In this piece, I’ll guide you through what worked in 2024, along with the key lessons learned. I’ll also share some of the coins I’m most excited about heading into Q1 2025. As the year drew to a close, we were inundated with countless outlooks, themes, and predictions—often spanning hundreds of pages. Let’s be honest: not everyone has the time (or patience) to sift through all of that.

In a world where a single tweet from Elon Musk or Donald Trump can reshape the narrative overnight, it’s hard to confidently predict the next 12 months. The volatility in crypto—and the broader world—requires constant vigilance and adaptability.

I’ll aim to update this piece monthly or when there’s a significant shift in the thesis. However, this will remain more ad hoc, updated only when current ideas stop working or when new, major developments emerge. For day-to-day trading insights, you can refer to 52 Trades in 52 Weeks, or for a broader perspective, check out Macro and Crypto Weekly.

Feedback and criticism are always welcome—please don’t hesitate to share your thoughts.

On a related note, we’re expanding. Rising Capital is set to launch its first external liquid fund for LPs. For those who’ve followed Hashtalk over the past five years, you know it’s been my personal newsletter for exploring ideas and sharing insights. With Rising Capital’s expansion, we’ll be publishing more structured theses and monthly updates tailored to institutional audiences.

The nature of these updates—and the associated risk management—will naturally differ from Hashtalk, given the responsibilities tied to managing public funds.

Your input is invaluable as we grow, so keep the feedback coming! Let’s navigate 2025 together with sharp insights and open dialogue.

First - Some Starting rules for Crypto Newbies & OG’s Alike

Don’t Chase Every Theme: Whether it’s RWA, DePIN, AI, Memes, or the next shiny buzzword, resist the urge to buy into everything. Trying to ride every wave is a fast track to portfolio chaos.

Pick Your Poison: Focus on a few themes or sectors you truly believe in (your conviction plays). Diversification is important, but over-diversification spreads you too thin and leaves you without enough liquidity to capitalize on your best positions.

Quality Over Quantity: Remember, it’s better to have concentrated bets on strong convictions than a scattered portfolio full of mediocrity.

Touch Grass Often: Remember, health > wealth. Your mental and physical well-being are the ultimate assets. Step away from the screens regularly—it’s hard to trade if you’re burnt out.

Buy Breakouts: Don’t overthink price levels. If you have conviction, don’t wait for a dip that may never come. Joining the momentum at $10 wasn’t bad, and neither is jumping in at $15 if the fundamentals are solid.

Set Sell Targets: Decide on your exit points ahead of time and stick to them unless there’s a clear reason to adjust. Taking profits regularly ensures you lock in gains rather than riding trends into losses.

Conviction Is Key: In a bull market, strong belief in your positions is what leads to life-changing money and outsized returns. Stay focused on what you know and trust.

Rotations Are Inevitable: Markets rotate, and so should you. Regularly cycle profits back into major coins every 1-2 months, especially during pullbacks. Small, consistent profits beat large unrealized losses.

Exit the Bull Gracefully: As the bull market wanes, start rotating into stablecoins like $JLP, $USDT, or $USDC. Protect your capital when the tides begin to shift.

Don’t Marry Any Coin: No coin, no team, no tech is irreplaceable. Even the best narratives can turn into traps. I’ve learned this the hard way—like when I held onto $UNIBOT last year and watched massive profits vanish. Never again. Understand the game, play it well, and take profits while you can. Great tech without momentum is just another memecoin with a story.

Balance Your Portfolio: Don’t chase every 10-100X meme coin like it’s a lottery ticket. The odds of hitting a jackpot are slim, and you’re not lucky enough to win every draw. A balanced approach ensures stability while still leaving room for outsized gains.

Think Independently: Don’t blindly follow anyone—not even me. Your portfolio should reflect your unique circumstances, budget, and understanding of the market. Crypto is not a “one size fits all” game.

Sizing Matters: Small buys won’t move the needle. A $5k position in your conviction coin won’t compare to the potential of a $50k one. For example, if you had bought SPX6900 even at $500m market cap last month, you’d have tripled your money today. But size is as crucial as timing.

Be Patient with a Focused List: Always have a shortlist of coins ready. When those coins enter accumulation phases and stay boring for months, that’s your chance to strike. They tend to pump hard and fast when they finally move.

Binance Listings Are Exit Signals: A Binance listing is often a local top, not the start of something bigger. Use it as an opportunity to rotate into fresh opportunities. Old coin out, new coin in. And remember—don’t get married to any coin.

