5-Min Monday Macro, Crypto: #73, 3rd Mar

Momentum unwind or growth scare? Why macro environment favour crypto?

Hey!!!! It’s Monday again. Welcome to another fantastic week!

I spend hours reading, researching, and talking to the smartest founders and investors in macro, crypto, and AI every week. This is my attempt to give you a short 5-10 minute summary on how I am thinking about the macro and crypto markets and what lies ahead. Hundreds of hours summarized, so you don't have to.

For live updates, you can join our Telegram channel or listen to the experts that we bring on our podcast, 'Greed is Good'

Zoologist and primatologist Jane Goodall on making a difference:

"The greatest danger to our future is apathy. We can't all save the world in a dramatic way, but we can each make our small difference, and together those small differences add up. Every single person makes an impact on the planet every single day. The question is: What kind of impact do you want to make?"

Source: Reason for Hope (paraphrased)

Via James Clear

TL;DR

Macro Zeitgeist - The market’s growth jitters from last week have carried over into this week, as a steady stream of weak economic data fuels concerns about a slowdown. Adding to the pressure, the White House confirmed that Trump’s tariffs on Canada and Mexico will take effect as planned on March 4, while China faces an additional 10% tariff. This escalation in trade tensions is further weighing on sentiment, reinforcing fears that economic headwinds could intensify in the months ahead.

Crypto - Ignore the noise, focus on the macro framework, and zoom out. The largest gains in this cycle are yet to come.

The Macro Zeitgeist

Momentum Unwind or Growth Scare?

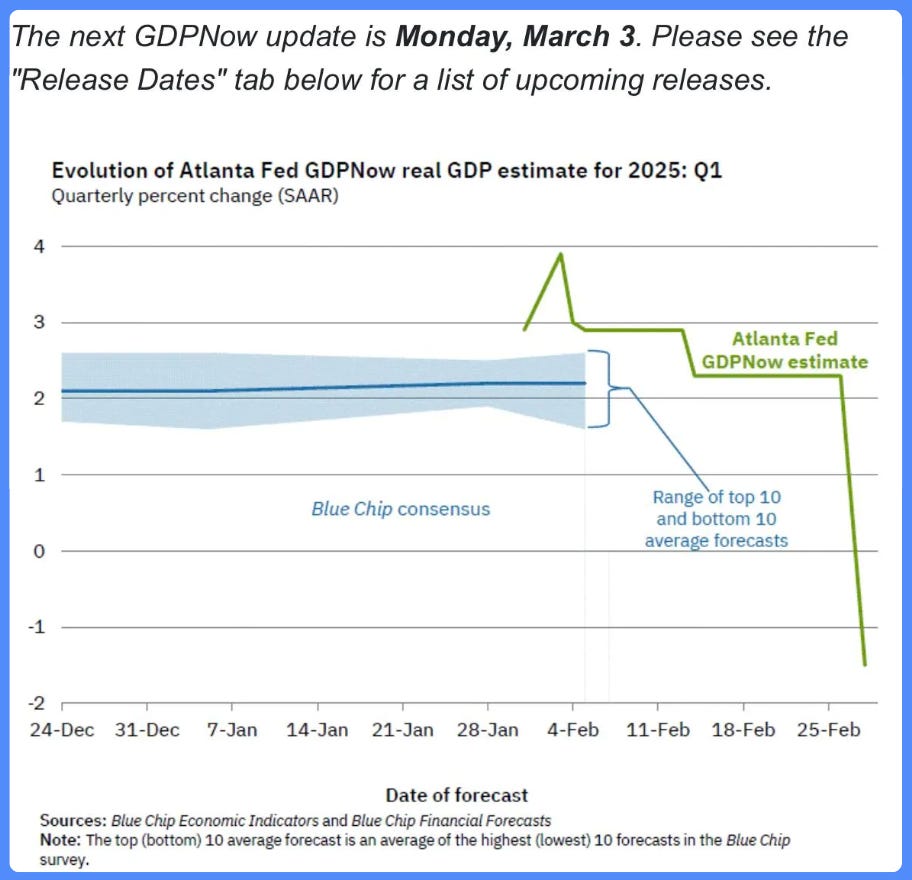

What began as a tariff scare led momentum unwind in high-growth sectors now risks evolving into a broader macro growth scare accompanied by aggressive DOGE cuts.

