5-Min Monday Macro, Crypto & AI: 18th Nov 2024

Stocks ATH, BTC ATH, Memes ATH. Bonds and deficits worrying. What next? Let's dive in....

Hey!!!! It’s Monday again. Welcome to another fantastic week!

I spend hours reading, researching, and talking to the smartest founders and investors in macro, crypto, and AI every week. This is my attempt to give you a short 5-10 minute summary on how I am thinking about the macro and crypto markets and what lies ahead. Hundreds of hours summarized, so you don't have to.

For live updates, you can join our Telegram channel or listen to the experts that we bring on our podcast, 'Greed is Good'

"Decide the type of person you want to be. Prove it to yourself with small wins." or as Emily Dickinson says "Forever is composed of nows."

THE MACRO ZEITGEIST

TL;DR

Zeitgeist - Voters have mandated Trump to fix America. I think Trump will not disappoint.

Macro - Goldilocks - soft landing, ATH stocks, ATH crypto. Markets look rosy for the next few more months, even if FED scales back rate cuts

Stocks, Bonds, Fx - Rally, pause, rest and go again

Crypto - Are you long enough?

Voters want Trump to fix America & Trump will not Disappoint

Today’s global meta-themes are impossible to miss—AI is reshaping industries, climate change remains a rallying cry, social media is both reviled and irresistible, and above all, there’s a growing distrust in governments worldwide. This isn’t just an American phenomenon; it’s a universal undercurrent.

Rising living costs, dwindling opportunities to own assets like homes or businesses, widening inequality, and seemingly endless wars are the frustrations that dominate voter concerns. These are the grievances that surface relentlessly in every election cycle, and yet, little changes.

Trump’s victory, then, is more than just a political win—it’s a thunderous mandate from the American electorate. Voters are demanding a clean break from the status quo. They’re fed up and have lost faith in the institutions that are supposed to serve them: the SEC, healthcare, borders, education, defense, FBI, CIA—you name it. The perception of crumbling rule of law in the U.S. only amplifies this discontent, leaving everyday citizens feeling powerless in the face of an unraveling system they can’t control.

In short, Trump’s win is a reflection of a deeper, collective cry for accountability, reform, and a sense of agency in a system that feels increasingly detached from the people it’s meant to serve. This vote for Trump is to fix them.

Bitcoin and the memecoin mania you’re witnessing are not just trends—they are the alter ego of a revolution against the debt-laden fiat system that props up political power and, in turn, perpetuates the decay of institutions. With fewer opportunities to own homes or provide a secure future for their families, millennials are looking for an escape hatch. Enter the world of memes, GME-style stock frenzies, and the ultimate meme of all—Bitcoin.

Bitcoin is more than just a digital asset; it’s a decentralized, community-driven uprising. It’s a silent but powerful rebellion against a broken financial system, one that institutions, politicians, and sovereigns can no longer afford to ignore. Ironically, not only are they paying attention—they’re joining in.

This movement represents a seismic shift, and we’re just at the starting line. The millennials’ search for meaning, fairness, and opportunity in a world that feels rigged is fueling this decentralized revolution. Bitcoin and its offshoots are no longer fringe; they’re becoming foundational.

Trump’s presidency is shaping up to be anything but conventional, and I believe he won’t disappoint. Here’s why:

Legacy over Tradition

It’s his last term, and Trump has his sights set on something far bigger than just another stint in the White House. He doesn’t want to be remembered as a placeholder like Biden; he’s aiming for a legacy that echoes through generations. Love him or hate him, the man knows how to make a mark.A Mandate with Gravitas

With a clear voter mandate and even surviving an assassination attempt, Trump has every reason to aim for greatness. While I’m neither American nor Republican, as a market observer, I see the potential for one of the most dynamic presidencies in recent history. It won’t be perfect—perfection is, after all, the enemy of the ideal—but it could be transformative for America and, by extension, the world.A “Bretton Woods Bitcoin Moment”?