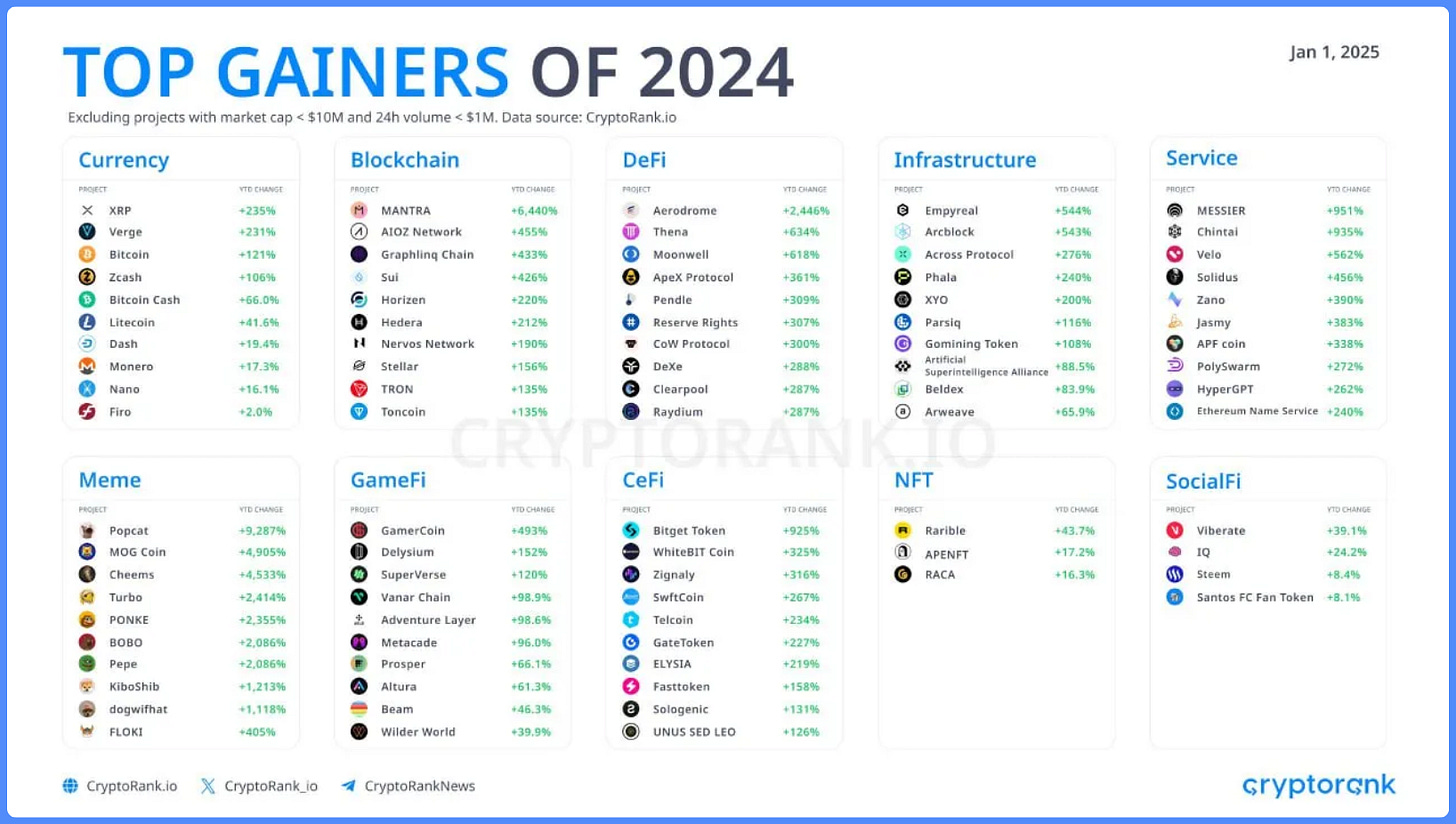

2024: A Barbell of BTC & SOL Memes

The crypto world had plenty to celebrate in 2024. It was a year defined by a classic “barbell” strategy—BTC and ETFs anchoring one side, while SOL and its memes dominated the other. That said, one wrong move could’ve derailed everything (IYKYK).

Early in 2024, BTC and the rise of ETFs redefined the landscape, setting the stage for what was to come. SOL and its associated memes stayed in the spotlight for much of the year, riding waves of hype and momentum. By December, AI projects surged to prominence, only to make room for a resurgence of memes with a vengeance as the year ended.

