Quarterly Macro & Crypto Outlook - Q3’ 2025

Stable Macro creates Euphoric conditions that demand caution while BTC consolidates before its next leg up

“If you‘re smartest person in the room, then you are in the wrong room.”

- Confucius

TL;DR

The "One Big Beautiful Bill" may light up Q3 with short-term sugar highs, but behind the confetti lies a darker truth: $5 trillion in new debt and a long fuse on the inflation time bomb. The music’s still playing, but the fiscal floorboards are creaking. Stay bullish — but keep one eye on the exit, and the other on your fireproof hedge.

Macro: Washington’s $3.4T stimulus and $5T debt ceiling fuel short-term gains but risk long-term chaos; investors are hedging hard across stocks, gold, and Bitcoin—not confidence, just existential dread.

Crypto: A Wall Street show: institutions pour billions into Bitcoin ETFs while altcoins languish in the velvet rope lounge; Q3/Q4 playbook is simple—accumulate BTC below $95K, favor crypto equities over on-chain drama, and watch ETH and Solana jockey for spotlight as the “Suit Playbook” rolls on.

Before we go any further, customary Disclaimers first:

DISCLAIMER: DYOR & NFA

Don’t follow us blindly. All views, education and trades are my personal views and should not form the basis for making investment or trading decisions, nor be construed as a recommendation or advice to engage in investment or trading transactions. Not Financial Advice (“NFA”). Do your own research (“DYOR”). These are my free thoughts gained from years of experience in banking and crypto. Build your own view and trade accordingly

If you want to read more of what we produce, you can follow below:

Macro Crisis to Confetti: The Swan That Never Crashed

Q1 2025 began like a financial remake of The Shining: tariffs shot up like it was 1930, oil surged as if the Strait of Hormuz were on fire (again), tech wobbled, inflation whispered “stagflation,” and Wall Street stocked up on canned goods. Economists dusted off their Paul Volcker biographies. Markets braced for blood.

And then? Nothing.

No recession. No black swan. Just a quick costume change and suddenly—it’s Gatsby’s party again. The S&P 500 finished Q2 up over 10%, clocked its best May since Bill Clinton was president, and printed new all-time highs. Markets didn’t just shrug off risk—they gave it a piña colada and told it to relax.

Let’s recap this great escape in numbers and irony:

+10%: S&P 500 in Q2, as if soft landings were Fed-mandated.

Best gold rally since 2007: You know, the year before the financial system lit itself on fire.