Trump understands the importance of maintaining USD dominance, but rising bond yields and swelling deficits are flashing red. His solution? A bold pivot to Bitcoin as a reserve asset. Imagine this: Bitcoin mining incentivized in the U.S., BTC custody moving onshore, tax-free crypto zones, and America becoming the global hub for crypto innovation. Is Bitcoin about to “make America great again”? It’s not entirely impossible, and if you’re not holding some BTC, it might be time to reconsider.Wars Down, Prosperity Up

Trump knows that wars bleed economies dry, and he has the influence to dial down global conflicts. Whether it’s Putin or the Middle East, his message is clear: stop funding chaos and focus on domestic priorities. NATO’s checkbook days may also face a hard pause.Streamlining America’s Engine

The Trump administration is reportedly eyeing $2 trillion in government spending cuts, far beyond the current $1.7 trillion discretionary budget. And with appointments like Elon Musk and Vivek Ramaswamy potentially in key roles, this could be the most ruthlessly efficient cabinet in modern history. Call it the D.O.G.E. doctrine: Disrupt, Optimize, Grow, and Excel.

In summary, Trump’s return isn’t just another presidency—it could be a masterclass in shaking up the status quo. The markets, the dollar, and global geopolitics are watching closely. Are you?

Macro looks good for coming weeks

The Goldilocks economy is here, and the signs couldn’t be clearer—there’s no recession in sight, just a perfectly cooked soft landing. Here’s what’s shaping up:

The Economy’s Sweet Spot

Full employment, tax cuts, deregulation, and a stock market riding high—it’s like the economic dream team showed up to play. Post-election optimism is driving confidence, and greater certainty is giving investors the green light to take risks. Translation? The bears are out cold, and life is looking golden for the bulls.CPI: Calm and Controlled

October’s CPI data hit expectations perfectly: 2.6% YoY headline and 3.3% core. Inflation is under control, and the Fed is in no rush to overdo things with rate cuts. It’s a delicate balance, and the current pause is more of a strategic timeout than a game-changing move.Politics and Policy Dynamics

Behind the scenes, Powell and the incoming administration are navigating the fine print of what’s next. The appointment of a new Treasury Secretary will be critical. Overplaying tariffs could risk stoking inflation again, leaving the Fed with fewer tools down the road. The message is clear: don’t spend all your ammo now.

In summary: The economy is thriving, confidence is climbing, and markets are poised for new highs in stocks and crypto alike. As long as the delicate balance between fiscal restraint and monetary policy holds, this Goldilocks economy could keep the good times rolling.

GLOBAL MARKETS

Tariffs and China’s Potential Response: Walking the Razor’s Edge

All Eyes on January

The U.S. is poised to announce new tariffs on China, possibly as soon as January. The scope and severity of these tariffs will hinge on who’s negotiating under Trump’s administration—each advisor brings their own playbook.Inflationary Concerns

Tariffs could inject upward pressure on inflation, an unwelcome development given the Fed’s limited flexibility post-rate cuts. Policymakers must tread carefully to avoid overheating prices while maintaining leverage in trade negotiations.Beyond China: Europe and the UK on Watch

Trump’s trade focus isn’t solely on Beijing. Tariffs on the EU and UK, particularly targeting Germany’s auto sector and trade surplus, are also on the table. This risks straining relationships with key NATO allies and creating broader economic ripples.China’s Predicament

Already grappling with economic challenges, additional tariffs could back China into a corner. Potential retaliatory moves might include:Taiwan Escalation: Flexing its stance on Taiwan to signal defiance.

Mineral and Supply Chain Retaliation: Tightening access to critical resources.

BRICS Agenda: Doubling down on de-dollarization efforts and fostering alternative alliances to reduce Western dependency.

A Shift in Strategy

Regardless of specific retaliations, China’s long-term trajectory will likely accelerate towards reducing its reliance on Western markets and financial systems. This could reshape global trade and economic dynamics, fueling further decoupling.

Conclusion

The tariff game is a double-edged sword. While the U.S. seeks economic leverage, the risk of inflation, strained alliances, and intensified global rivalries loom large. China's response will be measured but potentially transformative, reshaping global economic strategies for years to come.

DATA TO WATCH

Nov 22: U.S. Manufacturing & Services PMI, U.S. Consumer Sentiment

MACRO SUMMARY

Golidilocks for few more months, especially going into Q1’25.

STOCKS, BONDS & FX

Stocks

Earnings Season Wrap-Up: Optimism Amid Consolidation

Strong Earnings Beat

With 76.3% of companies exceeding expectations this earnings season, the corporate landscape looks robust. However, markets are taking a well-earned breather after the post-election rally.No More Cuts? No Problem!