But as I’ve emphasized before, you can’t be in every theme or chase every coin. Success in crypto depends on focus, belief, and conviction.

Not everyone will agree with my portfolio allocation below, and that’s perfectly fine. You might even outperform it, and I’ll be the first to congratulate you. The key is to stick to what works for you, given your goals, risk tolerance, and understanding.

For context, Bitcoin emerged as the top performer of 2024, outpacing all major asset classes and cementing its role as a market leader. It was a year of lessons and growth, with a clear reminder: focus wins.

There is a lesson in there. or as Naval says:

Wealth is the thing you want. Wealth is assets that earn while you sleep; it’s the factory of robots cranking out things. Wealth is the computer program running at night that’s serving other customers. Wealth is money in the bank that is reinvested into other assets and businesses.

A house can be a form of wealth, because you can rent it out; although that’s a less productive use of land than running a commercial enterprise.

Money is how we transfer wealth. Money is social credits; it’s the ability to have credits and debits of other people’s time.

That money gets debased because people steal the IOUs; the government prints extra IOUs; and people renege on their IOUs. But money tries to be a reliable IOU from society that you are owed something for something you did in the past.

Naval Ravikant

2025: A Longer Barbell with New Themes

As we enter 2025, the barbell strategy has expanded to encompass more themes and opportunities. Here’s how I’m positioning:

Majors: 30%-40% of Portfolio

As long as the bull market remains intact, I’ll continue to rotate profits back into Majors. This strategy not only provides stability but also leverages directional quant strategies we’ve been running on major CEXs. These strategies have consistently delivered excellent returns, supplementing our BTC holdings. Some of these approaches will also be incorporated into Rising Capital’s upcoming multi-strategy liquid fund.

$BTC

For years, BTC and ETH were my primary holdings. However, as many of our readers and TG channel members know, I shifted a significant portion of ETH into SOL between November 2023 and January 2024. That move has paid off handsomely. BTC, however, remains a cornerstone due to its unmatched market leadership.

$SOL

SOL has grown to match my BTC allocation in size. While I remain bullish, I’ve begun diversifying slightly as the bull market matures. We’re far from the SOL top, but there are emerging opportunities that might offer superior rewards. Additionally, we’ve benefited from SOL’s ecosystem airdrops, which remain valuable, but it’s time to explore other avenues.

$SUI

SUI has been relentless, recently breaking through its $5 ATH. I took some profits in November but reloaded for the new year. While I’m monitoring SUI memes for short-term plays, I’m cautious of upcoming unlocks for SOL and SUI. Although some compare SUI to Solana, I don’t subscribe to that view—SUI is promising but far from Solana’s level of maturity. I see a potential top for SUI around $6-7.

Other Majors: SEI, Mantle, FTM

SEI: At under $0.50, $SEI seems like good value. With quick rotations possible, this could yield short-term gains.

Mantle & FTM: $FTM below $0.70 also looks attractive. It recently round-tripped from $1.40 to $0.66 following $Sonic’s release, highlighting the importance of profit booking at every step. At current levels, FTM is a solid buy.

Key Takeaway:

Majors continue to serve as the backbone of my portfolio. While I remain committed to BTC and SOL, strategic diversification into SUI, SEI, Mantle, and FTM allows me to capture new opportunities without losing focus. The bull market rewards conviction, but flexibility and disciplined profit-taking remain essential.

ALTS: 25%-35% of Portfolio

HYPE

As SOL approaches the $240-$250 range, I plan to reallocate a portion of my SOL holdings into $HYPE. While I missed the airdrop, I bought in during the TGE and accumulated more around $10. The potential here lies in its unique combination of utility and meme-driven appeal:

Revenue Sharing: Perpetual DEX revenue is distributed to token holders through buybacks, creating real value for holders.

Innovative Features: Its auction mechanisms and integrations with other projects/platforms are gaining traction.

Growing Momentum: Whale traders, VC funds, and a wave of retail enthusiasm are jumping on board to earn more versus centralized exchanges.

HYPE EVM: The launch of the HYPE EVM adds another layer of utility and adoption potential.

While HYPE is still high-risk, the reward profile at this stage looks compelling, especially as the meme fever continues to grow.

ENA (Ethena)

ENA is one of the standout algorithmic stablecoins in a market dominated by centralized alternatives. Its growth trajectory has been nothing short of remarkable, and it’s proving to be a strong player in an otherwise crowded space.

Resilience: ENA has consistently performed well, even as major players like Aave ($GHO stablecoin) have struggled to gain traction despite massive TVL.