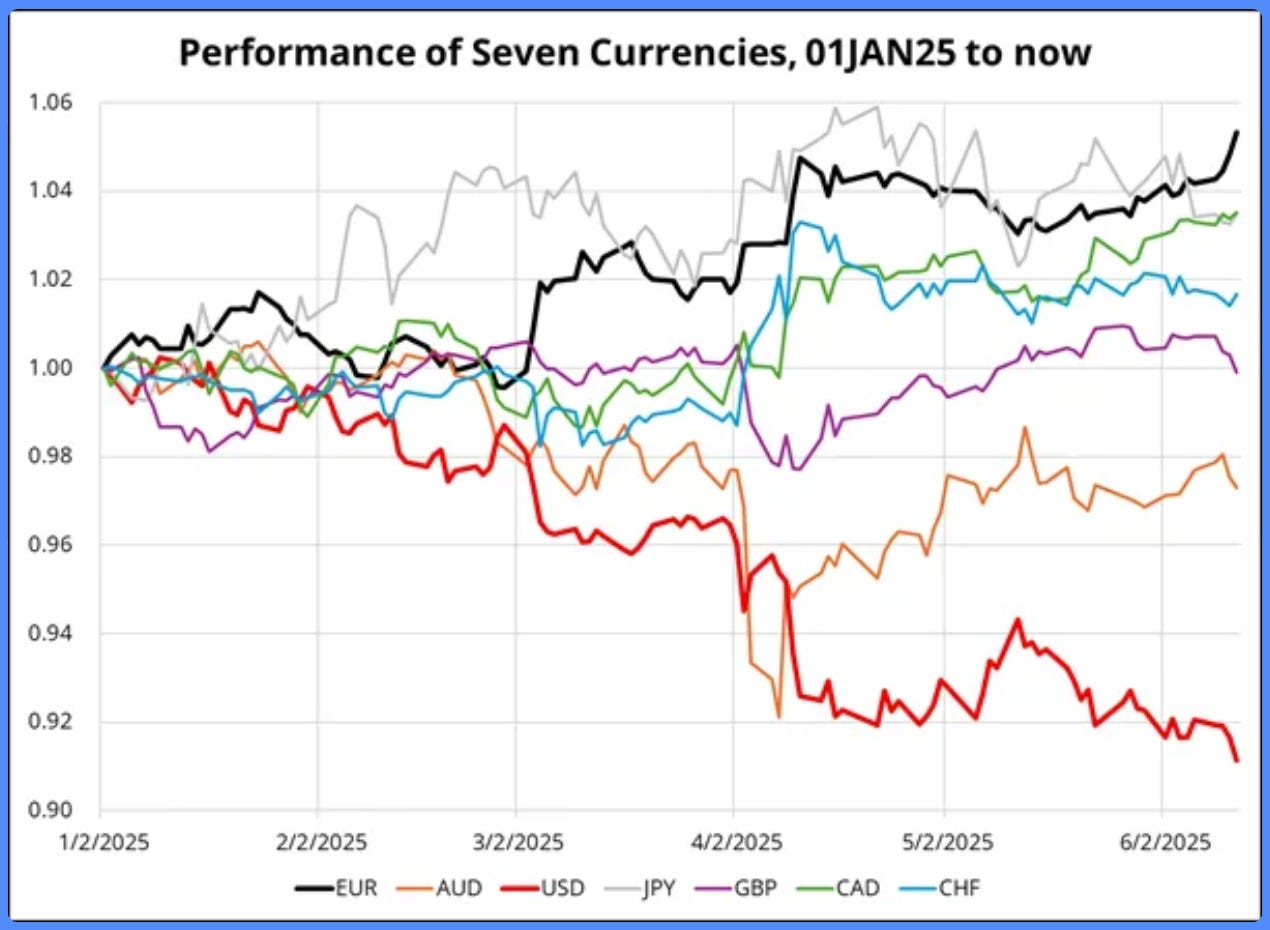

USD down 11% YTD: Its worst start since 1973—right when Bretton Woods collapsed and Nixon untethered the dollar from gold, triggering an 88% gold rally and a 12% S&P nosedive. Déjà vu, anyone?

Foreign stocks outperformed U.S. markets. Investors suddenly remembered there’s a world beyond the Nasdaq. Even Europe got a moment in the sun.

But keep in mind, while this market exuberance might have some legs coming out of summer, it is built on sentiment, vibes, a fiscal policy that’s pouring $3.4 trillion into the void, and investors who’ve decided that deficits are just vibes with a dollar sign. So yes, maybe the swan didn’t crash. Maybe it’s just circling. But if history teaches us anything, it’s this: When everyone’s dancing, you might want to check where the exits are—especially if the DJ is playing “We’re All In.”

Let’s drill down a little bit more on that with out macro outlook and mental model:

The Q3 and H2 2025 Macro Carnival & Outlook

A Spectacle of Stimulus, Sentiment, and Suspense

1. Fiscal Flamethrower, Meet Wobbly House of Cards

Washington’s dropped a $3.4T stimulus bomb with a $10K/year tax cut — and a $5T debt ceiling bump to match. It’s espresso for the economy... with a debt hangover built in. Great for Q3 risk-on vibes, but if bond markets crack (U.S., Japan, UK—take your pick), the dollar exodus resumes. The question is: where does the money run next?

2. Everything’s Rallying? That’s Not Joy — It’s a Fire Drill

Gold, Bitcoin, and stocks surging together isn’t a confidence signal — it’s a coordinated hedge against systemic madness. Just like the 1970s, gold is sanity, Bitcoin is sovereignty, stocks are yield… and the dollar’s the guy everyone’s ghosting.

Yes, we might get a pause here — but don’t confuse breath-catching with reversal. Smart money isn’t rotating, it’s relocating. The U.S. still runs the only deep liquidity pool in town, which means capital returns for now… but with its bags half-packed.

3. The Dollar’s Decline Echoes 1973 but Shorts Might Get Punished in the Short Term

The dollar’s down ~11% YTD — its worst opening act since 1973, when Nixon killed Bretton Woods and gold rocketed 88%. Now? Tariffs are back, deficits are biblical, and the Fed is quietly rehearsing its buyer-of-last-resort monologue. We’re issuing $1 trillion in debt every 100 days — even Caesar would’ve defaulted by now.

And yet, calls for another 30% dollar crash sound less like analysis and more like financial fan fiction. Even currencies need to inhale.

Bottom line? This isn’t collapse. It’s an intermission.

G10 FX Highlights: The Costume Ball Edition

Euro: Acting like it inherited Vienna. Noble, smug, likely in denial.

Yen & Yuan: Quietly regrouping. Fiscal discipline is fashionable again.

EM FX: Oddly resilient. Chalk it up to fundamentals—or horoscopes.

Aussie: Drunk at the punch bowl, muttering about China. No one’s quite sure why it's here.

Moral of the story? Don't bury the dollar yet. But don’t trust it to drive, either.