While further rate cuts seem unlikely, euphoria surrounding anticipated spending under the Trump administration is fueling optimism. Investors expect apex spending to trickle down, benefiting industries across the board.Small Business Boom

The small business index is surging, signaling confidence and renewed investment at the grassroots level. Favorable financing conditions and deregulation are setting the stage for sustained growth, especially for small and mid-cap companies.A Healthy Pause

After significant price appreciation, consolidation is underway. This is a natural pause, allowing for profit-taking before the market regains momentum. December could see the rekindling of "animal spirits," with a broader rally expected.Breadth Expansion

AI continues to shine as a dominant theme, but the rally is likely to broaden. Small and mid-caps are well-positioned to benefit from valuation expansion and increased investments. A rising tide of animal spirits might just lift all boats.

Conclusion

Markets may be catching their breath, but the foundation for a broader and more inclusive rally is solid. Eyes remain on the small and mid-cap sectors as key beneficiaries of a pro-business agenda and favorable market conditions.

The big picture is clear: the bull market remains intact. While a brief consolidation may occur over the next week or two, it pays to stay long.

Bonds & FX

Rising Yields Signal Brewing Concerns

Climbing Yields

U.S. 10-year yields are inching toward 4.5%, with 30-year yields not far behind at 4.6%. These increases reflect mounting expectations of inflation driven by anticipated Trump-era spending.Treasury Pain

If debt issuance spikes to address the multi-trillion-dollar deficit, Treasury losses could deepen, with yields potentially breaching the 5% threshold. This scenario could significantly strain fixed-income markets.Market Pause Ahead?

As the reality of higher borrowing costs and inflationary pressure sets in, markets may cool off. A potential breather in late Q1 or early Q2 2025 seems plausible as investors digest the fiscal and economic implications.A Balancing Act

While spending can boost growth and investments, runaway deficits paired with rising yields risk unsettling markets. Watch for policy maneuvers to strike a delicate balance between stimulus and stability.

Conclusion

The bond market is sounding cautionary notes. While optimism surrounds pro-growth policies, the risk of sustained yield increases could prompt markets to recalibrate early next year.

CRYPTO

Bitcoin is holding steady between $90K and its recent all-time high of $93.5K, signalling that the bulls remain firmly in control. The RSI is easing, which suggests a healthy cooldown as momentum resets for the next potential move. Meanwhile, Bitcoin continues to trade significantly above its 200-day moving average, reinforcing the strength of its long-term uptrend. This period of consolidation is a natural and positive pause, allowing the market to digest gains and set the stage for further upside. BTC looks well-positioned to maintain its upward trajectory as the broader crypto market watches closely.

Unless there's a major stock market crash or sweeping tariffs on China, we could very well see round two of this bull run. As mentioned earlier, staying long in crypto looks like a smart play for now. However, as Bitcoin nears psychological resistance levels, expect a tug of war, with early holders likely to take profits, leading to some selling pressure. There’s still a chance for one more dip to around $85K if stock market consolidation continues and ETF flows start to lose steam. That said, Polymarket is betting on a 60% chance of Bitcoin reaching $100K by the end of the year—so the bulls are still in charge for now.

A repricing against gold’s appreciation to date alone suggests Bitcoin in excess of $140K is likely justified - Charles Edwards, Capriole

Look above at those post election moves - BTC v s NASDAQ. It seems to me that Bitcoin is breaking out while stocks are starting to take a much needed breather.

Last week saw mixed performances for crypto assets. Some alts showed strength - TRX, SUI, ATOM while others continue to slide - APT, ETH. Even some Dino coins are coming back to life - XRP, HBAR, LTC, ADA etc.

This is what we wrote last week and repeated several on our telegram channel. Hope you are following closely. There is much more alpha on our 52 weeks trade newsletter as well on some live trades that we take and share.

All signals are pointing towards a major rally in Bitcoin, and we believe this is just the beginning of a strong upward move in the coming months.

Memecoin Frenzy Continues Unabated

Dogecoin its up by $30bn and hovering around $50bn now. Thank you Trump, thank you Elon.