Macro Mental Model for the Next Few Months: A Trader’s Guide to Navigating the Chaos

The global economy is serving up a cocktail of fiscal tightening, geopolitical uncertainty, and inflation that just won’t take the hint. Here’s how I’m thinking about the macro landscape—and what it means for crypto markets.

1. Fiscal Tightening: The Domino Effect of DOGE’s Budget Cuts

For years, Uncle Sam has been the life of the party, pumping money into the economy like a high-rolling Vegas gambler. But with the new DOGE administration slashing spending—potentially cutting 500,000 jobs in the coming months—the party is winding down fast.

The ripple effect is real: Fewer government contracts mean fewer six-figure consulting gigs, fewer power lunches, and a sharp drop in overpriced lattes fueling bureaucratic debates. The unofficial economy (real estate brokers, service industries, and corporate middlemen) takes a hit too, amplifying the slowdown.

What does this mean? Lower spending, weaker earnings, and more layoffs. Expect the first warning signs in next month’s payroll data. Translation: Pain isn’t over, and slower growth with rising unemployment is likely in H1 2025

2. Tariffs Take Effect on March 4: Inflation Just Found a New Best Friend

Remember that TV show cliffhanger that had everyone panicking—only for it to be undone a few episodes later? That’s exactly what happened with tariffs. Trump’s Art of the Deal playbook made it look like a high-stakes negotiation, but now it’s clear: the tariffs are here to stay.

Markets Hate Tariffs, But They Keep Coming Back

Every time tariffs rear their ugly head, markets panic—but the impact has been short-lived so far. If the U.S. actually follows through with tariffs on Mexico and Canada, though, the shockwaves could linger. Until now, investors have bet that these threats are more bark than bite. But if this time is different, brace yourself for turbulence.Tariffs Sound Simple—Until They Aren’t

The idea behind tariffs is straightforward: tax imports, get fewer imports. But in reality, the global economy is like a game of whack-a-mole. Block Chinese goods? They’ll just find a backdoor through Mexico or Vietnam. The trade deficit isn’t shrinking because tariffs aren’t addressing the root cause—our own fiscal and economic policies. Trying to fix trade imbalances with tariffs is like putting a Band-Aid on a leaky dam.The lesson is clear—balance the budget, fix spending, and let the economy grow. Tariffs are just the wrong tool for the job.

3. Inflation: Like a Stubborn Stain That Just Won’t Wash Out

In theory, government downsizing should ease inflation—fewer people spending, weaker demand, and businesses slashing prices like it’s Black Friday. But this isn’t 2008.

The gig economy changes everything—laid-off professionals aren’t just sitting around. They’re freelancing, flipping sneakers, launching AI-generated art startups, or posting motivational nonsense on LinkedIn for six figures.

This keeps demand afloat, meaning inflation could stay sticky. The Fed may have to rethink its timeline for rate cuts.

The wildcard? Elon Musk. If he starts paying Tesla workers in Dogecoin, all bets are off. Also, if that $5,000 dividend check rumor for U.S. citizens turns out to be real, I’ll be irrationally jealous of my American cousins.

4. The Fed: Watching Inflation and Unemployment Like a Nervous Parent

The Federal Reserve is in the ultimate waiting game—trying to balance a slowing economy with inflation that refuses to play nice.

The big question: Will we see a soft landing with GDP growth moderating to 1-1.5%? Or does the combination of tariffs and spending cuts push the economy into deeper trouble?

What’s likely? Given that both Trump and Bessent want lower rates and a weaker dollar, expect a rate cut by June 2025. Powell might not have much choice.

5. Stagflation: The Word No One Wants to Say Out Loud

The worst-case scenario? Inflation creeping to 4% while GDP growth slides below 1%. That’s classic stagflation territory.

If corporate hiring remains frozen and Trump’s policy unpredictability continues, we could be in for a tough six months.

Powell and Trump would be stuck between a rock and a hard place, with unemployment numbers likely dictating the next move

6. The Dollar: Titanic or Unsinkable?

Slower growth usually means a weaker dollar—like a heavyweight champ finally showing signs of age. But if markets believe these policy shifts will make the U.S. economy leaner and meaner, capital could still flow back in, keeping the dollar surprisingly resilient.