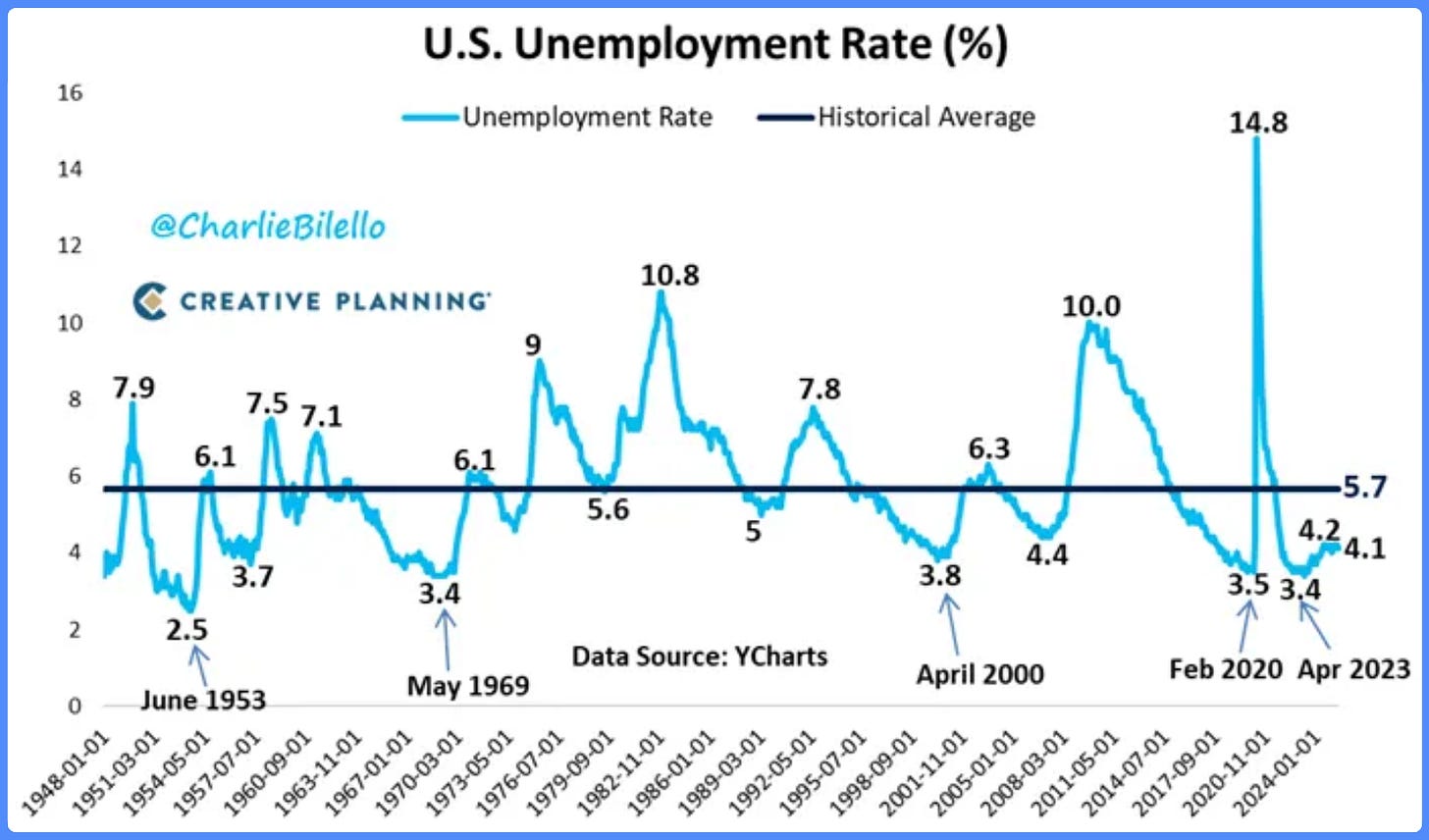

4. Jobs: Still Breathing, But the Cough’s Getting Louder

June’s payrolls beat at +147K — but squint a little: over half came from government education. The private sector? A limp +74K — weakest since October. ADP showed -33K jobs lost, with white-collar and healthcare bleeding out.

Manufacturing? Hiring just hit a 2016 low. Immigration squeeze + tariffs = labor supply crunch. The foreign-born workforce has shrunk three months straight — worst since COVID.

Wages are cooling, workweeks are shortening, and bosses are trimming—not building. From SMEs to MAGA CEOs, no one’s hiring. Why? Because planning under this policy circus is like building IKEA furniture blindfolded.

This isn’t Goldilocks — it’s Hansel and Gretel. And the Fed’s wisely letting the breadcrumbs run out.

5. Services and Manufacturing: A Tale of Two PMIs

The S&P Services PMI posted a modest 52.9 — not thrilling, but enough to keep hope alive. ISM’s version barely crawled into expansion (50.8), with backlogs collapsing and hiring going in reverse. Manufacturing? S&P says it’s growing on inventory restocking and domestic demand (PMI 52.9), but ISM counters with a contractionary 49, as new orders vanish and layoffs outnumber hires 3-to-1. Tariffs are punching holes through both sectors like termites through plywood.

6. Liquidity Is the Lifeblood — and It’s Back

Key signs of stealth easing:

TGA refill & RRP drain = net liquidity still holding

Dealer balance sheets growing

Repo markets greased

QT tapering in practice if not in name

Talk of TBTF-backed stablecoins = new Treasury buyers = more demand for risk

Liquidity is sneaking in the back door like a drunk teenager past curfew. It’s not officially here. But the signs are everywhere.

7. Tariff Theater Returns: Kafka in a Hard Hat

A proposed 70% tariff is not trade policy — it's economic warfare in a necktie. The idea of taxing Chinese content in Vietnamese goods is so byzantine it makes the Byzantine Empire look well-governed. This isn’t protectionism — it’s performance art. Smoot and Hawley would be proud.

8. Stocks - Sentiment Smells Like Dot-Com Spirit

Valuations are stretched, the VIX is napping, and retail is euphoric. The S&P trades near 23x forward earnings — froth last seen when AOL still made CDs. Everyone’s bullish on Bitcoin treasury companies, foreign equities, gold, AI chips, and maybe Labubu’s. It’s starting to feel like January 2000 — but with memes and monetary steroids. Tech earnings haven’t blinked. AI budgets remain sacred. Semiconductors still sing. And the average American is more focused on Taylor Swift’s setlist than crude prices in the Gulf.

Shorting this market now? That’s like standing in front of a freight train because you spotted a squirrel on the tracks.

To borrow from Churchill: "This may be the beginning of the end, or the end of the beginning" — but it’s certainly not the end of tech earnings.

