Monthly Macro & Crypto Outlook - September 25'

Macro drives crypto, jobs & inflation drive macro, tariffs driving jobs and wages lower, inflation higher - Whats next for Q4 - Recovery or Stagflation?

Writer Harold V. Melchert reminds us that success is sweeter when you savor the path:

"Live your life each day as you would climb a mountain. An occasional glance toward the summit keeps the goal in mind, but many beautiful scenes are to be observed from each new vantage point. Climb slowly, steadily, enjoying each passing moment; and the view from the summit will serve as a fitting climax for the journey."

Source: The Toastmaster magazine (October 1965) - Via James Clear

TL;DR

Rate cuts are now almost given in September meeting as inflation stays sticky and job market continues to weaken. The winners in this debt laden economy then are the hard and riskier assets (especially Gold & Bitcoin). The question however is: What next for Q4?

Macro: The "One Big Beautiful Bill" may have lit up Q3 with short-term sugar highs, but behind the confetti lies a darker truth: $5 trillion in new debt, a long fuse on the inflation time bomb and a weakening labour market. The music’s still playing, but the fiscal floorboards are creaking. Everything is feeling peckish right now.

Crypto: A Wall Street show: institutions pour billions into Bitcoin ETFs while altcoins languish in the velvet rope lounge; Crypto Q4 playbook is simple accumulate BTC below $100K, favor majors and revenue producing protocols over Alts, avoid DAT’s for now (unless they come back roaring in Q4), and watch ETH vs Solana jockey for spotlight as the “Suit Playbook” rolls on.

Before we go any further, customary Disclaimers first:

DISCLAIMER: DYOR & NFA

Don’t follow us blindly. All views, education and trades are my personal views and should not form the basis for making investment or trading decisions, nor be construed as a recommendation or advice to engage in investment or trading transactions. Not Financial Advice (“NFA”). Do your own research (“DYOR”). These are my free thoughts gained from years of experience in banking and crypto. Build your own view and trade accordingly

If you want to read more of what we produce, you can follow below:

MACRO

The Fed’s Tightrope Act 🎭

Powell faces a dilemma that borders on tragicomic. Rate cuts may soothe markets, but tariffs keep reheating prices like a cook repeatedly tossing oil on an already smoking pan. This isn’t a “fire extinguisher moment”; it’s more like draping a damp cloth over a skillet - the smoke abates, but the fire beneath still smolders.

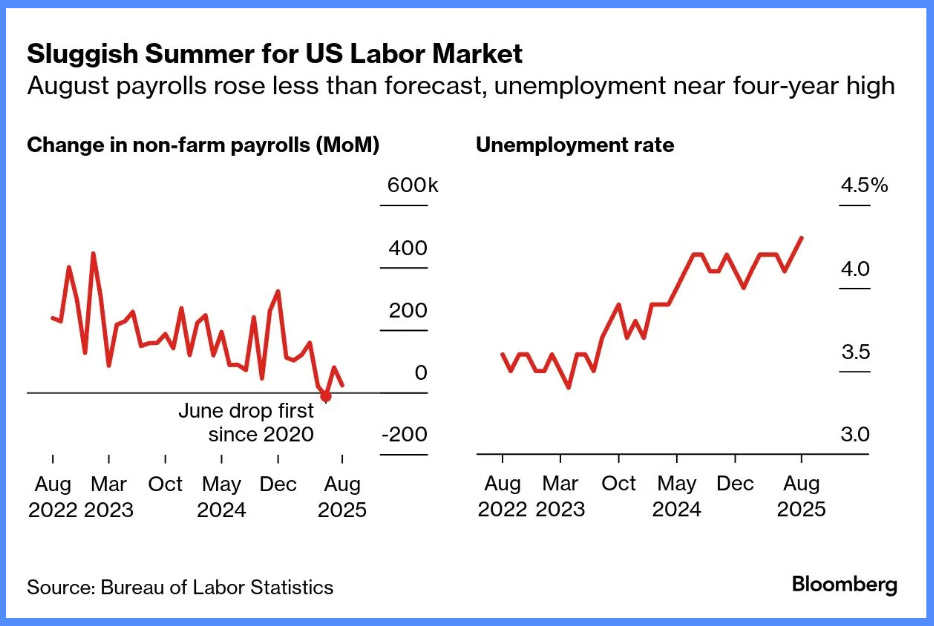

Meanwhile. the U.S. labor market is showing signs of stress with poor job numbers and rising unemployment, inflation is creeping up, and the Fed is in a tight spot. A 25 basis point rate cut is a given now and the market does not know which way to swing. Let’s analyse.