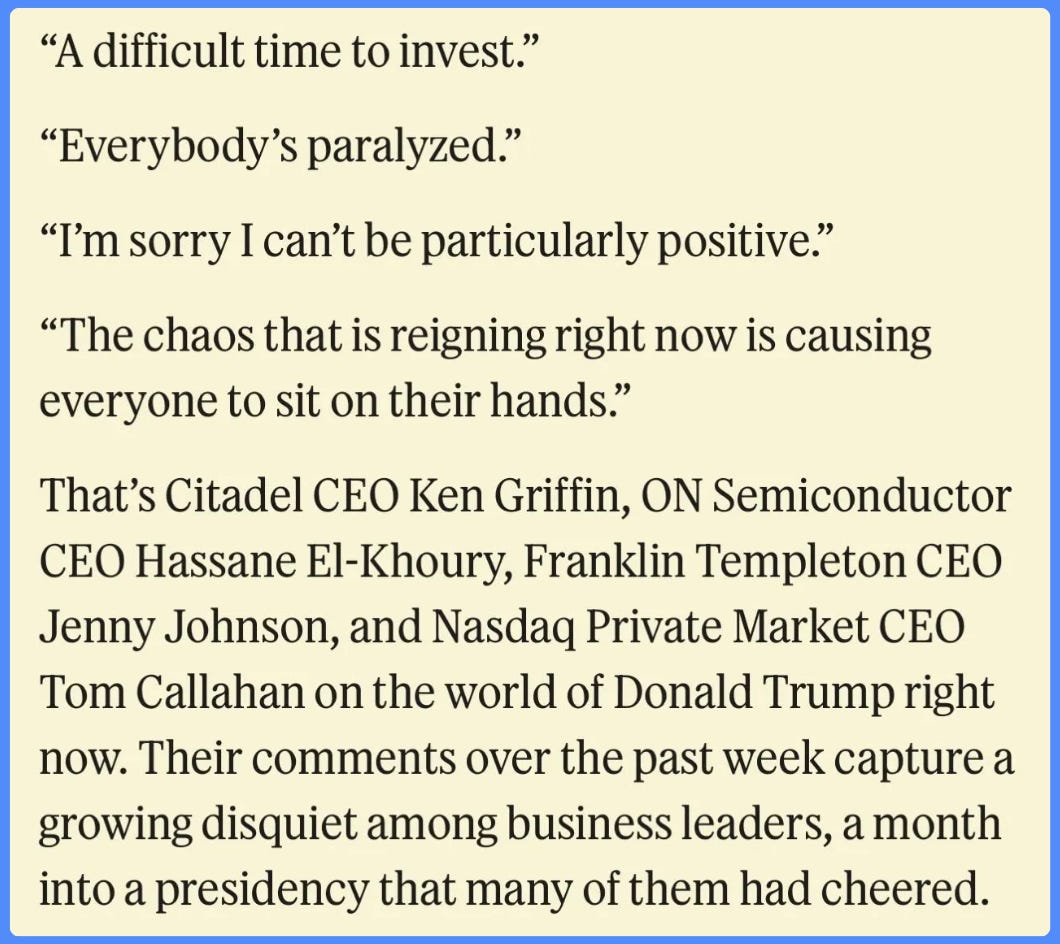

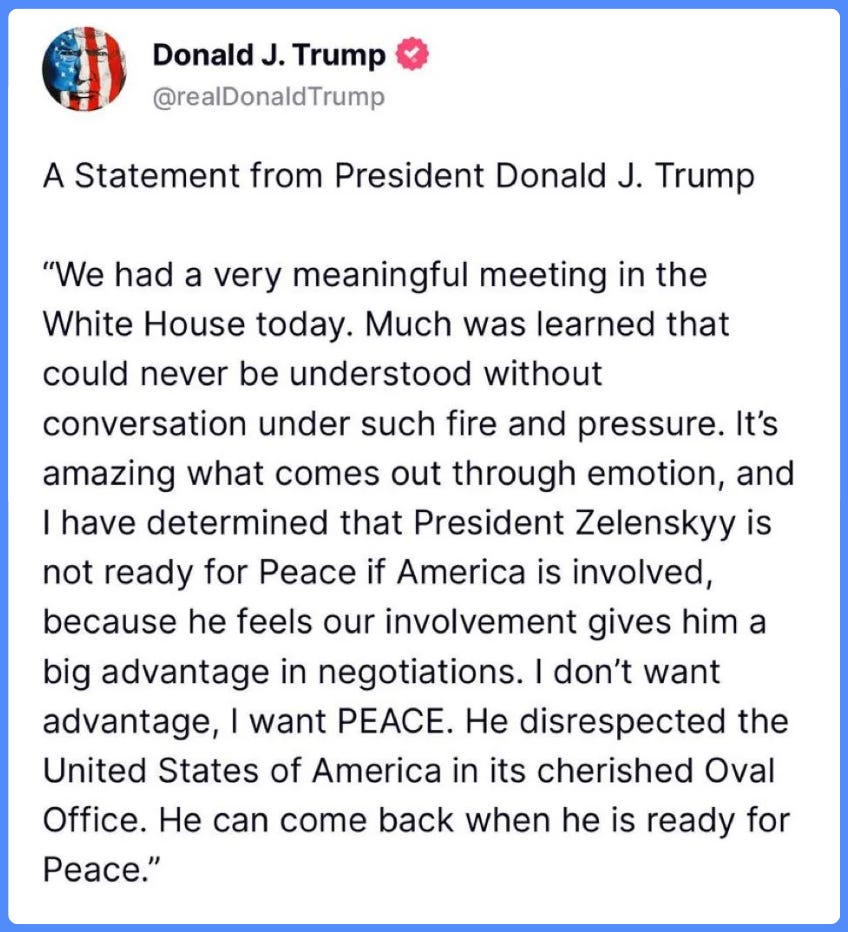

7. Geopolitical Chaos: Ukraine and the Trump-Vance Drama

Just when investors thought markets could stabilize, geopolitics delivered another curveball. Over the weekend, the Oval Office played host to a high-stakes showdown between Zelensky and the Trump-Vance camp.

Markets were pricing in peace talks. That looks premature.

Trump’s stance is clear—he’s shutting off U.S. financial support to Ukraine. With Europe likely following suit, Kyiv faces an increasingly difficult battle.

Zelensky’s public gratitude? A little too late to change the narrative.

Bad for Ukraine. Bad for geopolitics. And definitely bad for market sentiment.

Macro Tailwinds: Why the Environment Favors Crypto

1. US Dollar & Yield Reversal

Earlier this year, U.S. growth exceptionalism pushed yields and the dollar higher, creating a macro headwind for crypto. But the sugar high from pre-election spending is fading, leading to softer data. The dollar and yields are reversing lower, setting the stage for Bitcoin’s next move.

2. Global Liquidity is Expanding

A weakening dollar boosts global liquidity.

China may ramp up stimulus to counter deflation, injecting fresh capital into markets.

Global M2 money supply is breaking out to the upside.

The U.S. Treasury General Account (TGA) is drawing down, adding liquidity.

Oil is down 13% since the inauguration, further easing inflationary pressures.

3. The Fed Will Be Forced to Cut Rates

