Digital Asset Treasuries: How DAT's Turn Tokens Into More Tokens

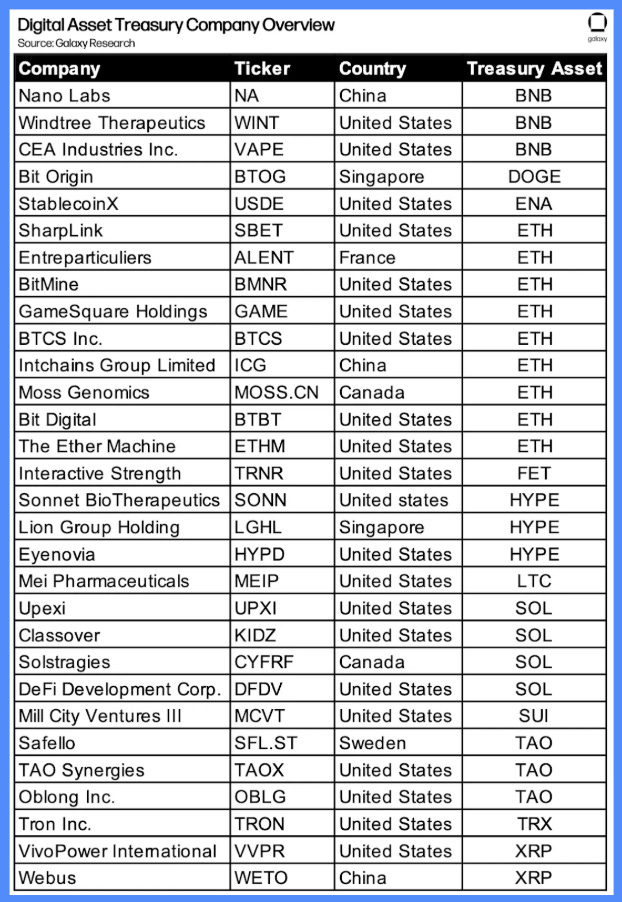

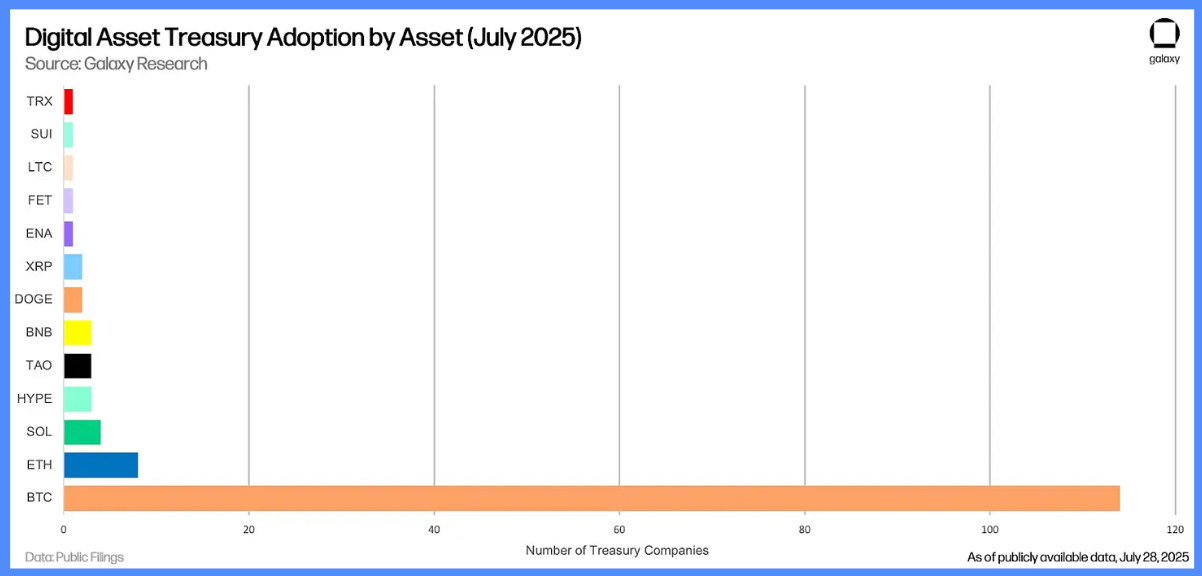

Digital Asset Treasuries (DATs) have exploded onto the scene as public companies turn their balance sheets into active crypto portfolios.

