Jackson Hole & Fed Jitters: Intermission or The End?

Every August, central bankers retreat to Wyoming to whisper into the void and the void whispers back in the form of market earthquakes.

TL;DR

Jackson Hole is less a sleepy resort and more a monetary Olympus where Powell plays high priest. Inflation remains stubborn, labor markets are cooling (but not collapsing), and risk assets wait nervously for Powell’s words. Markets are defensive—meaning a balanced speech could spark a sharp relief rally. Crypto, ever the toddler on a sugar high, amplifies every macro whisper: Bitcoin stalls, Ethereum rises. This is not the end of the bull market; it is merely an intermission before September’s crucible.

The Gods Gather in Wyoming

Every August, Jackson Hole ceases to be a sleepy mountain town and becomes Olympus-on-the-Snake-River. Central bankers descend like quarrelsome gods, economists posture as philosophers, and a few words muttered from the altar can shift the fate of trillions. Forget summer seminar—this is a medieval war council, quietly deciding whether to light the catapults.

And at the center stands Jerome Powell—America’s high priest of money—speaking in incantations that can make or break empires. Markets wait as parishioners at vespers, convinced salvation or damnation hangs on a single phrase.This week, Jerome Powell steps forward as the high priest of monetary policy. The markets listen with the reverence of parishioners whose very lives depend on the sermon. And in a sense, they do. Every August, the sleepy resort town of Jackson Hole transforms into a geopolitical Olympus. Central bankers descend, economists pontificate, and a few carefully chosen words have the power to reshape trillions in global wealth. Think less “summer academic retreat” and more “medieval council deciding whether to unleash the catapults.” This week, Jerome Powell steps up as high priest of monetary policy, and the markets are listening as if their very lives depended on it and they have reason to be cautious.