9. Risk-On Rally with a Bond Market Time Bomb

Bond Market Tension: Behind the stock market rally and BBB stimulus, lies a risk: Treasury issuance could spike front-end rates. A repeat of the Sept 2019 repo panic isn’t off the table — especially if funding markets choke. If short-term yields climb too far from Fed Funds, expect a stealth bailout: “not QE QE” to stabilize rates. Inflation? Employment? Irrelevant. It's all about funding the monster.

10. FED Monetary Policy: Cuts Coming, Just Not Yet

PPI and CPI have cooled, tariffs haven’t reaccelerated inflation (yet), and the Fed is itching to ease — but politically boxed in. Rate cuts likely in Q3/Q4, especially as financial conditions quietly loosen.

Expect the Fed’s “pause” to become a “pivot” as we approach Jackson Hole. Fed Funds could be 100bps lower 12 months from now. And if Trump replaces Powell in 2026 with an überdove, all bets are off. The next chair might bring back QE with a vengeance. The long arc of U.S. monetary history bends toward repression.

Final Macro Thought: The Party Isn’t Over — But the Floorboards Are Creaking

This rally wasn’t built on fundamentals—it was conjured from panic, levitated by positioning, and carefully bubble-wrapped by policymakers who fear recession more than reality. It’s not rational, but it’s working. For now.

The 2025 playbook remains clear:

Don’t fight the Fed.

Don’t fight the fiscal.

And definitely don’t fight Trump’s polling numbers.

But as this macro carnival parades on, remember: it's all confetti and champagne—until someone loses a trillion. GDP is tracking at a polite 1.5%, but strip out the fiscal sugar highs, inventory illusions, and vibes-based optimism, and the engine starts to sputter. Exports are sagging under the weight of tariffs. Private hiring is wheezing. And the labor market is more “held together with duct tape” than “resilient.”

This isn’t the end of the cycle. But it is the soundcheck for the next act—and the band is tuning up in a minor key.

Momentum isn’t immunity. Volatility isn’t the bug—it’s the operating system.

The rally still has legs—but they’re starting to shake. Goldilocks is grinning, sure. But the wolves are watching from the treeline.

So enjoy the ride. But wear a seatbelt. And maybe tuck a Xanax in your pocket. Just in case.