How DATs Turn Tokens into More Tokens

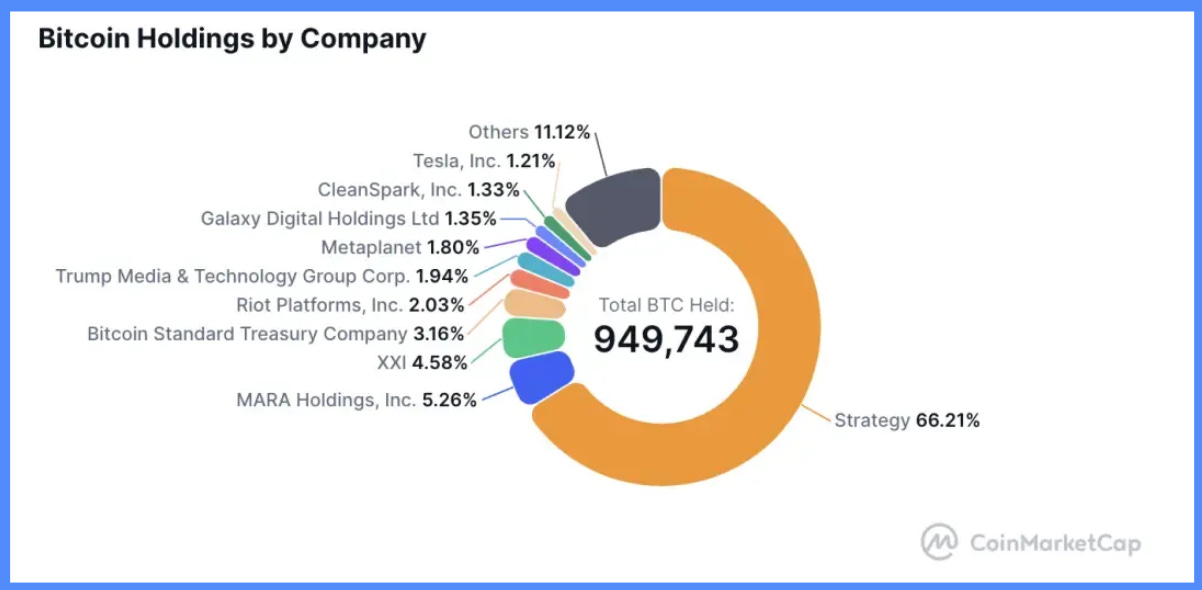

If Bitcoin ETFs are polite custodians—watching over coins like museum guards—Digital Asset Treasury companies (DATs) are industrialists. They don’t just hold; they build, borrow, and breed their holdings. In the last two years, MSTR, BMNR, SBET, and 200 of their peers have proven that this isn’t magic—it’s a highly disciplined corporate-finance-meets-crypto playbook.

The Four Engines of DAT Growth

Premium Equity Issuance – Selling shares above net asset value (NAV) and recycling the proceeds into BTC or ETH. Imagine issuing stock certificates in exchange for more treasure maps—and then actually finding the gold.

Convertible Securities – Turning market volatility into a revenue stream, monetizing price swings in both the stock and the underlying token.