Inflation: The Guest Who Refuses to Leave

Inflation is proving less a passing storm and more an unwanted houseguest refusing to go quietly into the night. Core PCE printed 2.9% in July, its highest level since February and this is before the tariff barrage has even properly landed. One shudders to think what the autumn numbers might reveal once policy-induced price hikes seep through the system.

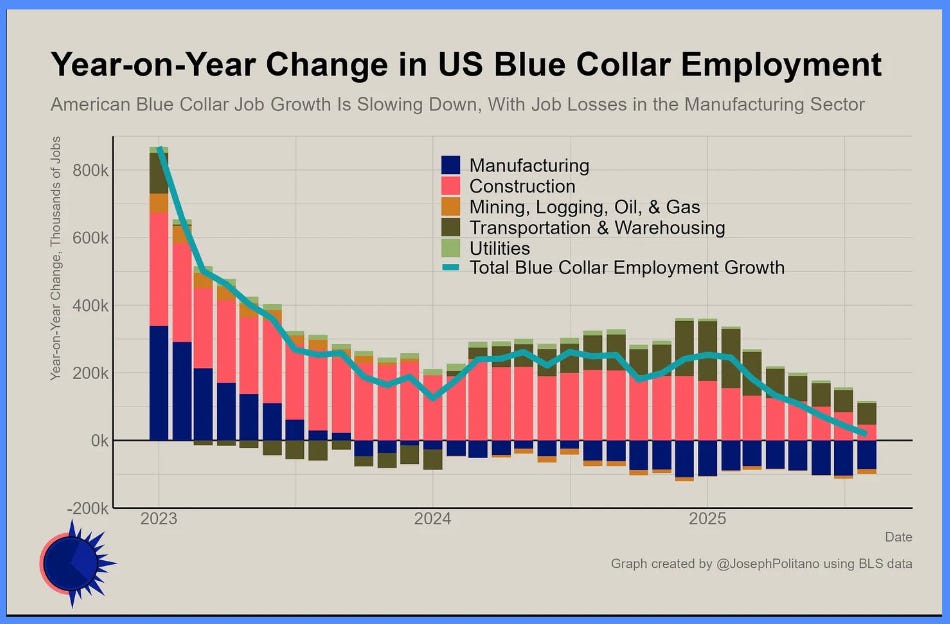

The Labor Market: Cracks in the Façade

At 4.3%, unemployment still wears the mask of stability, but the underlying cracks are becoming impossible to ignore.

Corporate Strategy as Trench Warfare

Trump’s tariffs were supposed to be economic artillery. Instead, they’ve left boardrooms looking like the Somme—mud, barbed wire, and no good options. Firms are no longer preparing to expand; they are retrenching, hoarding resources, and pulling down the shutters. Job openings have declined, the modern equivalent of the watchman extinguishing the city’s lamps before a siege.The Winter Is Coming Moment

Declining vacancies signal not resilience, but retreat. The labor market is quietly whispering: brace yourself. And unlike 2009, when stimulus flooded the trenches, the fiscal taps today are choked by politics and debt ceilings.The Household Engine Sputters

Wage gains have softened, draining the oxygen from household consumption. What Keynes once called “animal spirits” now resemble weary donkeys trudging uphill. Momentum is evaporating; malaise is metastasizing.False Pundits back on Stagflation Bandwagon

Put bluntly: high inflation + weakening labor market = stagflation. A toxic cocktail markets have historically despised. Let me be clear. We are nowhere close. But always beneficial to keep an eye on the numbers. Recall the 1970s: CPI peaked above 12% in 1974 while unemployment crossed 8%, producing the infamous “misery index” that toppled presidents and rattled markets for a decade. Today’s numbers are less grotesque, but the formula sometimes rhymes.

Europe meanwhile reprises its tired role as the “sick man.” Germany posted higher CPI and unemployment (6.4%) in August, and the ECB is once again stuck between doing too much and doing nothing at all. Tesla’s 40% sales plunge in Europe is no aberration—Chinese BYD tripled registrations, showing that industrial policy and execution beat charisma and Twitter memes every time.