The Macro State of Play: Between Scylla and Charybdis

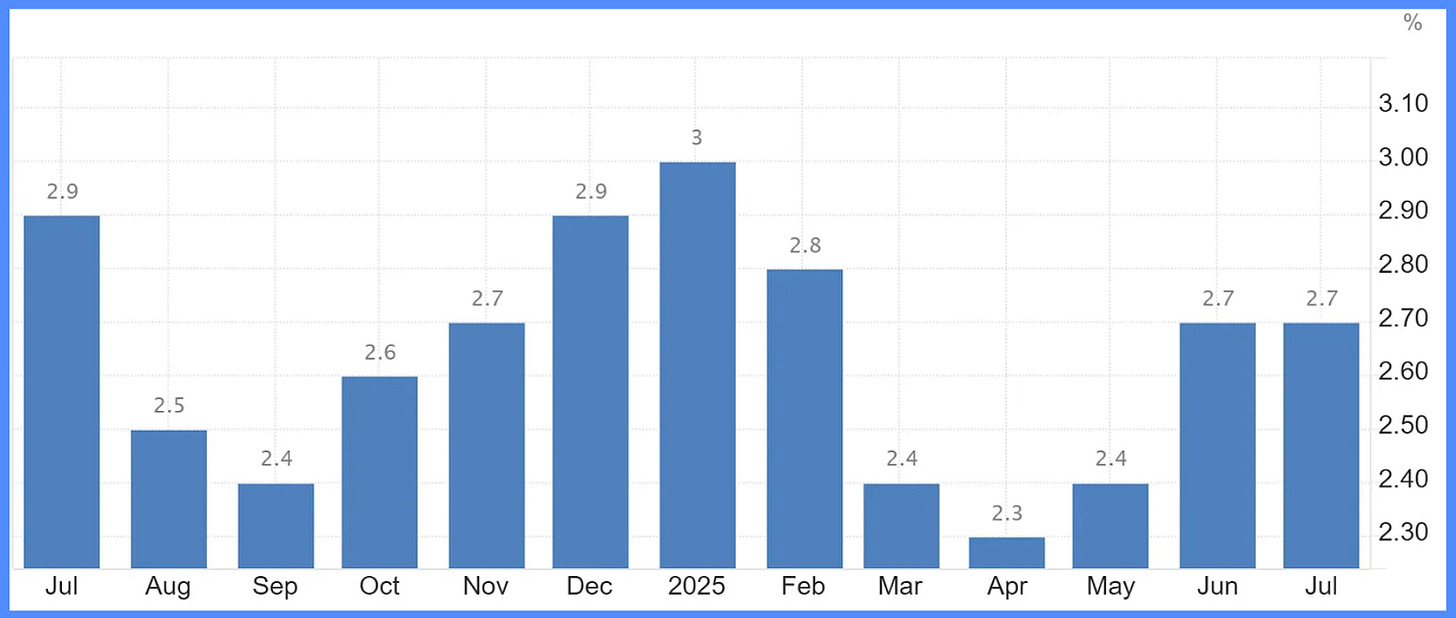

Inflation: The Mosquito in the Tent

Persistent, maddening, but not yet mortal. A nuisance that keeps the Fed’s torch lit long into the night.Labour: Cooling, Not Collapsing

Job openings shrink, quits ease, but the body is not lifeless—merely sweating through convalescence.