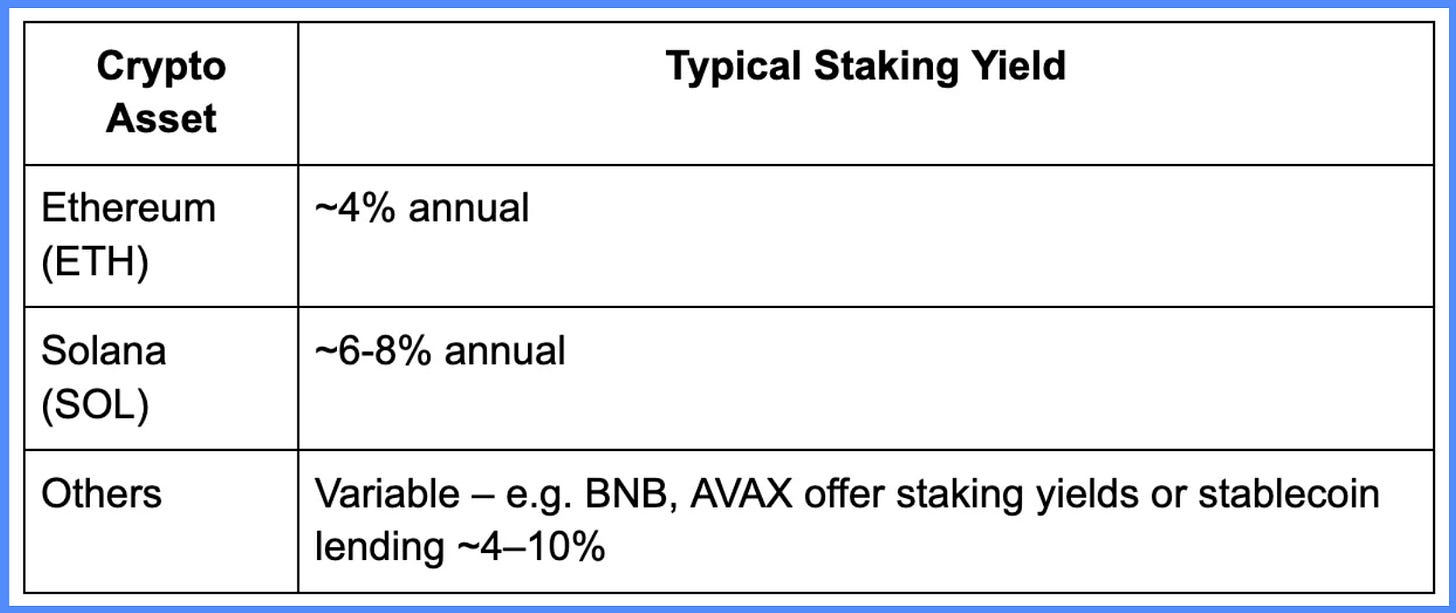

On-chain Yield – Staking and DeFi strategies via in-house desks or external hedge funds, earning yield in tokens while the principal sits secure.

Acquisitions – Buying smaller DATs trading near or below NAV, a corporate version of a whale swallowing minnows.

Unlike passive ETFs—static vaults chained to the spot price—a DAT is a listed company that actively compounds its treasury. The pitch is beguilingly simple: grow NAV per share, and you end up owning more underlying crypto per share than the market price alone would ever give you. In short, a DAT is a vault with ambition and a taste for conquest.

Case Study: The BitMine Playbook & the “Alchemy of 5%”

The Imperial Objective – Chairman Tom Lee (Fundstrat) wants BitMine to own 5% of Ethereum’s total supply. Napoleon wanted Europe; BitMine wants the financial internet.

