The Great Bitcoin Stalemate: Between Rocks, Walls & Wall Street

When markets go silent, it’s not peace — it’s the inhale before the storm.

TL;DR

QUICK MACRO ZEITGEIST

THE GREAT AMERICAN DATA ECLIPSE— where gold glitters, credit cracks, and everyone’s still pretending AI makes money.

The world’s most powerful economy has gone dark — a data blackout so complete it feels like the Bureau of Labor Statistics just rage-quit. Gold, meanwhile, is behaving like it’s 2009 again, drunk on fear and negative real yields. Regional banks are busy discovering new species of fraud — while Wall Street debates “AI partnerships” that are about as real as Elizabeth Holmes’ lab reports.

In short: the great momentum machine is coughing. Liquidity’s thinning, credit’s cracking, and the once-euphoric risk rally has the distinct sound of a party running out of champagne. We’ve been gliding toward a cautiously bearish setup since early October — the kind that starts with soft whispers of “position trimming” and ends with CNBC anchors invoking 2008.

But—but—but— the story’s not done yet IMO. CPI looms on the horizon, the Fed continues to quietly taper its quantitative tantrum, QE staying unabated, and Trump seems suddenly inclined to make Xi “happy-Gilmore”. That cocktail of liquidity whispers, political theatre, and rate-cut hopes could ignite a spectacular November — the kind of melt-up that reminds us why monetary policy is the most addictive drug ever invented by man.

The stage is set. The lights are dim. Either we get a gentle fade into deflationary dusk — or one last, glorious, liquidity-fueled hallucination before the year end credits roll.

CALM BEFORE THE BITCOIN BREAK

Hey degenerates, dreamers, and digital gold hoarders — it’s been a minute.

I’ve been knee-deep setting up our liquid fund (now roaring like a Rolls-Royce engine on a Concorde) and babysitting a few investments that behave like rebellious teenagers — full of potential, allergic to discipline. But all good and very proud of what we have built in 2025. Reach out to learn more.

Also rolling out a few trading tools soon so you can fly solo — with autopilot precision, not emotional turbulence.

But today, let’s talk about the elephant in the blockchain: Bitcoin. The market’s been wedged tighter than the Ever Given in the Suez Canal, and everyone’s pretending they know which way it’ll tilt.

Here’s my thought process — part analysis, part therapy, and entirely too caffeinated.

THE BATTLEFIELD: RANGE-BOUND AND BORED

Bitcoin has been trapped between $107K–$110K — a glamorous cage fight where neither contender has landed a hit. Meanwhile, its elder sibling Gold is flexing quietly — up nearly 60% YTD, the refined aristocrat to Bitcoin’s restless revolutionary

1. Short-Term Holders (STH): The Anxious Brigade

Anyone who bought from April onwards is now underwater below $108K — emotionally compromised and statistically predictable. Humans handle losses like toddlers handle candy rationing: poorly.

To add poetic insult, the 200-day moving average sits precisely at $108K — a beautiful coincidence, if you enjoy tragedy.

2. Long-Term Holders (LTH): The Fragile Defenders

Around $105K, roughly half of the LTH cohort goes underwater. That’s the first true line of defence — paper-thin and emotionally brittle. Would you buy there? That’s the test of faith we’re all quietly taking.

3. $100K: The Abyss Beckons

Below $100K lies the psychological Maginot Line — once breached, the streets of crypto Twitter will overflow with memes, meltdowns, and margin calls. Not to forget Jim Cramer and his SNBC brothern.