Macro Summary - My Mental Model

The pundits cry “stagflation” and “recession.” I laugh. Rising unemployment is no longer a death knell for productivity in the age of AI, machines do the heavy lifting while output climbs.

Here’s the paradox: the more workers get fired, the faster the Fed cuts. The faster the Fed cuts, the quicker liquidity gushes. And liquidity, like gravity reversed, pulls asset prices higher.

Result? Bitcoin and Gold soar as faith in fiat erodes. Capitalism’s cruelest magic trick plays on: Main Street bleeds, Wall Street feasts.

Equities, Bonds, FX – A Delicate Balancing Act

Treasuries Tremble, Gold Glitters

Treasuries are once again the seismograph of sentiment. The 10-year hovers near 4.15%—not a cataclysmic number, but high enough to make equities wobble and to restore gold’s luster. Here lies the paradox of the modern market: every incremental tick higher in yields does not affirm faith in the dollar, but rather strengthens the case for anti-dollar refuges like gold and Bitcoin. It’s as if Uncle Sam’s borrowing costs rise, and the world quietly mutters, perhaps we should diversify into shinier, harder assets.

Yield Curve: Steepening Without Panic

The US yield curve is steepening, but for the “right” reasons:

Longer-dated yields are drifting lower, while

Short-term yields are falling even faster.

This isn’t the market screaming about growth collapse or inflation spiraling—it’s more a sigh of relief, a rebalancing of expectations. History reminds us that such “bull steepenings” often precede recoveries in risk appetite. Consider 1995: Greenspan cut preemptively, the curve steepened, and equities entered one of their most dazzling five-year runs. The rhyme is not perfect, but echoes are unmistakable.

Overlay this with the prospect of a new Fed board arriving in 2026—a potential reshuffling of the guardians of money—and you have the makings of a fertile backdrop for risk assets, particularly into Q4 once September’s seasonal malaise passes.

Equities: Gravity Returns, AI Remains Oxygen

August equities closed +2%, but the late-month wobble reminded investors that higher yields still bite. Big tech slipped modestly, hardly a rout, but enough to whisper: “gravity exists.”

The real spectacle is Tesla. Sales in Europe are down 40%, while BYD surges ahead. The company that once styled itself the iPhone of EVs increasingly risks becoming the BlackBerry of batteries—iconic in hindsight, irrelevant in real time.

Meanwhile, the only narrative holding equities aloft is AI capital expenditure. Nvidia, Broadcom, Salesforce each earnings call is less about revenue and margins and more about how much was spent on GPUs. Strip AI out, and the equity rally deflates like a balloon after a children’s party. Corporate reports now read like scripture, CFOs like disciples. The catechism is simple: How much silicon salvation did you purchase this quarter?

FX & Carry: The Dollar’s Double Life

The dollar continues its double act. As a carry darling, it powers trades like USDBRL to fresh lows, offering yield-hungry investors their feast. But it remains a binary beast:

If tariffs escalate and inflation reignites, the dollar surges.

If growth softens, the dollar retreats, and risk assets breathe easier.

This Janus-faced role of the dollar is hardly new; in the 1980s, it was both the scourge of exporters and the darling of bondholders. Today’s cycle feels no less schizophrenic.

China: The Unwritten Chapter

The market everyone declared finished six months ago. The Shanghai Composite has quietly strengthened, fueled by retail flows into AI, semiconductors, and growth darlings. Beijing is not blaring trumpets, but playing its cards with surgical precision. For those writing obituaries too early, China’s resilience is a sly reminder: the Middle Kingdom rarely exits the stage when predicted.

Closing Equity Thoughts : Splashing Without Depths

Equities today are playing in the shallow end - lots of splashing & little depth. Momentum may drift into September, but don’t mistake froth for tide. With three rate cuts on deck (read: liquidity traps) and midterms around the corner, expect a compromised Fed and an administration with one mandate only: markets must go up.

The Lodestar: AI Capex

Beneath the noise, one gravitational force anchors everything: AI spending. The question is no longer “What do you sell?” but “How much GPU time did you buy?” In its infinite absurdity, the market has canonized silicon as scripture, and capital pays tithe accordingly.

The Commandments of 2025

Thou shalt receive liquidity, courtesy of the Fed.

Thou shalt see productivity gains, courtesy of AI.

And thou shalt worship at the altar of capex, until the cycle ends.