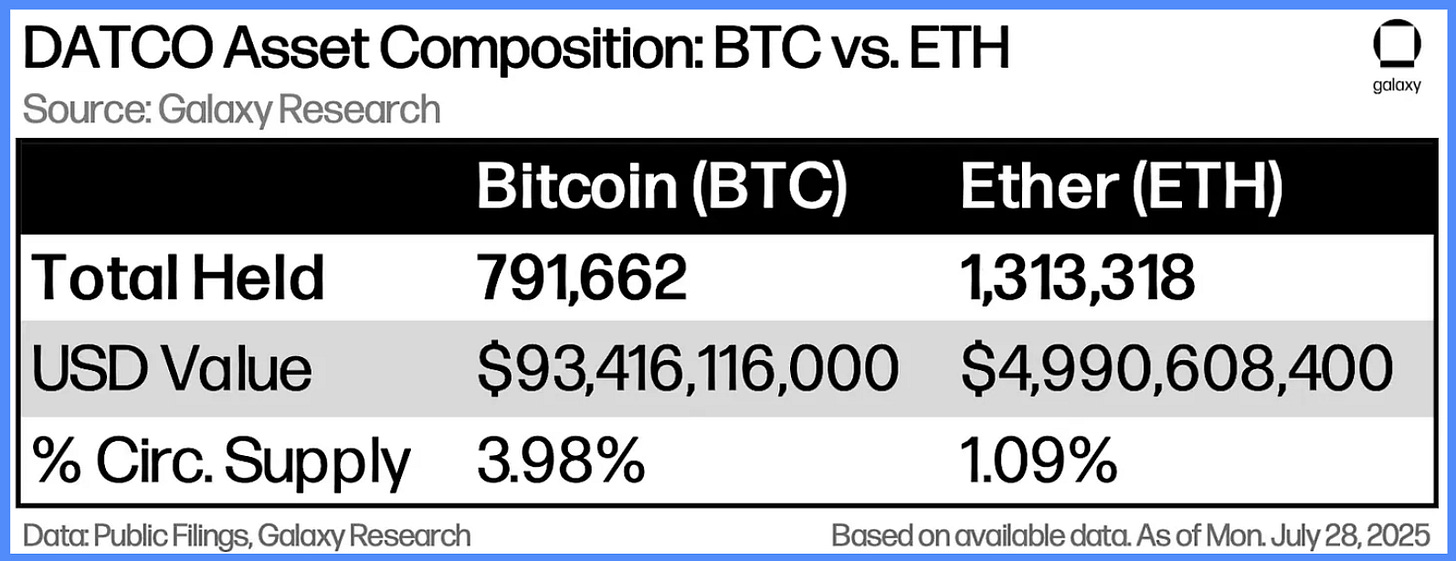

Scale in Motion – Holding 1,150,263 ETH ($4.9B), BMNR is the largest ETH treasury on Earth, third-largest DAT globally, and the 25th most liquid U.S. stock—trading $2.2B daily.

The Ethereum Bet – Wall Street is moving onchain. Already $25B in tokenized real-world assets and $260B in stablecoins live on Ethereum, making stablecoins, as Lee quips, “the ChatGPT story of crypto.”

The Three Levers of Value Creation

A DAT’s market value = Tokens per Share × Token Price × Multiple of NAV (mNAV).

For BMNR:

EPS Growth (~60% of gains) – ETH-per-share soared ~330% in one month.

Token Appreciation (~20%) – ETH climbed from $2.5k to $4.3k.

mNAV Expansion (~20%) – Premium to NAV rose from 1.1× to 1.7×.

Just as top-tier banks trade above book value because they consistently earn more than their cost of capital, elite DATs command a NAV premium because they compound NAV rather than sit idly on it.

The Road Ahead: DATs vs. ETFs and Vaults

DATs vs. ETFs: Static Vaults vs. Compounding Machines

An ETF is a locked chest. A DAT is a chest that mints coins while you sleep.

Staking & DeFi – Earning yield by validating transactions or lending assets.

Structured Products – Overlaying options, collateralized lending, or basis trades to generate income.

Capital Raises – Issuing stock or bonds above NAV, using proceeds to buy more crypto, creating a self-reinforcing flywheel.

On-chain Tokenization – Turning DAT equity itself into a tradable token (e.g., Injective’s SBET), enabling 24/7 liquidity.

This blend of corporate finance and crypto-native tooling blurs the lines between ETFs, operating companies, and on-chain DAOs.

Yield Farming: Putting Idle Coins to Work

DATs are the modern landlords of the crypto world—staking their “real estate” for rent:

Solana Example – SOL Strategies Inc. and DFDV stake millions of SOL, compounding 6–8% yields directly into their treasuries.

Ethereum Example – SharpLink Gaming (SBET) staked its entire ETH reserve, earning ~4% annually while adding 176,270 ETH in a single month.

The result? Shareholders receive both asset appreciation and a stream of new coins—hands-free leverage on their crypto exposure.

Many other DATs operate similarly: DFDV focuses on compounding SOL, SharpLink on ETH and some BNB or altcoin projects have their own DAT strategies.

Aside from staking, DATs can also lend crypto. They might deposit assets in lending markets (Aave/Compound) or use collateralized loans, earning interest in stablecoins or tokens. They can also enter yield farms or liquidity pools when terms are attractive. All told, DATs function like balance-sheet hedge funds: they actively grow crypto reserves through a mix of debt issuance, discounted token buys, staking rewards, and protocol partnerships.

By actively reinvesting, DATs can boost the per-share crypto exposure. In fact, analysts track a metric called Base Asset Growth (BPS): it measures how much more crypto each share of stock represents over time. If successful, DAT investors gain “hands-free” leverage even a premium-priced DAT like MicroStrategy (trading at 2x NAV) can double your Bitcoin exposure per share if it issues new equity and buys more BTC.

Governance & Partnerships: Shaping Crypto Ecosystems

Yield is one part of the DAT playbook, the other is ecosystem influence. DATs aren’t just hoarding tokens; they are becoming active participants in the projects behind those tokens. In practice, many DATs form close partnerships or even join a protocol’s governance structure. For example, SharpLink Gaming enlisted Ethereum co-founder Joe Lubin as its chairman and strategic advisor, effectively bridging traditional finance and Ethereum development. Similarly, BitMine (an ETH-DAT) appointed Tomas Lee – a former JPMorgan strategist and crypto bull as its chairman to steer its ETH strategy. These moves signal that DATs want a seat at the table.