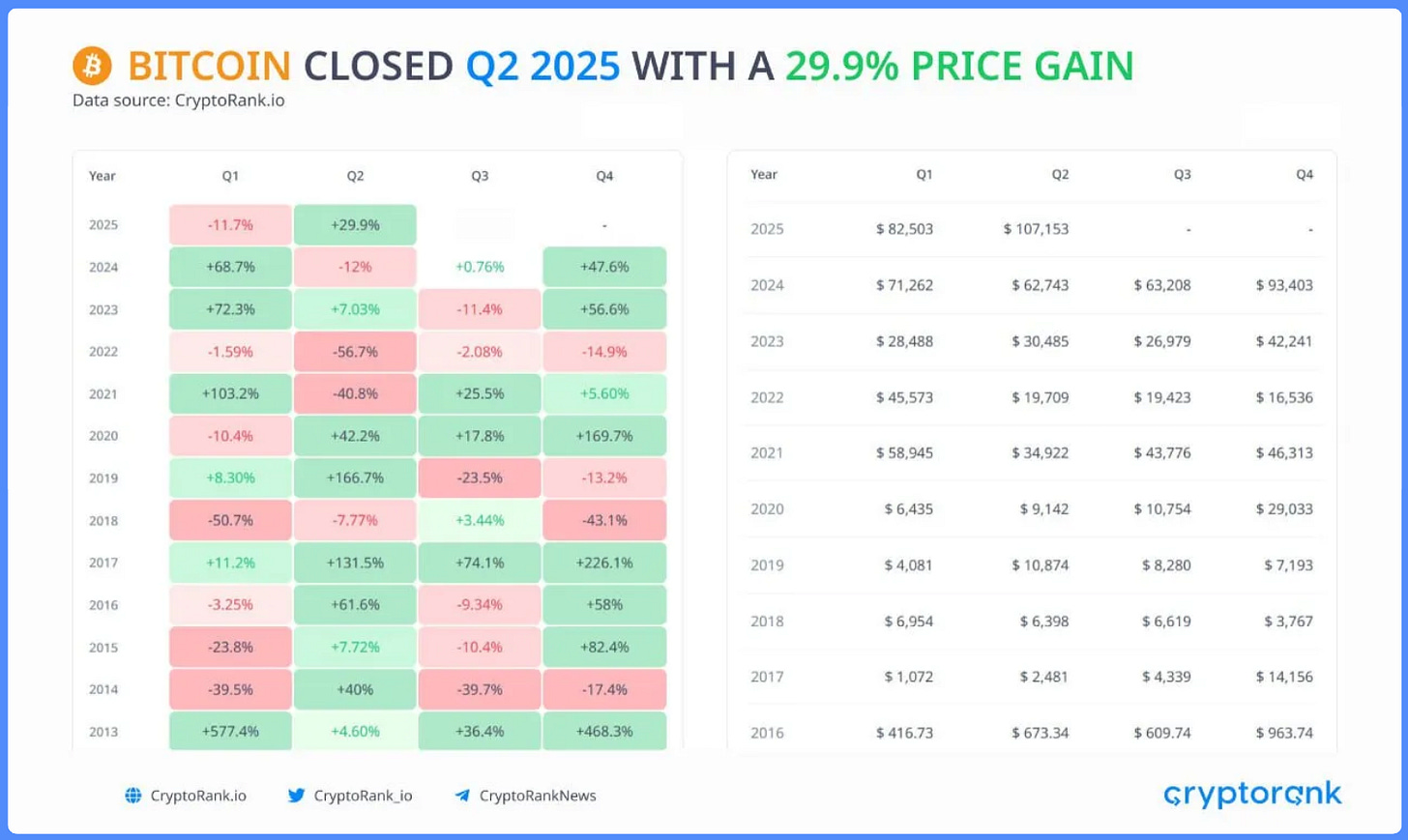

Crypto - From Anarchy to Armani

Suits in Total Control

Once upon a time, crypto was a digital frontier—lawless, chaotic, and full of anonymous heroes and dog memes. Now? It’s a boardroom buffet served on a Bloomberg terminal. The revolution got a LinkedIn profile. Here’s your mid-2025 dispatch from the frontlines of this strange, suit-and-chain hybrid world

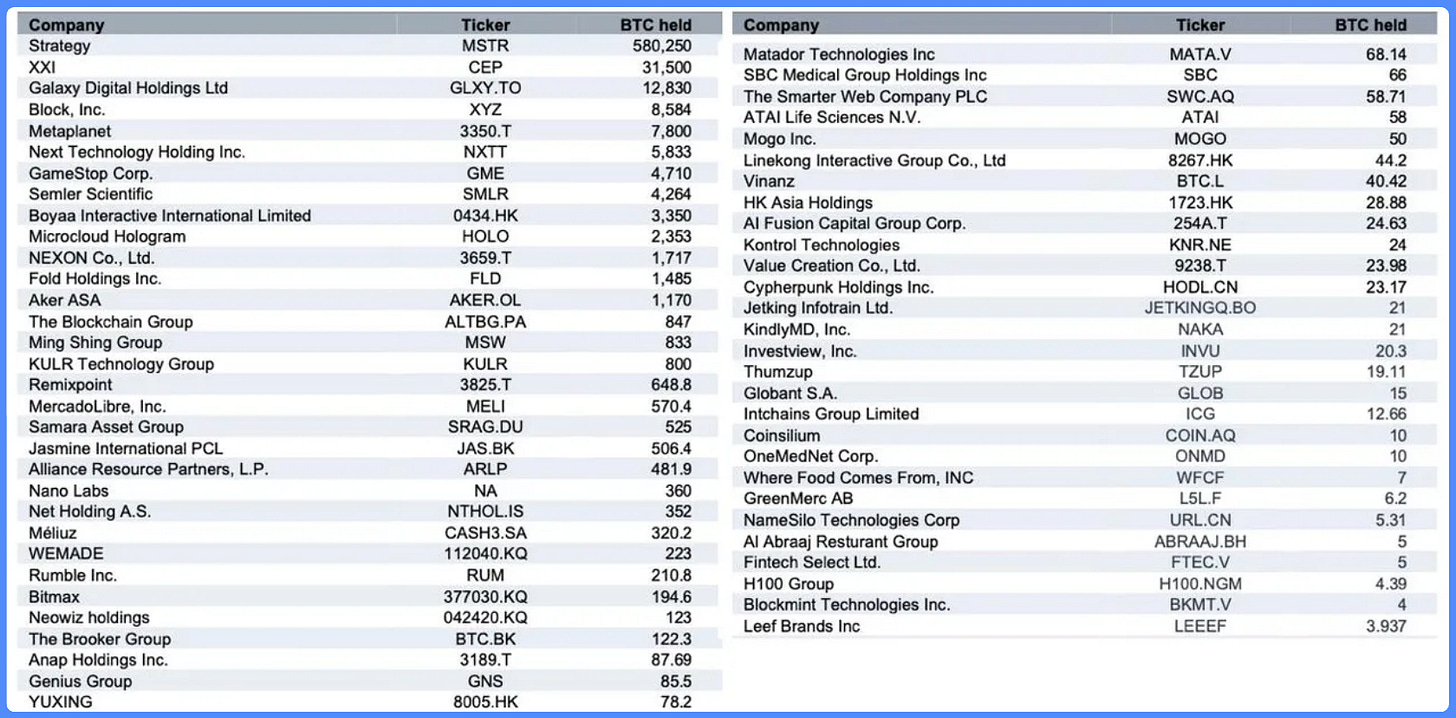

1. The Suits Have Seized the Server Room one Act at a Time

What started as a decentralized experiment is now a corporate arms race. The past 18 months have unfolded like a Netflix thriller with a Goldman Sachs cameo:

Act 1: The ETF Invasion – The first shot fired. Bitcoin ETFs opened the door and massive capital flooded in. BlackRock’s IBIT alone attracted billions.

Act 2: The MSTR Ascendancy – Saylor’s microstrategy became a macro religion

Act 3: Bitcoin Treasury Fever – Over 100 BTC Treasury Companies (BTCo) emerged, and are now quickly being followed by ETH Treasury Companies (ETCo). What is next - Solana? XRP? We already have a few I believe.

Welcome to Wall Street: On-Chain Edition. All that’s missing is a quarterly earnings call hosted by Vitalik in a suit.