4. $115K: The Other Door

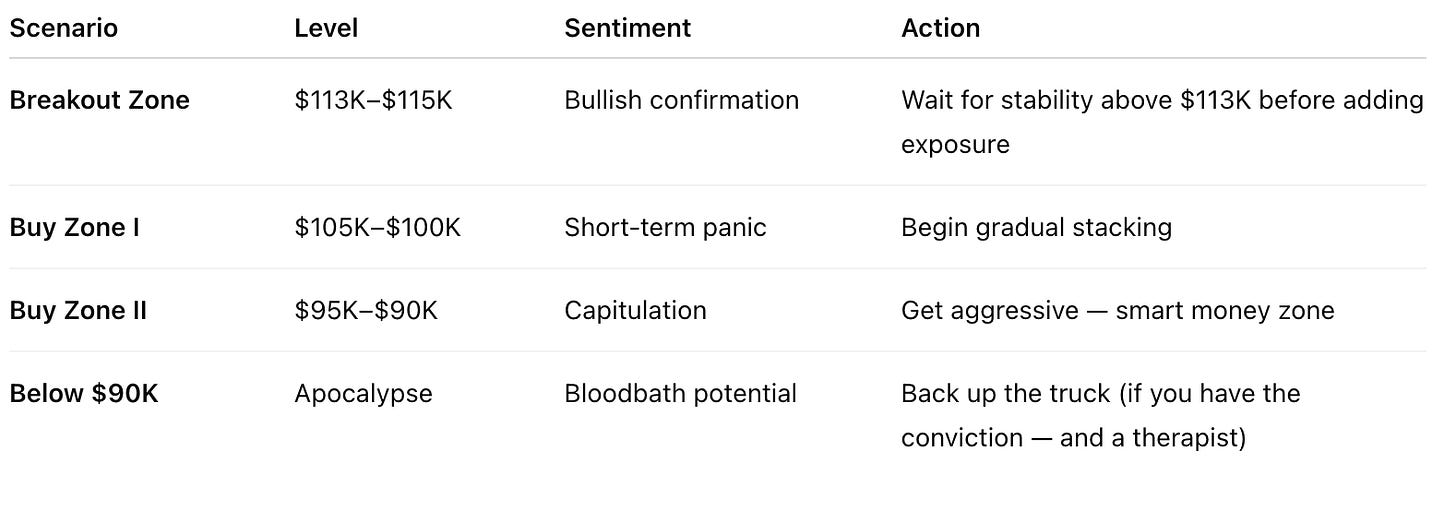

Of course, there’s an equal probability we pierce $113K straight to $115K before any of that. This is not calculus — this is chaos theory with a leverage button

SELL PRESSURE VS. SUIT PRESSURE

Roughly $1 billion in daily BTC sales still flow through the market. Yet post–Black Friday, spot, ETF, and futures volumes have exploded. The market’s taking punches like a heavyweight — dazed but still upright.

The Sellers: Short-term holders locking in profits to look virtuous on their year-end reports.

The Buyers: Wall Street and the suits — the new apes in tailored Patagonia vests.

ETF inflows: ~$500 million this week — not euphoric, but far from lifeless.

ETF trading volume: ~$35 billion per week — pure institutional caffeine.

Translation? The “Bitcoin is dead” crowd forgot to check the volume bars. It’s not that bad out there.

THE GAME THEORY OF PAIN

There’s a non-zero chance we slip to $95K if STHs capitulate and CNBC’s doom choir starts singing again. That’s when smart money quietly accumulates your despair — value investing, but make it emotional.

My playbook: NFA & DYOR

Start stacking below $105K — cautiously.

Get aggressive below $100K.

Go feral below $95K.

Below $90K, I’m pawning furniture and calling it “conviction.”

Why? Because as QT fades and the dollar begins its slow descent, liquidity will come roaring back like the Nile after a long drought. And Bitcoin? It’ll soar — not like Icarus, but like a phoenix strapped to a jetpack

WORRY NOT - FINAL THOUGHTS

This sideways malaise is temporary. We’re approaching an inflection point — either a clean breakout or a biblical flush. Markets don’t whisper at turning points; they roar. The next move will be violent, obvious, and career-defining for those positioned right.

You can’t control the market any more than you can control the tides — but you can build a boat before the storm. That cash truck is your boat.

Bitcoin doesn’t care about your feelings, your cost basis, or your Christmas bonus. It obeys no master but liquidity. And liquidity is just round the corner. FED should confirm that on 29th IMO.

And when the tide turns — and it will — you’ll either surf it like a god…

or drown in disbelief.