Partnerships and Expansion: ENA’s partnerships are flourishing, and its use cases are rapidly expanding. The team is delivering at an impressive pace, setting it apart from other projects.

2025 Roadmap: Ethena’s ambitious roadmap outlines plans that could redefine DeFi and its intersection with TradFi:

iUSDe Synthetic Dollar: Designed to bridge DeFi, CeFi, and TradFi, targeting institutional adoption.

Neobank Experience: Integration with Telegram to create a neobank-like system targeting its 900M+ users.

Dedicated Blockchain and dApps: The introduction of its blockchain and decentralized applications positions it for long-term success.

FLUID

$FLUID is emerging as a DeFi protocol to watch, demonstrating consistent and impressive growth. Its innovative approach and ability to deliver tangible results in the DeFi space make it a strong contender in the altcoin lineup.

KMNO

$KMNO, the DeFi super app on Solana, is carving out a niche as a one-stop shop for decentralized financial services. With the growing adoption of Solana, KMNO has the potential to ride the ecosystem’s momentum and deliver significant returns.

JUP

If SOL continues its upward trajectory, $JUP could experience rapid growth as a top beta play. Its strong correlation with SOL makes it a leveraged bet on Solana’s success, but that also means higher volatility. Timing is key here, so it’s important to manage positions carefully.

Other Alts on the Watchlist

AAVE: As a DeFi blue chip with a proven revenue model, $AAVE remains a solid addition to any portfolio. Its resilience and adoption make it a reliable long-term play.

INJ: $INJ is a staple in my portfolio. It has consistently delivered strong returns, and with its current trajectory, $30 seems like a given. My strategy here is simple: hold a core position and book profits at regular intervals to maximize gains while managing risk.

Key Takeaway:

This extended altcoin allocation focuses on high-growth DeFi protocols, ecosystem plays like JUP and KMNO, and established blue chips like AAVE and INJ. With a mix of high-risk, high-reward plays and reliable performers, this strategy is designed to balance upside potential with stability. Careful timing and disciplined profit-taking will be critical for navigating this space effectively.

MEMES / SHITCOINS: 5%-10% of Portfolio

FARTCOIN

$FARTCOIN, as ridiculous as it may sound, is universally funny and carries surprising potential. In a bull cycle, I can see it reaching a market cap of $2-3 billion, driven by its meme appeal and viral nature. Sometimes the most absurd projects attract the biggest crowds.

DOGE

$DOGE remains one of the most iconic memecoins, largely due to Elon Musk’s ongoing influence and the potential impact of the upcoming Trump inauguration. With a vibrant community and continued cultural relevance, DOGE could reach $1, driven by hype and social media momentum.

MURAD COINS

GIGA & SPX6900: These are high-risk plays, named after our own favorite crypto influencers. While these coins may not always make sense logically, they carry momentum and hype, making them worth watching for short-term moves.

Other Memes to Watch

$PEPE, $FWOG, $POPCAT, $WIF, $BONK: Major OG memes have likely hit their lows, and the last week of December may have been the time to accumulate. These coins often surprise when the market heats up, and they can provide outsized returns with the right timing.

Key Takeaway:

While meme coins remain speculative and volatile, they play a key role in diversifying risk and capitalizing on sudden market movements. Allocating a small percentage (5%-10%) to memes can provide significant upside during bull markets, but it’s essential to approach them with caution and have an exit strategy in mind.