2. Bitcoin’s Breather, Ethereum’s Ascent — The Next Leg Is Loading

Bitcoin Near All-Time Highs, and Still Undervalued?

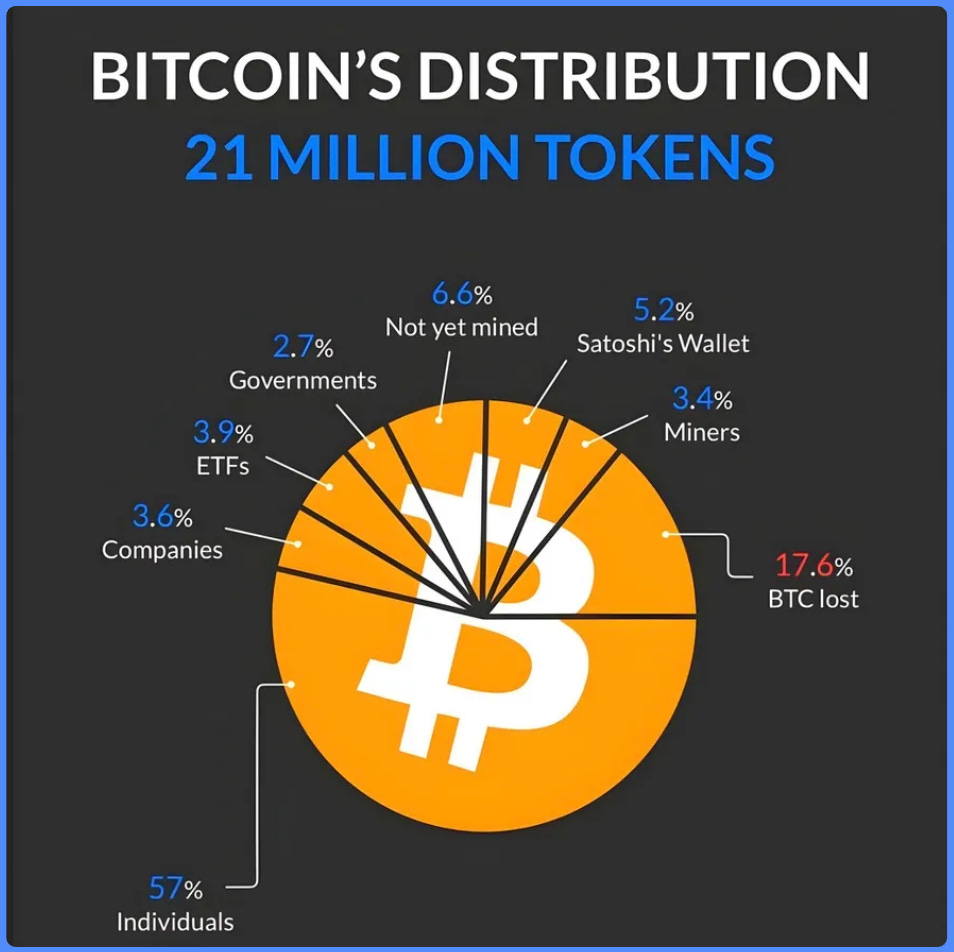

Bitcoin is trading just below $108,000 — less than 5% off its all-time high — and doing so with grace. Momentum is building quietly: 30-day price strength has flipped positive, open interest is up 7% this week alone, and exchange reserves are bleeding out like it's early 2021. Inflows into Bitcoin ETFs (BTCO, IBIT) have resumed after the brief June lull, and sovereign-style demand is back on the bid. This isn't euphoria. This is structural.The trigger? Circle’s IPO, a deluge of stablecoin optimism, and a U.S. fiscal outlook that reads like a Weimar Republic sequel. Add $1 trillion in new U.S. debt every 100 days, and suddenly Bitcoin doesn’t look speculative—it looks like insurance.

Bitcoin Is the Bid That Doesn’t Close at 4PM

Institutions have embraced it as the sovereign hedge, the pristine collateral, the digital gold. It’s now the first call for any asset allocator building a post-dollar thesis. And it’s not just big funds—treasuries, family offices, even endowments are getting exposure via BTCOs and separately managed accounts. This isn't a trade. It’s reallocation.ETH & Solana: From Punchline to Powerhouse

Ethereum’s renaissance has begun — no longer just a “tech play,” ETH is morphing into the high-yield corporate bond of crypto. Solana could be next. Liquid staking yields beat most sovereign debt, and treasury desks are quietly adding ETH exposure as ETF approval looms. Treasury companies like VanEck and Franklin Templeton are building ETH infrastructure as if it were the next reserve asset.Think of it like this: BTC is your digital gold. ETH is your programmable yield engine. If Bitcoin was the first chapter of institutional adoption, Ethereum is the next. And this time, it comes with cash flows and composability.

The Institutional Suit Playbook: BTC → ETH → ?

We’ve seen this before. First they buy Bitcoin. Then they understand staking. Then they realize ETH is a yield-bearing, regulatory-cleared asset with a vibrant ecosystem that doesn't sleep. SOL might get a cameo next, but ETH is next in line for the main stage.Rocket Fuel: Favourable Risk On Macro, Liquidity, and Regulation

The July 9th tariff deadline, softening inflation data, and dovish whispers from the Fed are all working in crypto’s favor. Liquidity is returning globally. The euro is strong, the dollar is soft, and risk assets are heating up. Bitcoin is the breakout artist—but ETH is still soundcheck testing its amp.