CRYPTO

Stablecoin, Treasuries & DAT Circus

Stablecoins

It has quietly become Washington’s favorite trick pony. Forget sovereign wealth funds and foreign central banks - America now funds its $36 trillion debt mountain by outsourcing it to retail investors via Tether, USDC, and their many cousins. Instead of Beijing buying Treasuries, it’s Chad from Ohio who unknowingly finances Uncle Sam’s deficit—parked in a digital token that magically earns 4.5% on paper while quietly underwriting the Empire. It’s financial alchemy, or perhaps more accurately, a debt-funded Ponzi with better UX.

Stablecoins as sovereign substitute: With $2 trillion in annual interest costs, the US needs buyers. Stablecoins provide them. Retail gets yield, providers get fees, the government gets funding. Everybody wins—until, of course, they don’t.

The great Treasury loop: For this merry-go-round to keep spinning, regulators must finally give clarity. Without it, stablecoin growth risks stalling, cutting off one of America’s newest and most convenient debt taps.

Innovation at the fringes: On-chain/off-chain yield schemes keep sprouting - offering juicier returns on USDT than Powell himself dares. As long as “safety” remains the illusion, expect the circus tents to keep multiplying.

Digital Asset Treasuries

If stablecoins are the Treasury’s new enablers, digital asset treasuries are Wall Street’s new hobby horse. Since MicroStrategy proved you could turn a boring balance sheet into a 10x meme stock by stapling Bitcoin to it, the Street has been scrambling to industrialize the trick.

ETH and SOL treasuries: Corporate vaults now hold 4.4m ETH ($19.2B), while Solana is the rising belle of the ball with new billion-dollar treasury funds forming. We’ve moved from tokens on Binance to stocks on NASDAQ, but the game is the same: financialize everything.

Momentum fatigue: Everyone wants a “digital treasury strategy,” but investors demand differentiation. Without a mega-name, a deep-pocketed backer, or Trump himself tweeting, the trade feels stale. Expect consolidation around the top 5–10 names while smaller players burn out.

MicroStrategy keeps flexing: 3,081 more BTC bought, bringing its hoard to 632,457 BTC ($70B). Unrealized profit: a cool $23.5B. A corporate raider in Satoshi cosplay.

The Bitcoin treasury boom is beginning to look less like a gold rush and more like a crowded fire exit.

Too many diners, too little steak: With 156 companies now boasting Bitcoin on their balance sheets, the room is thick with competitors jostling for the same plate of institutional capital. At some point, the banquet runs out of meat.

The yield mirage: Bitcoin’s fixed supply means that “treasury yields” inevitably decline over time. Every additional firm is chasing diminishing scraps, while the ETF offers institutions the simpler, cleaner option.

Reflexivity cuts both ways: A record 27% of firms now trade below their Bitcoin net asset value (mNAV < 1). At high mNAVs, raising capital is easy; at low mNAVs, these companies risk becoming value traps, tempted to dump BTC just to survive.

Momentum losing oxygen: Mean mNAV and Days Cover are at all-time lows, signaling a market where enthusiasm once fed on itself but is now wheezing. If institutional buying—already slipping on Coinbase—continues to fall, the reflexive loop could flip from virtuous to vicious.

For now, the machine still hums—institutions absorb four times daily issuance, and 93% of treasury firms remain net buyers. But beneath the surface, the gears are grinding. What began as a parabolic ascent could end, as all manias do, not with a bang but with a forced seller.

Bitcoin treasuries promised alchemy; they may yet deliver gravity

Where does this leave us for the year?

The structural demand for digital dollars and digital treasuries creates a floor beneath Bitcoin—likely around $100–105K. If the macro backdrop behaves (one or two modest cuts, no inflation blowout), BTC could finish the year in the $135–140K zone—a 30–40% run from here. ETH should continue to outperform BTC, and Solana should continue outperforming ETH, at least until the market tires of the AI + Solana + Treasury meme cocktail.

But don’t get greedy: the graveyard of “can’t lose” trades is deep and crowded. Book profits as you go. Because in crypto, as in life, the circus always packs up faster than you think.

$SOL: The DAT Reckoning Awaits

Every trader’s whisper has turned into a shout: can $SOL replicate $ETH’s meteoric rise through the DAT phenomenon? The answer may be hiding in plain sight, if you know where to look.

