. Both spot & leveraged positions

While I am not a fan of XRP, it looks very attractive sub 1.75 from a r/r perspective. Their PR team and closeness to the government and a die hard Barmy Army helps a tonne. Accumulating below $1.75

MEMES / SHITCOINS / NARARTIVES

FARTCOIN: My Meme Market MVP

Fartcoin’s the only meme coin showing real strength right now—solid volume, strong mindshare, and I’ve been accumulating around $0.0043. If $PEPE can 2x to $5B, $FART could 10x there too. No super conviction elsewhere yet, but once macro stabilizes and SOL clears $150, expect more memes to pop. I’ll be rotating into old favorites from late 2024 as momentum returnsMore will follow once Fartcoin breaks $1, macro settles, and Solana reclaims $150. Hard to pick winners early, but top memes from Nov–Jan should shine again. You can start nibbling now or wait for momentum—these coins are down 95%, and a 2x can happen overnight.

MY SECONDARY CONVICTION LIST

MAJORS - SONIC

Accumulating SONIC below $0.40 – great R/R with full supply already circulating. If TVL grows, demand could explode. Cronje’s still got the magic. That said, sizing remains tricky—I've had to trim some SOL and HYPE to fund this, which are more convincing in the current macro. Also holding its beta play: $SHADOW.

BLUE CHIP ALTS - PENDLE, ENA, INJ, JUP, RENDER, FLUID

Altcoin supply is relentless—new unlocks, constant emissions. Most are manipulated, which is why TradFi steers clear. I avoid high-supply names unless there's a compelling exception (like above). No fresh narratives yet, but if BTC hits $90K (my base case), the degen swarm returns and new themes will form fast.

We’re likely near local bottoms on most Alts—March’s pain looks absorbed and seller exhaustion is setting in. No high leverage here until macro improves. Watching how my conviction list performs.

MEMES / SHITCOINS / NARARTIVES - SHADOW, AI16Z, PEPE

Watching for rotations and new narratives. These are high risk, high reward—positioned small, but ready to scale when momentum returns.

FINAL THOUGHTS

This year is starting to feel less like a typical economic cycle and more like a wild premium streaming series, written by a crew of chaotic screenwriters who are clearly fuelled by a caffeine overdose. Picture a Netflix original that’s a mashup of House of Cards, The Kardashians, and Jumanji, with a pinch of Game of Thrones politics and a splash of Breaking Bad chemistry. It's been that unpredictable.

On the market side, we're now dealing with the second major scare of the cycle, following the August 2024 yen-carry unwind. Volatility has returned like the unwanted sequel no one asked for, but the key takeaway is this: Bitcoin and Gold are still holding firm as the go-to safe havens in a sea of debt-driven fiat liquidity.

Crypto and altcoins will follow Bitcoin, and Bitcoin itself is becoming an intriguing blend of fiat, gold, and the S&P. Sure, we could dip back to $75K-$80K, but that would be snapped up quickly by smart money.

Q2 will likely remain turbulent, but at some point, I expect Bitcoin to decouple from the S&P/NASDAQ and start to track more closely with gold as more countries and corporations adopt it. As always: zoom out, stay hydrated, and never trust a market that reacts to tweets. Fiat currencies can be printed endlessly, but thankfully, Bitcoin can’t be.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @Risinghashtalk or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out Our Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!

What a timing, almost right after BTC and ETH started going up crazy 🤝