DATs also can stake governance tokens and vote in DAOs. As industry observers note, companies are now buying tokens and “staking governance tokens to influence the protocol roadmap”. In practical terms, a DAT might hold a large chunk of a DeFi project’s governance token and use it to guide key decisions (e.g. grant programs, protocol upgrades, or treasury management). By investing in ecosystems they “help govern,” DATs behave much like venture backers or “ecosystem funds” but in a transparent, on-chain way.

Beyond votes, DATs can create on-chain instruments. Injective’s SBET is one example: it tokenizes SharpLink’s ETH treasury on-chain, so anyone can trade or stake SBET itself. In the future, we may even see DATs issuing their own equity tokens or special-purpose vehicle (SPV) tokens on-chain – essentially converting corporate actions into smart contracts. In short, DATs are evolving from investors into builders of the crypto infrastructure: issuing stock or tokens, backing projects and forming protocol partnerships to accelerate ecosystem growth.

Regulatory Tailwinds: The Policy Push

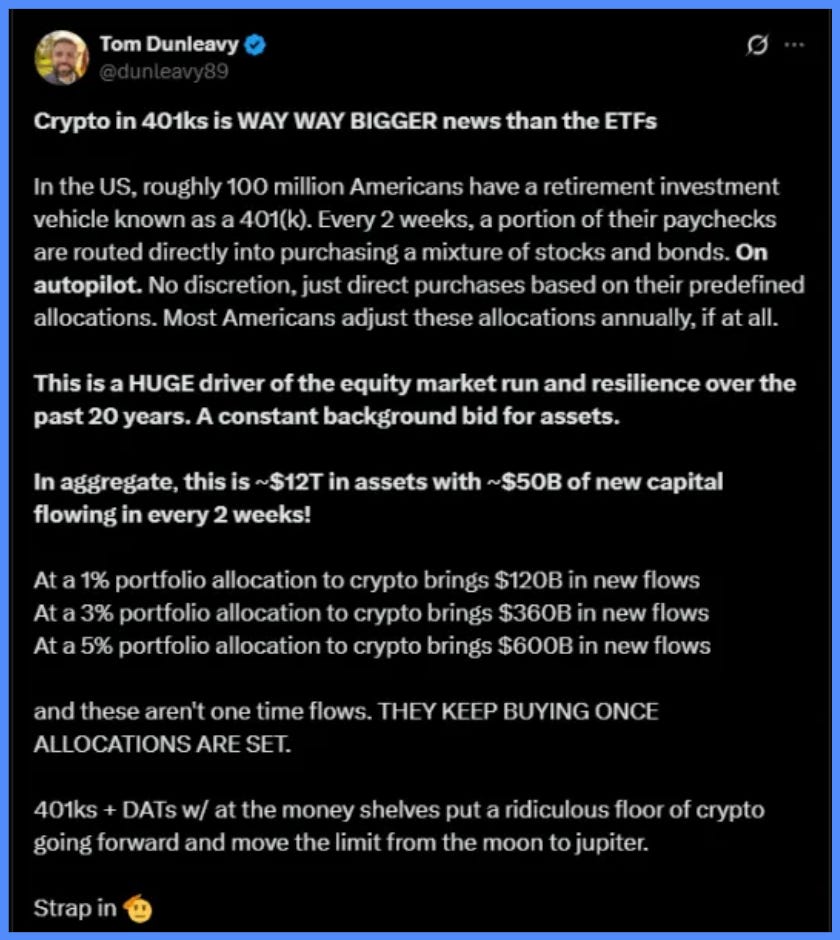

The U.S. government’s proactive stance, exemplified by President Trump’s executive orders, is facilitating the inclusion of digital assets in traditional investment vehicles. Notably, the expansion of 401(k) plans to encompass cryptocurrencies and private equity is unlocking access to digital assets for a broader investor base. Simultaneously, the SEC’s engagement with asset tokenization is paving the way for the digitization of equities, enabling 24/7 global trading. These moves don’t just create a friendlier environment for DAT strategies; they also widen the potential investor pool, speed up mainstream adoption, and set the stage for seamless TradFi–DeFi integration.