3. Massive Flows this Quarter Again into BTC ETF’s

Crypto funds have now notched 11 straight weeks of inflows, raking in a staggering $16.9 billion since mid-April. That’s not a trickle — that’s a firehose. And where did 83% of that cash land? Right into Bitcoin’s lap.

The rest of crypto? Mostly left standing on the sidewalk like someone who brought a ukulele to a Wall Street job interview. Altcoins got a few pity tips, but for now, it’s clear: Institutions came for the digital gold, not your favorite governance token.

4. Altcoins? More Like Alt-Gone.

While Bitcoin’s throwing a champagne party with the suits, altcoins are stuck behind the velvet rope — broke, ignored, and wondering what happened to "altseason."

Most alts are still down 50% to 75% from their cycle highs, and many look like the crypto version of MySpace: once hot, now ghost towns. Aside from a few lucky tokens riding niche narratives (hello, $HYPE and a few AI tags), the rest are just collecting dust on the portfolio spreadsheet.

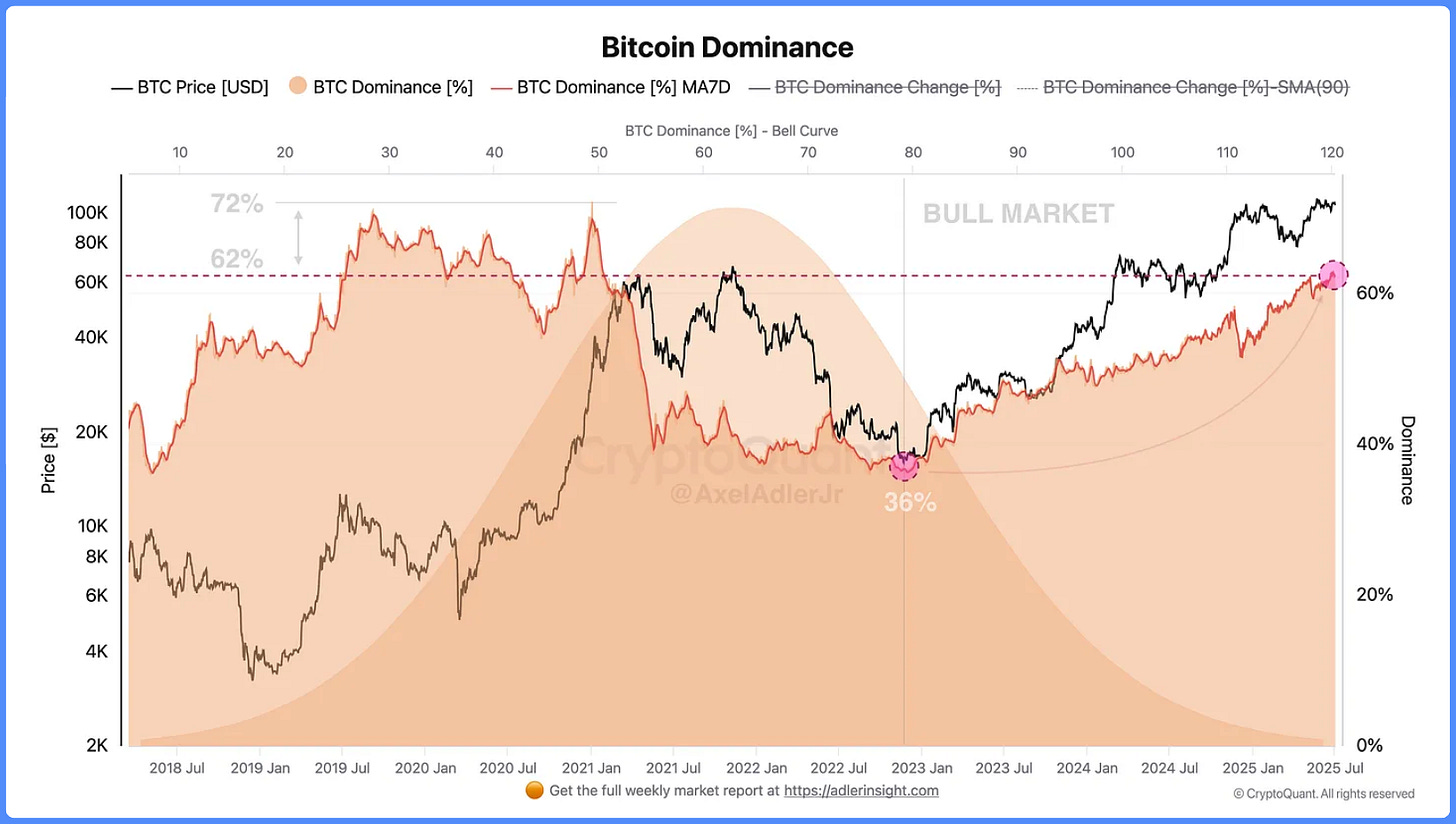

Meanwhile, Bitcoin dominance has surged past 65% — a level we haven’t seen since late 2021, when institutions were first flirting with BTC ETFs and Elon was still tweeting memes about Dogecoin.

It’s clear:

The suits want BTC, not your favorite anime-named layer 2.

Even ETH is getting only cautious side-eye attention — the real flows are laser-focused on digital gold.

The altcoin buffet is open, but nobody's hungry.