The Macro-Crypto Link: Why Jackson Hole Matters

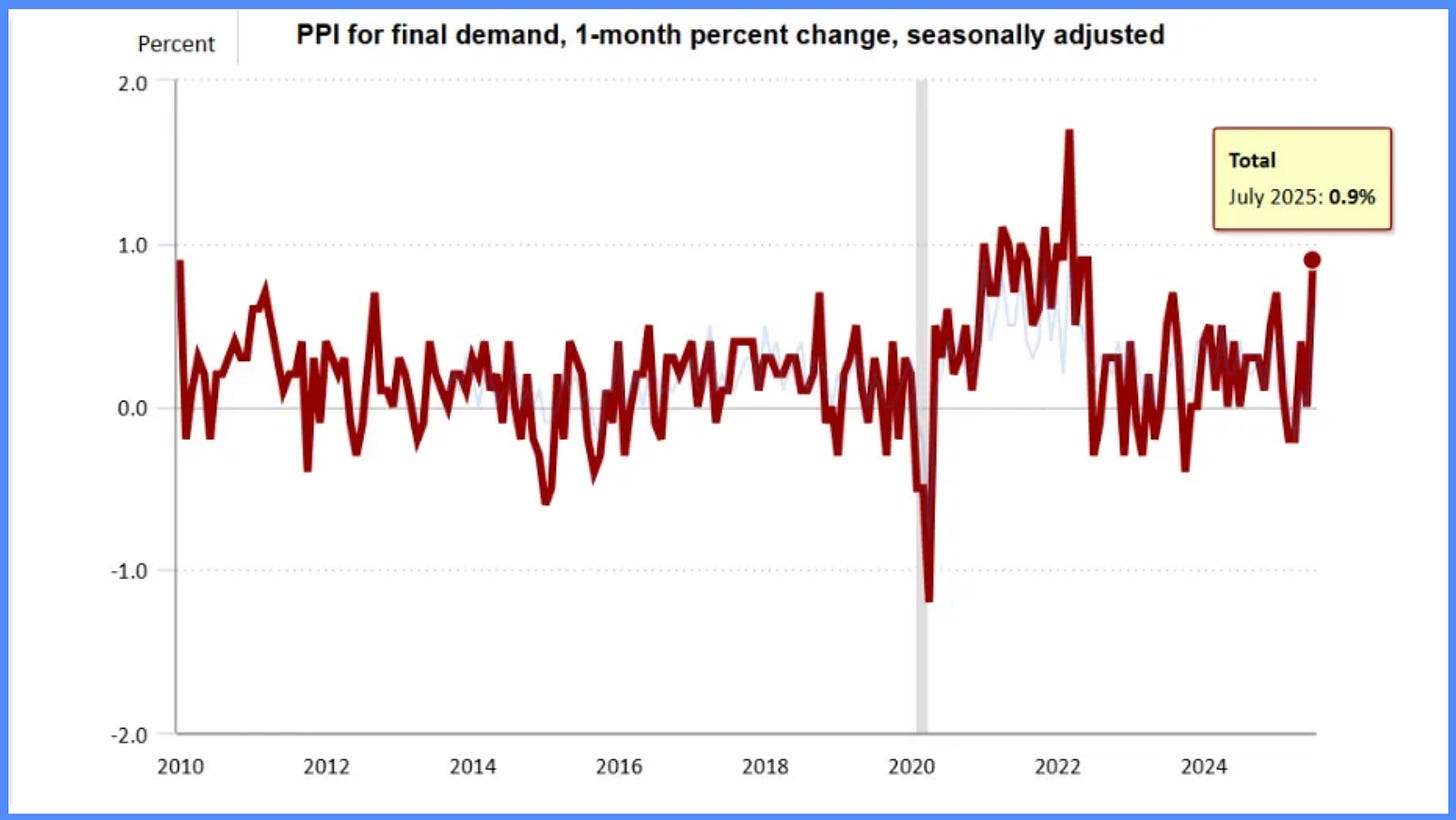

The pullback in crypto is not just about crypto itself. Macro uncertainty is weighing on sentiment. Hot PPI data rattled investors and with Jackson Hole looming, traders are quick to cut risk. But positioning cuts both ways. If Powell delivers a balanced message, the fact that markets are already defensive could spark a relief rally.

Crypto is more reflexive than equities. The same flows that powered BTC higher now amplify the downside when they fade. Yet the reverse is also true: when optimism returns, recoveries are often explosive. That is why managing exposure is so important. Pullbacks can be opportunities, but they require discipline.

Powell’s Script: What to Expect

This year’s Jackson Hole symposium runs from August 21 to 23, with Powell speaking on Friday morning. The anticipation is not about an immediate rate move but about how Powell frames the Fed’s thinking ahead of September.

Three questions will dominate investor focus:

Has the Fed done enough? Inflation is cooling and some argue that rates are already restrictive. Any hint from Powell that the Fed recognizes this could sound dovish to markets.

Will policy remain restrictive for longer? Even without additional hikes, Powell may stress that rates will stay elevated until inflation is firmly at 2 percent. That “higher for longer” language would likely weigh on risk sentiment in the short run.

How data dependent is the Fed? Powell is expected to repeat that policy will be guided by the data. With PPI surprising higher and CPI still mixed, this keeps the Fed’s options open.

Powell will walk the knife’s edge. He is unlikely to unsheathe a hawkish blade—markets are already crouched behind their shields—but neither will he lull investors with complacent hymns. Jackson Hole, therefore, is unlikely to become the spark for mass liquidation. Yet markets being markets, and Powell being Powell, even a carefully measured whisper can echo like thunder across the mountains. Mostly in spot and stables for now.