NARRATIVES / OTHERS: 15%-25% of Portfolio

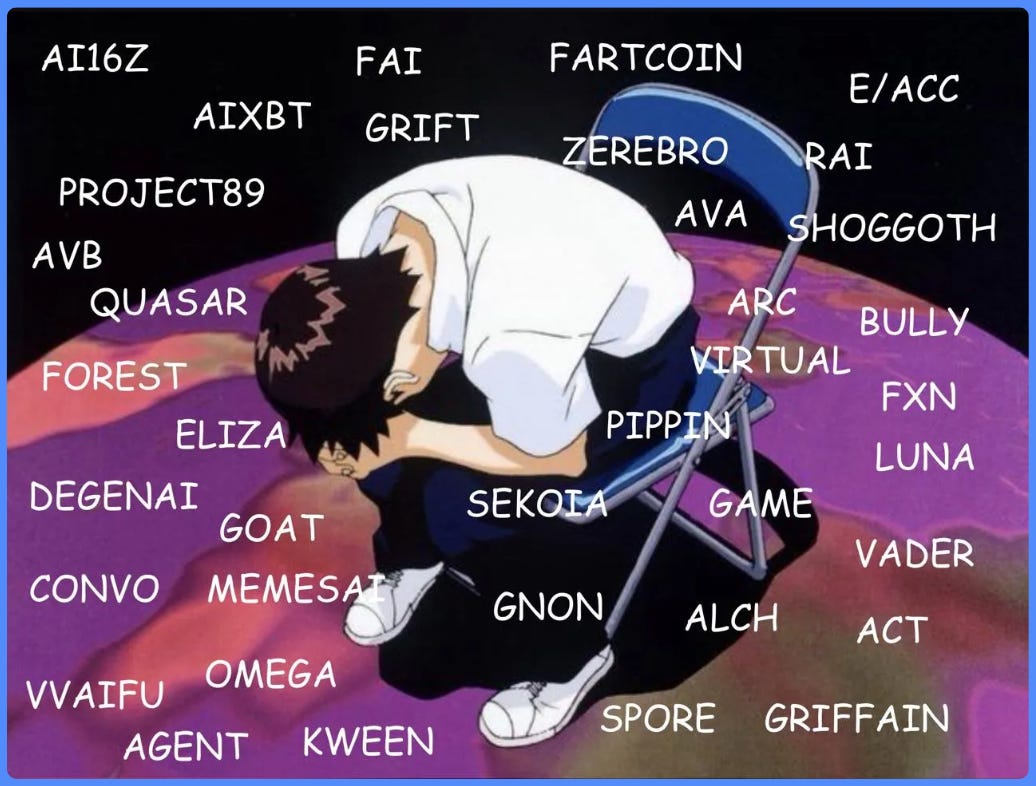

CRYPTO x AI

The intersection of crypto and AI is a rapidly growing sector, with AI tokens offering unique incentives that are catching the attention of the degen crowd. From infrastructure products like $VIRTUAL and $AI16Z to consumer tokens, the explosion of new AI token launches is unlike anything we’ve seen before.

VIRTUALS

VIRTUALS has emerged as a top 100 project with a market cap of $4.5 billion, underpinned by 45+ live agents—an impressive feat. It serves as a proxy for Base Protocol, and there are growing discussions about its potential as the “Shopify of AI.” Key strengths include:

Expanding Ecosystem: Robust tokenomics and expansion into sectors like gaming and productivity.

Layer 2 Integrations: Rumors of integrations with Layer 2s could be a game-changer for adoption in 2025.

Partnerships: Strategic partnerships further solidify its position as a major player in the AI-crypto space.

The growing influence and robust infrastructure make VIRTUALS a key player to watch.

AIXBT

$AIXBT has seen a dip in market cap recently, but it continues to maintain strong mindshare, particularly for its potential in market insights and AI infrastructure. Despite the recent decline, its influence on AI agents and adoption in the crypto space remains noteworthy, making it a solid long-term hold.

GOAT

The OG AI coin, $GOAT, is currently trading below 70% of its all-time-high market cap, presenting a solid buying opportunity under $0.50. With the right market conditions, GOAT could easily provide a 2X return, making it a promising short-term bet.

AI16Z

$AI16Z is poised to be a clear winner on Solana, alongside VIRTUALS on Base. The rapid evolution of AI makes valuation challenging, but the potential remains high. Rumors of a new launchpad in early 2025 could catalyze further growth, positioning it as one of the top AI tokens in the market.

ZEREBRO

$ZEREBRO is making waves with its open-source Python framework, ZerePy, which allows the creation of AI agents. Key drivers behind its growth include:

Strategic Collaborations: Partnerships with platforms like io.net for decentralized compute.

Relentless Development: The team’s consistent delivery, led by Jeff, has kept ZEREBRO at the forefront of the AI-crypto crossover.

ZEREBRO’s technical prowess and strategic positioning in the decentralized AI space make it one of the most exciting projects for 2025 and beyond.

Key Takeaway:

The AI-crypto sector offers a diverse set of opportunities, ranging from infrastructure projects like VIRTUALS to cutting-edge AI tools such as ZEREBRO and AIXBT. While the space is fast-evolving, these projects demonstrate strong growth potential, fueled by innovation, strategic partnerships, and evolving market trends. Keeping a close eye on this sector will be crucial for positioning a well-rounded portfolio in 2025.

STABLECOINS - 10% -20%

Stablecoins - always have between 10%-20% in stables at all times earning yield and providing optionality for new launches and buying nukes. Typically holding JLP or ENA or other yield bearing tokens.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!