Risks & Considerations

All this innovation brings risks. DATs lean on both crypto markets and capital markets, so vulnerabilities on either side can cause trouble. Two red flags to watch:

Liquidity Crunch: If a DAT’s business burns cash (e.g. on hires or R&D) too fast, it may have to sell crypto to raise funds. Likewise, issuing debt to buy crypto creates refinancing risk. A highly-levered DAT could face a “debt repayment crisis” if markets sour, forcing it to dump tokens and collapse NAV. In other words, DATs must manage burn rate and debt carefully to avoid being wiped out by a market swing.

Market Feedback Loops: Because DATs trade in public markets, they can create reflexive cycles. As one analysis warns, a DAT’s share price depends on NAV, which depends on crypto prices. If crypto prices fall, a DAT’s NAV per share and its stock premium shrink. That weakens its ability to issue new equity or debt at attractive terms, possibly forcing asset sales into a falling market. The result could be a cascade: “falling coin price → shrinking NAV per share → capital raises become dilutive → crypto sell pressure → further coin price decline”. This feedback loop could trigger a self-reinforcing crash if not managed.

Valuation Premiums: Many DATs trade at a big premium to NAV (e.g. MicroStrategy at ~70% premium). High premiums imply investor optimism but they also pose risk: if sentiment reverses, the premium can evaporate quickly. In the worst case, shareholders see the stock plunge even if the underlying coins haven’t moved much.

“Castle in the Air” Concerns: Some recent altcoin-DAT launches were backed by token founders or insiders, not pure new money. For example, a DAO might allocate tokens to its own DAT as seed funding. While this jump-starts the treasury, it isn’t “real” market buying, raising questions about whether these DATs truly inject fresh capital. Investors should scrutinize how initial coin purchases were funded.

Regulatory Uncertainty: Because DATs straddle TradFi and DeFi, they face dual regulatory scrutiny. Public companies must file disclosures and comply with securities laws, which may not yet neatly cover yield farming or validator operations. Future regulations (or a regulatory clampdown) could impact a DAT’s strategy or even its ability to stake certain tokens.

In summary, while DATs offer powerful new tools, investors must weigh volatility, leverage, and governance oversight. Rigorous financial controls and transparent disclosures will be key as these models scale.

Outlook: The New Frontier of Finance

DATs reflect a broader shift: crypto is merging with traditional corporate finance. One analyst put it best: “Tomorrow’s DATs will be programmable capital machines: issuing shares to purchase ETH, farming yield through nine-figure balance sheets, and shaping the ecosystem through governance”. In 2025 we’ve already seen the “DAT Summer” phenomenon – dozens of firms raising tens of billions to go all-in on crypto. Today’s treasuries hoard Bitcoin; tomorrow’s will re-invest and vote it.

Empirical evidence of this shift is striking. By mid-2025, nearly 900,000 BTC (~11% of supply) is held by public companies and ETFs. As one chartmaker noted, “Bitcoin has become a corporate asset class”. That institutional foothold lends crypto markets more liquidity and legitimacy. In parallel, regulators are inching toward acceptance: U.S. policymakers have even floated ideas like a national Bitcoin reserve, and some filings hint at crypto inclusion in retirement plans.

What comes next? If the DAT model flourishes, we may see corporate finance reimagined: CEOs will manage token portfolios alongside cash, and treasury reports will detail on-chain rewards alongside interest income. Onchain, the boundaries between DAOs, VCs, and corporate entities may blur – with DATs forging new products on leading platforms. Injective, for instance, envisions a world where on-chain DAT stocks (like SBET) can be traded or used as collateral around the clock.

Of course, skepticism remains. As one columnist wryly observed, this could turn out to be “the fanciest game of corporate roulette” or a revolutionary financial architecture. Yet even critics admit that prices and innovation change, if these bets build useful infrastructure, the trend will persist.

In the end, DATs are not an either/or proposition of yield vs. control. They are both. A successful DAT will farm staking yield and engage with protocols. It will balance the books with new capital while voting with its tokens. The short-term play might be to ride the yield curve, but the long-term bet is that corporate and crypto governance will intertwine. As corporate treasuries become “programmable,” we may enter a new era where the question isn’t whether companies hold crypto, but how they deploy it - both for returns and to help write the next chapter of those projects.

Stay ahead with our latest insights—catch up on our previous articles below:

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out Our Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!