Crypto Markets: Divergence Between BTC and ETH

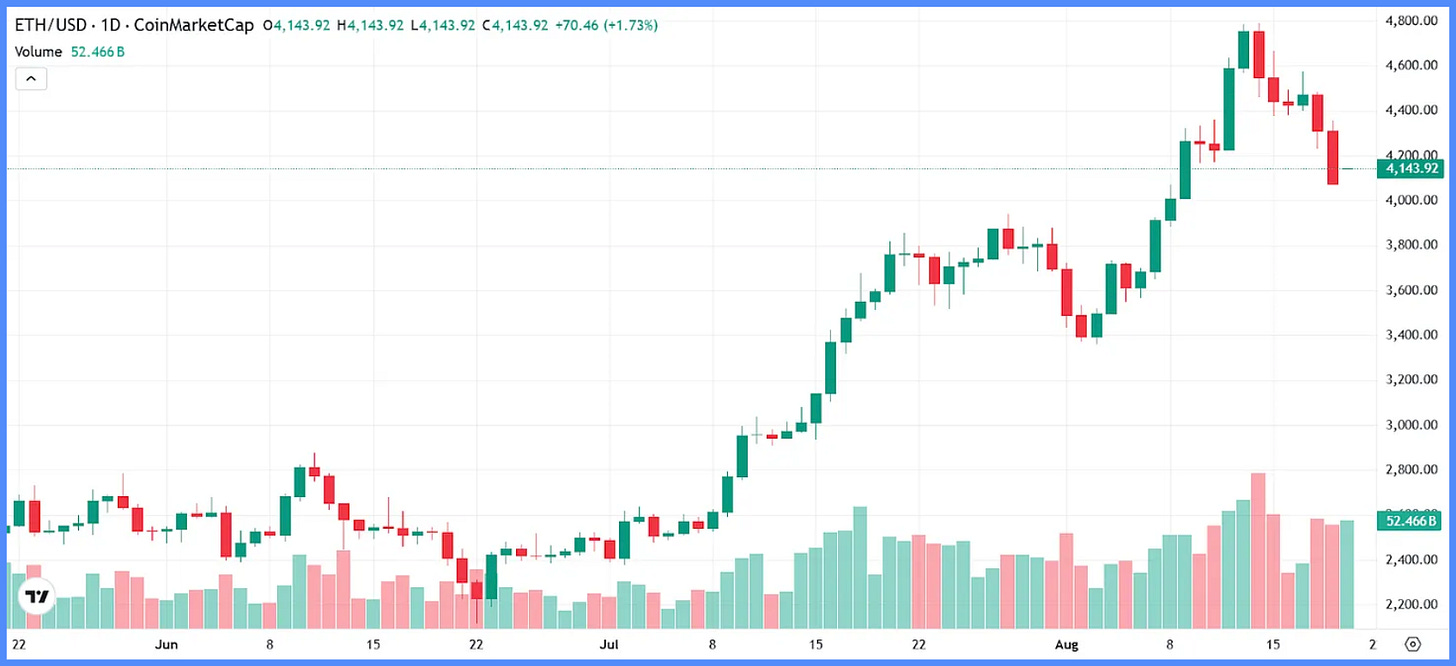

Crypto investors have been asking the big question: is the bull market over? The short answer is no. What we are witnessing is rotation and consolidation, not a breakdown.

If equities are a disciplined teenager, crypto is the sugar-fueled toddler—reflexive, volatile, and prone to tantrums. Jackson Hole matters here precisely because crypto magnifies every macro whisper.

Bitcoin’s Sluggishness: Once the heavyweight champion, BTC now drifts in the 112–113K range, sluggish as an emperor gone soft.

Ethereum’s Ascent: ETH ETFs absorbed $3–3.4B inflows last week vs. BTC’s $0.6–1B. This is not a fluke; it’s a transfer of power. Think of Caesar marching on Rome while the Senate still debates.

Positioning Paradox: Markets already defensive. Which means: if Powell speaks balance, the rebound could be violent.

Crypto is the mirror in which macro fears become grotesque caricatures. But caricatures, too, reveal truths.

Range-Bound Markets: The Pause Before the Drumroll

History tells us: no great rally is uninterrupted. The roaring 1920s had multiple double-digit pullbacks before the peak. Healthy markets breathe—inhale with rallies, exhale with corrections.

Bitcoin’s Range: Traders seeking fireworks get a slow grind instead. Frustrating, yes. But also safer.

Altcoin Resilience: In earlier cycles, alts collapsed like poorly built tents in a storm. This time, they bend but don’t break.

Discipline Over Drama: For patient investors, this is accumulation season. For impatient ones, it’s purgatory.

The correction is not a funeral. It is an intermission.

Is the Bull Market Over?

Let’s dispense with the melodrama: the bull is not dead - it is napping. Every great cycle includes pauses to expel excess froth.

$27B on the Sidelines: Capital waits & itching to re-enter.

Ethereum’s Leadership: With ETH showing strength, the next leg could be led by the underdog, not the incumbent.

Delays ≠ Derailments: If July’s PPI had been softer, we’d already be higher. The path stretched, but the destination remains.

To mistake a breath for a death is to miss the rally of your life.

The Road Ahead: September’s Crucible

Three forces converge as the next act:

Powell’s Jackson Hole Speech – Expect calibration, not shock therapy.

The September FOMC – A pause is likely, a pivot is possible.

Crypto Flows – ETH leadership + alt resilience = explosive potential when risk appetite returns.

The stage is set. The actors are in place. September will decide whether this is a minor chapter or the turning of the page.

Conclusion: The Pause That Refreshes

This Jackson Hole will generate headlines, but not heralds of doom. Expect Powell to walk the middle road, keeping the Fed flexible but markets calm. For equities, supports remain firm. For crypto, the BTC-ETH divergence tells us the baton is being passed.

This is not the end of the bull market. It is merely the market catching its breath, the way a marathoner slows at mile 20 - not to quit, but to summon strength for the final push.

Stay ahead with our latest insights—catch up on our previous articles below:

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out Our Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!