PEPE & WIF got listed on Coinbase and rallied. Profits were taken and they are back to where they started. Almost.

ACT & PNUT got listed on Binance and rallied something like 20-50X. Some millionaires were made. This is better than lottery. No?

AI coins rallied like crazy post these listings - ai16Z, Fartcoin, Shoggoth, Zerebro etc all rallied

$FWOG which is the largest frog coin on Solana, reached a new ATH at $700M.

DeSci - New Narrative in Town

Over the past week, a new genre of tokens have started to take significant mindshare: DeSci. A new platform called pump.science is combining the virality of memecoins on Solana, with science to incentivize longevity experiments - very innovative. The vision is to create a protocol for financing, researching, and developing chemicals that increase healthspan, the time a person (or any organism) can live with high physical and cognitive function.

Pump.science works by allowing users to bet on which compound and experiment will increase an animal’s lifespan. For example, today, on the pump.science site there are two compounds being tested on flies: Rifampicin and Urolithin A.

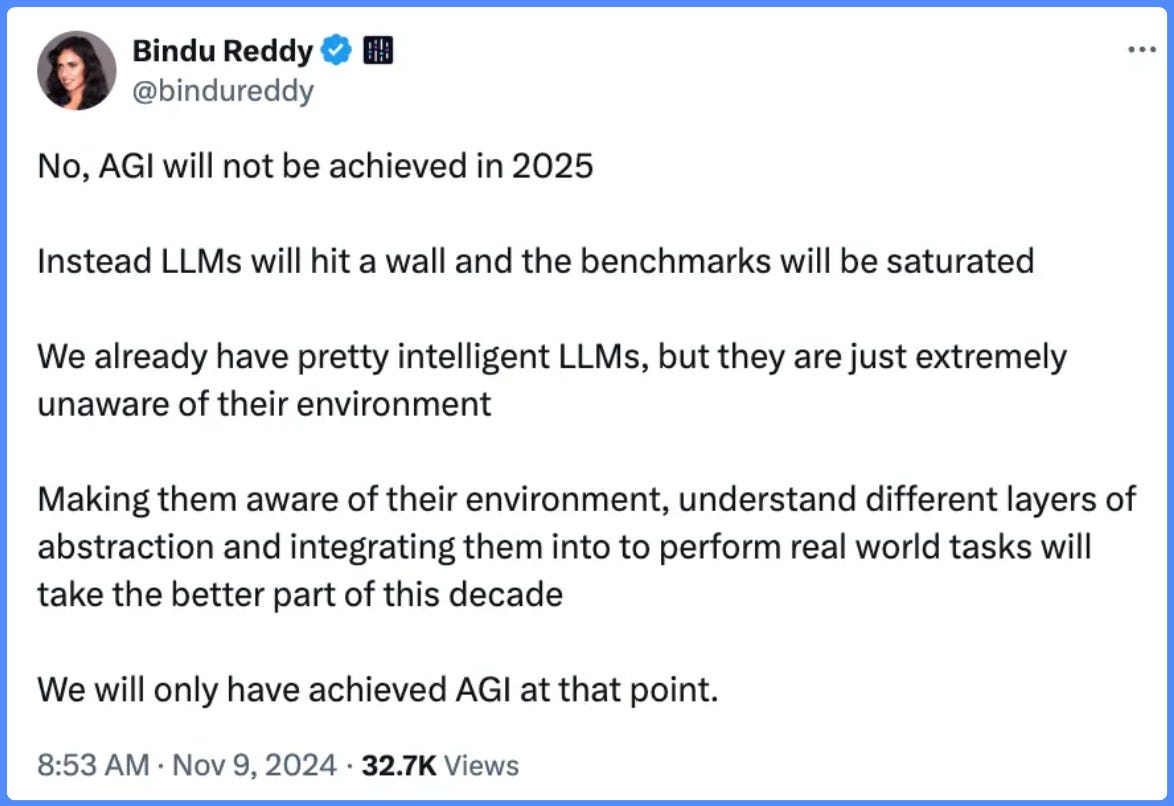

AI

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

Tech for Good: Al Morris’ Journey With Koii Foundation

If you loved this, you may subscribe for immediate notifications on our latest episodes!

May your Monday be filled with coffee & profits.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!