The U.S. economy has been artificially propped up by fiscal stimulus, but that era is ending. Structurally, high real rates are unsustainable. Markets are still underestimating how many rate cuts the Fed will need to deliver.

Macro Summary

Short-Term Chaos, Long-Term Gains—Like a Bad Haircut That Eventually Grows Out

2025 is shaping up to be shakier than a Jenga tower at a frat party. Sticky inflation, rising unemployment, and short-term economic turbulence will dominate headlines, keeping markets on edge. But if the pieces fall into place, the long-term outlook isn’t all doom and gloom.

A leaner, more efficient economy could emerge from the mess—kind of like a bad haircut. It looks terrible at first, your friends roast you mercilessly, but give it time, and either it grows back stronger or you find a great hat (aka strategic investments). Patience will be key in navigating this cycle.

DATA TO WATCH

March 7 - U.S. Nonfarm Payrolls (Feb)

March 19 - U.S. FOMC Interest Rate Decision

March 28 - BTC CME March (BTCH25) Options Expiry

CRYPTO

February began strong above the $100K mark but quickly turned into a downhill slide, culminating in a dramatic plunge during the final week. Prices tumbled off a proverbial cliff, hitting a low of $78,303 before staging a last-minute comeback in the closing hours of February 28. Ultimately, the month wrapped up at $84,366, marking a 17.6% decline overall and a peak-to-trough drop of 23.8%—a rollercoaster ride that investors won’t soon forget.