SOLETH’s Quiet Lull: While ETH basked in the spotlight of the DAT craze, $SOL lingered in the wings, unnoticed—like the understudy in a Broadway play, waiting for its cue.

The Rumor Mill Whirls: Multiple $SOL DATs are reportedly in the pipeline. At least one could be colossal, injecting fresh liquidity onto the open market and replaying the ETH DAT playbook. History, as they say, rarely repeats—it rhymes.

Market Implications: If ETH’s DAT trajectory is any guide, $SOL is poised for a renewed rally, likely outperforming broader altcoins. DAT-driven momentum can transform measured speculation into a feeding frenzy

A Word of Caution: Investors should watch carefully—DATs are the financial equivalent of Roman chariots: spectacular, fast, and occasionally catastrophic. Timing and positioning matter more than bravado.

In short: $SOL may be ready to step out of ETH’s shadow and claim center stage—at least for the next DAT act. The play is set; the audience is watching, and the sparks are about to fly.

My Alt Watchlist - Cowboy Memes to Revenue Focus

$HYPE is oscillating between $38 and $50 since early July. If macro holds like we write above, and BTC pushed ot new ATH, $HYPE could easily explode above $60. A $50bn FDV sounds gargantuan, but with a smaller market cap and a large portion of supply locked, selling pressure may be minimal. Every trader I know is now trading on $HYPE and finding ways to monetise further. Picture it as a champagne cork teetering—one careful pop, and the market could fizz spectacularly.

The setup feels binary: either it breaks above $50 and fizzes spectacularly, or it drifts sideways until macro delivers a catalyst. The risk-reward is clear, and in this tape, few trades carry as much narrative weight as HYPE’s cork pop.

$PUMP: The Slow Climb Back that I prefer - This is the one I am most bullish about. $PUMP struggled post-TGE, tumbling from a $7bn FDV peak to $2.3bn. It rebounded to $4bn (ICO price) mid-August, dipped again, and since August 26, has been steadily ascending to around $4.6bn Mcap currently. Made perfect sense and a no brainer to long this stuff below $2.5bn—a reminder that in crypto, slow and steady often beats frantic clicks.

Revenue has been climbing fast since the August low, with 100% directed into buybacks. The project holds a treasury in the high hundreds of millions, a deep war chest that underwrites confidence. Importantly, no unlocks are left, presale sellers are flushed, and the buyback flywheel is running.

Final Concluding Thoughts

Markets are a theater, and last month’s performance was delightfully absurd:

Treasury vs Fed Pricing: While traders priced in aggressive rate cuts, U.S. 5-year breakevens the market’s thermometer for inflation—slid lower. The message is clear: the specter of stagflation is still a ghost story.

Liquidity as Rocket Fuel: Bulls have always thrived on fear. With positioning underweight risk and financial conditions easing, every worried seller becomes tomorrow’s short squeeze. Think of it as medieval alchemy: panic transmutes into gains and Equities Ignore History.

Bitcoin and Gold’s Silent March: Bitcoin digests supply, consolidating quietly, while gold shatters records—the modern echo of Weimar’s hyperinflation: fiscal excess meets financial repression. Fiat is being debased, and hard assets rise in elegant protest.

Do Not Underestimate the Pro-Crypto administration - Shillers will shill and you don’t want to be left behind - Bessent, Trump, Lutnick, Sacks, and the usual D.C. crew will be yelling from every podium: crypto is the future- personal gains or not, America gains as no one else is buying that debt. You must take advantage of that.

Reflexive Momentum: Cross-asset dynamics are powerful: rising equities and liquidity inevitably lift Bitcoin. The moral is simple—when fear and liquidity dance together, the bull always has the last laugh.

For Q4, the hierarchy of opportunity looks clear:

$SOL, $HYPE, $PUMP → $ETH → $BTC → Gold

$SOL, $HYPE, $PUMP: High-beta, revenue producing, nimble, and primed for speculative reflexivity. Expect outperformance if the DAT narratives and market momentum hold.

$ETH: Still the king of smart contracts, and now constant DAT demand, solid but less explosive than the alt-high-fliers.

$BTC: Steady, predictable, and ever the barometer of macro risk appetite but less likely to spike as aggressively as ETH or SOL in Q4.

Gold: The ultimate hedge, gliding quietly above fiat debasement, but no showstopper in a liquidity-fueled risk-on wave.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @Risinghashtalk or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out Our Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!