This isn’t an “everything rally.”

It’s a "one-asset-to-rule-them-all" moment — and Bitcoin just lit the beacon of Gondor

5. Narratives & What’s Hot

Pumpfun announced that they were planning to do an ICO at $4bn FDV, and raise $1bn through the ICO. Raising this much after having made $700M in revenue sounds like grift to me. SOL and the largest Solana memecoins (FARTCOIN) all dumped on the news, which went out on June 3

Robinhood announced on June 30 that they would be issuing stocks on-chain, and that they were going to launch their own L2 based on the Arbitrum Orbit stack. The news was heavily frontrun on $ARB as it went up +30% on the day before, and then dumped on the actual news.

One of the most noticeable coins for June has been $HYPE once again. Its price action has been quite unstoppable since the sub $10 bottom on the April bottom. It broke its $40 resistance in June 10, and then made a new ATH at $46 on June 16. It then corrected to almost $30 but closed the month at around $40. $HYPE is undeniably the main coin of the cycle behind $SOL now.

$HYPE is the serious, revenue-generating protocol that crypto natives want to bid, and on the other end of the spectrum, we have the pure memecoins like $SPX, that also received a lot of inflows in June. After some time consolidation between $1 and $1.2, $SPX finally broke out and then went basically up only for a few days until it reached its previous ATH again (around $1.7), where it topped locally once again. Murad has been able to create a Schelling point around $SPX as a cult meme, and he does now only shill this coin on X (as well as on Tiktok), relentlessly. FARTCOIN is the other pure memecoin that permanently gets bids too, it performed decently in June versus most coins.

Three memecoins on-chain clearly stand out in June : $AURA, $USELESS, and $JOE. $AURA is a 2024 cat/culture coin which basically pumped from $1M to $200M mcap in two days, and does now sustain above $100M. $USELESS is the main coin launched on letsbonkfun which is the memecoin launchpad of BONK. It’s also heavily shilled by Unipcs (Bonk guy), and the coin has been going up only (with a price action similar as the first FARTCOIN run) from its $5M MC bottom to $230M at the end of the month. Finally, $JOE is the 2023 ETH memecoin that managed to maintain relevancy, and it went from $15M to $70M in June. It’s one of the ETH memes I like the most.

Q3–Q4 Outlook: Equities > On-Chain Plays

Risk Is Back—But Keep It Classy, Folks: With macro finally looking stable, risk appetite is staging a comeback. But let’s not get fancy: if you want crypto exposure without the existential dread of wallet hacks and rug pulls, equities are your smooth, liquid, “business casual” entry point.

Crypto Stocks > Crypto Tokens: Why wrestle with on-chain gymnastics or explain yield farming exploits to your compliance officer? MSTR, COIN, miners, and the rising breed of Treasury Companies (ETCos) soak up crypto’s upside while you keep your sanity—and your portfolio intact. On-chain is flashy, but equities are the low-hanging fruit in this risk-on orchard.

SOL Is Lurking… But ETH’s Stealing the Show—for Now: It’s the natural progression in the “Suit Playbook”: BTC → ETH → SOL. Solana’s next in line for that corporate makeover—expect SOL Treasury Companies (STCos?) soon. But as you descend the altcoin ladder, institutional appetite thins faster than a gambler’s resolve in Vegas.

What Comes After Crypto IPOs? The TradFi Remix: Welcome to 2025–26:

SPACs hunting crypto unicorns like Wall Street gold rushers.

Pre-IPO syndicates with more fine print than a lawyers’ convention.

Leveraged yield baskets so exotic even DeFi degens say, “Nah, I’m good.”

ETFs on BTCo, ETCo, STCo, and the inevitable ETF-of-ETFs.

TradFi never creates—it absorbs, repackages, and slaps on a shiny prospectus with a golf schedule for good measure.

The suits didn’t kill the crypto dream—they just put it in a prospectus.

So, dear degen, go forth—but maybe pack a blazer with that hoodie.

Final Thoughts: The Q3/Q4 Playbook—Same Tune, Slight Remix

Short-term Risk-On, but Watch July 9: U.S. fiscal boost + strong jobs data may fuel markets briefly, but the July 9 tariff deadline and new PCE data could bring inflation fears roaring back.

Key Macro Triggers Ahead: Powell’s tone in the FOMC minutes and the outcome of tariff talks will steer market direction. Dovish Fed + no tariff hike = bullish. Hawkish tone or new tariffs = brace for volatility.

The Playbook for the second half of 2025 remains straightforward—pretty much a rerun of our Q2 highlights, with a few evolved nuances:

Accumulate Bitcoin on dips below $95K (we were stacking under $80K last time—welcome to the new baseline).

Favor crypto equities over on-chain token roulette. Think Bitcoin, Ethereum, Solana treasury companies, private pre-IPO gems (if you can get your hands on them), and SPACs—where we have solid access and insider vibes.

Watch out for new OnChain narratives, in case BTC catches a bid, there is always a fair chance that we see some on Chian runners

Keep concentrated, high-conviction token plays alive. $HYPE stole the show in H1; more will emerge. There always are.

Bitcoin dominance marches on, dragging its beta minions higher in tow. Expect BTC-correlated plays to outperform the riffraff.

In a nutshell: bet on the king, keep your suits handy, and let the altcoin fireworks light up from a safe distance.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @Risinghashtalk or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out Our Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!