Crypto’s Recent Rollercoaster: A Market Symphony in Chaos

The past week in Bitcoin has been nothing short of a financial opera—soaring crescendos, dramatic plunges, and a few discordant notes. Here’s the market breakdown, complete with humor and perspective:

1. The Great Stop-Loss Massacre: A Lesson in Market Brutality

Last week felt like a stampede of over-leveraged traders running off a cliff, blissfully unaware of the abyss below. Price levels at 92K, 88K, 85K, and 82K were systematically obliterated, sending Bitcoin plummeting to 79K. Market liquidity vanished faster than a magician’s rabbit, leaving investors in shock. Meanwhile, speculation swirled around Michael Saylor’s aggressive accumulation—was he the mastermind or just another casualty?

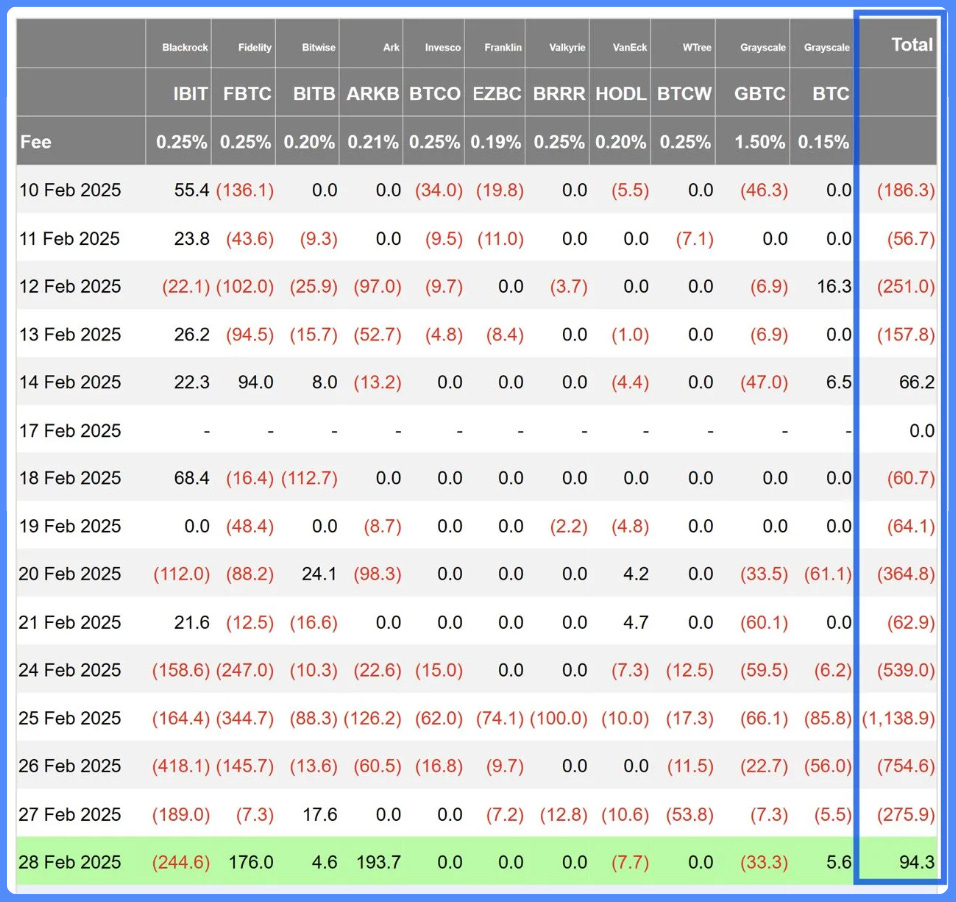

2. ETF Exodus: Investors Running for the Exits

U.S.-listed Bitcoin ETFs witnessed outflows on a biblical scale. Fidelity’s FBTC led the charge, shedding $344.65 million, while BlackRock’s IBIT offloaded $164.37 million, resembling a sinking hot-air balloon jettisoning weight. It seems investors weren’t just taking profits; they were outright bailing.

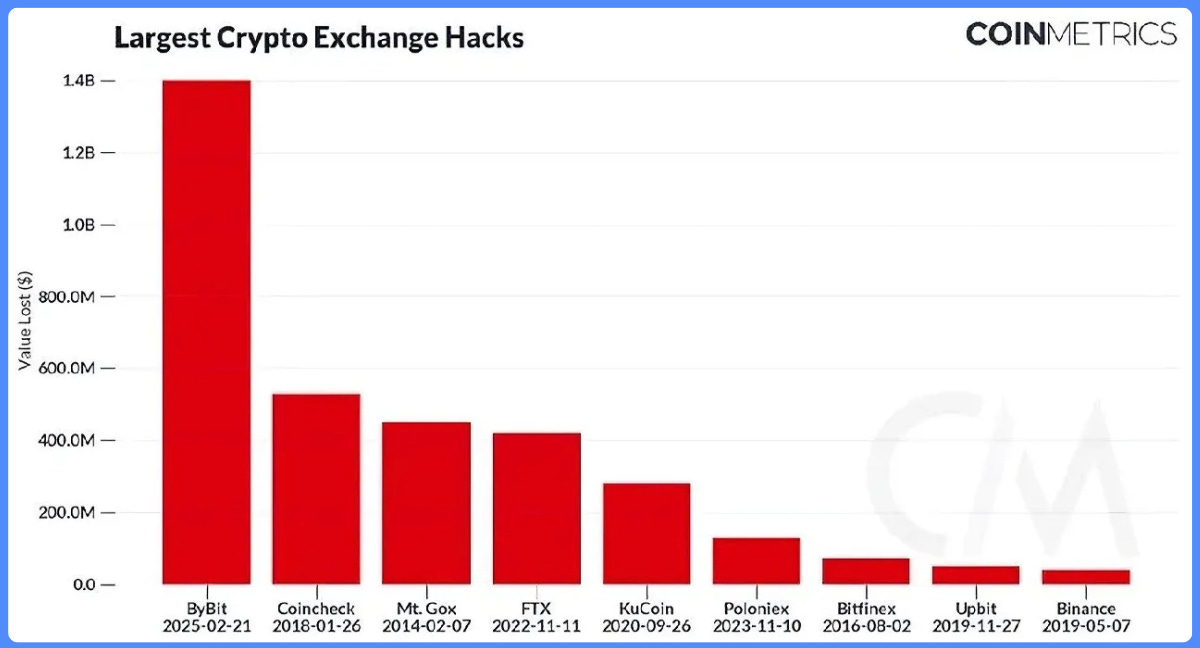

3. Bybit’s Billion-Dollar Blunder: A Comedy of Crypto Errors

As Bitcoin and Ethereum struggled, Bybit, the second-largest exchange by market share, suffered a $1.4 billion security breach. In a scene worthy of a Hollywood heist film, the hack sent shockwaves through the industry. The lesson? Security in crypto is like locking your doors in a zombie apocalypse—you can’t afford to get sloppy.

4. Trump’s Teleportation Trick: From Collapse to Rally in Hours

Heading into the week, expectations were set for a slow grind back up, possibly dipping into the low 70s. Then, Trump dropped a bombshell: a Strategic Bitcoin Reserve. Within three hours, Bitcoin catapulted from 85K to 95K, defying logic with the grace of a caffeinated kangaroo on a trampoline. Markets didn’t just move—they teleported.

5. The Sovereign Blessing Hypothesis: Bitcoin’s Golden Goose Moment

If Trump officially backs Bitcoin as part of a Strategic Bitcoin Reserve (SBR), it could send prices into overdrive. Betting against Bitcoin at that point would be like shorting gravity. With the U.S. capital markets dwarfing all competitors, this endorsement isn’t just a nod—it’s a paradigm shift.

What’s Next? A Crystal Ball with a Dash of Optimism

1. Tourists Evicted, Veterans Take the Wheel

The recent purge has rid the market of short-term speculators. What remains are seasoned investors who understand Bitcoin’s long game. These are the folks who rode the 2017 and 2021 cycles and know that patience is rewarded.

2. ETF Inflows Set to Resume

As Wall Street marketing machines rev back up, expect fresh ETF inflows. Bitcoin isn’t just an asset anymore—it’s a potential strategic reserve. If sovereign nations follow the U.S. lead, demand could skyrocket.

3. A Measured Climb, Not a Moonshot

Bitcoin is unlikely to explode overnight. Instead, think of its recovery like a majestic hot-air balloon ride—gradual, steady, and offering an incredible view. The first half of 2025 could see new all-time highs, barring any major macroeconomic shocks.

Potential Risks: What Could Rain on the Parade?

1. Does Trump Need Congress to Approve the SBR?

If Trump can declare a Bitcoin Strategic Reserve via executive order, bullish momentum will continue. But if Congressional approval is required, expect delays and political drama.

2. Crypto Cocktail of Confusion

If the SBR includes assets like XRP, ADA, or SOL, it could complicate matters. Bitcoin is the clear favorite, but regulatory uncertainty over altcoins could muddy the waters.

Final Thoughts: Bitcoin’s Macro Moment

Alright, listen up—if Bitcoin doesn’t rip higher in 2025, I’ll be as shocked as a squirrel finding out electricity exists. Kicking off in March, no less. Sure, it could take another dip, but two straight red months in a bull market? That’s like spotting Bigfoot at Starbucks—technically possible, but you wouldn’t bet the house on it. So yeah, I’m feeling good about BTC closing higher this month. As for a full-blown $100K comeback? That’s a tougher call—more of a 50/50 dice roll.

Now, let’s talk big picture. Liquidity is still flowing, and risk assets (yep, crypto included) are soaking it up like a sponge. Sure, the market had a little tantrum over growth concerns, but as soon as rate cuts start looking likely, it’s back to the races.

We’re still in that economic sweet spot—a “Goldilocks” zone where growth is slowing but not face-planting, which means the Fed can cut rates without sparking a full-blown recession. And on top of that, Trump’s latest moves are basically a flashing neon sign saying, “Hey world, the U.S. is all in on crypto!”

Bitcoin is still chilling below its true value, considering the seismic shifts happening in regulation and politics. The play here? Block out the short-term noise, focus on the macro trends, and zoom out. The real fireworks haven’t even started yet. 🚀

OTHER CRYPTO OBSERVATIONS

Web3 Agent Bloodbath - Time to start dipping back a little IMO

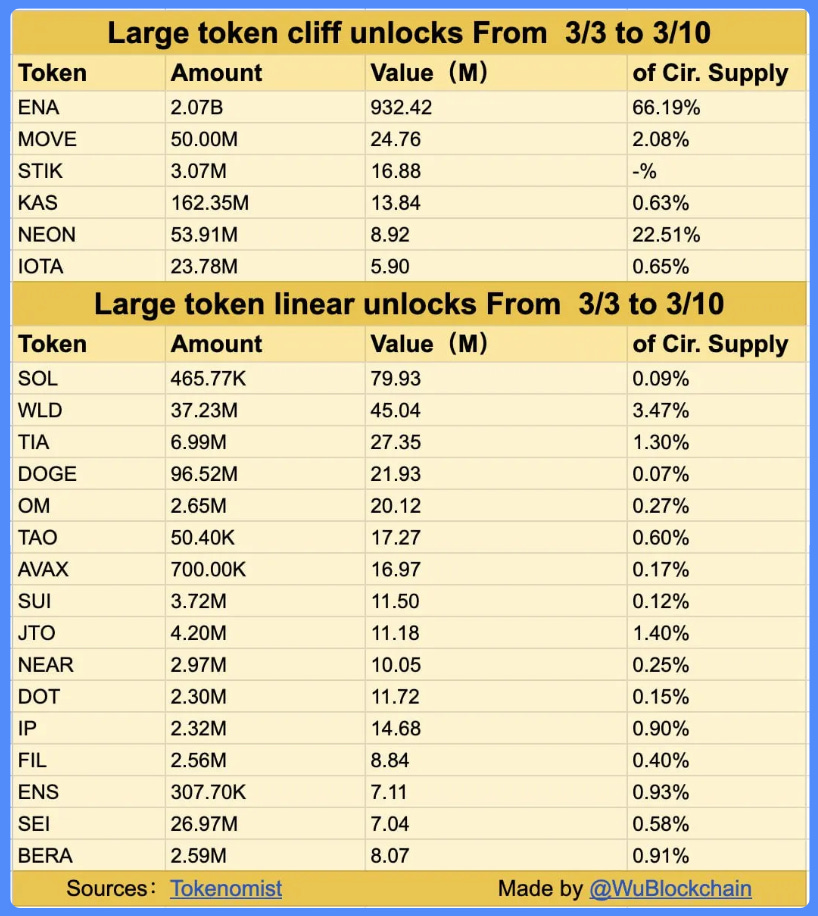

Upcoming Token Unlocks

May your Monday be filled with coffee & profits.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out Our Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!

What a great insight!!! Thanks a lot.

Great article! Very interesting.