5-Min Monday Macro, Crypto & AI: 16th Dec 2024

$BTC ATH at $106K, U.S. inflation accelerates as FED eyes rates cuts, Microstrategy & Palantir Added To Nasdaq100, UK Economy Stagnates, Canada slowdown, Chinese bazooka

Hey!!!! It’s Monday again. Welcome to another fantastic week!

I spend hours reading, researching, and talking to the smartest founders and investors in macro, crypto, and AI every week. This is my attempt to give you a short 5-10 minute summary on how I am thinking about the macro and crypto markets and what lies ahead. Hundreds of hours summarized, so you don't have to.

For live updates, you can join our Telegram channel or listen to the experts that we bring on our podcast, 'Greed is Good'

Novelist Ernest Hemingway on acting with confidence while living with humility: "Be humble after but not during the action."

Source: The Art of the Short Story, The Paris Review Via James Clear

TL;DR

Zeitgeist - Marktes are cheering & preparing for a Christmas rally

Macro - Inflation came in at 2.7% with core CPI. Markets see a 96% chance of a Fed rate cut next week.

Stocks, Bonds, Fx - Breath and USD dominance

Crypto - ATH, thanks to Trump & MSTR

THE MACRO ZEITGEIST

The FED's Next Move: A Balancing Act Between Inflation, Jobs, and Market Mania

The Federal Reserve is widely expected to deliver a 25 basis point rate cut this week, and it’s no mystery why. The Fed’s dual mandate — inflation and employment — remains front and center, as it should. Here’s a quick breakdown of the key factors shaping the Fed’s playbook and what it means for markets:

1️⃣ Inflation: Sticky but Stabilizing

Recent inflation data suggests the long-awaited "bottom" may be here, with core CPI clocking in at 3.3% — well above the Fed's coveted 2% target.

The Fed watches core CPI like a hawk (no pun intended), and this number is too high for them to break out the party hats. While headline inflation has eased, the sticky nature of core inflation means Powell and Co. are unlikely to go full-on dovish.

2️⃣ Jobs: Cracks in the Armor?

Weekly jobless claims hit a two-month high at 242k, a signal that the labor market — once seen as invincible — may finally be softening.

With holiday hiring now behind us, the post-holiday lull could exacerbate weakness in the labor market, giving the Fed one more reason to avoid being overly restrictive. This is a classic case of "careful what you wish for" when it comes to reining in wage-driven inflation.

3️⃣ What’s Next for the Fed?

Expect a shift from "dovish" to "hawkish caution." The days of rapid rate cuts may be coming to an end. Further reductions aren't guaranteed, especially as inflation proves sticky and labor data becomes more wobbly.

If Trump’s new cabinet continues to make "strategic" moves, and the U.S. economy stays resilient, we may see more cuts. But don't count on it being a straight line down.

Meanwhile, Markets Are on Fire 🔥

Everything is ripping — the USD, equities, and crypto. The Santa Rally is in full swing, and the elusive "soft landing" appears to be intact. Recession fears? For now, they're hiding under the mistletoe.

Here’s how to play it:

Don’t Fight the Flow: Sometimes, you don’t have to be a contrarian. Just follow the flow. KISS — Keep It Simple, Stupid. Stay long, but be smart.

Book Profits & Hedge: As the rally builds momentum, take some chips off the table. Hedge smartly to protect gains, but don’t sit on the sidelines. The bull market is alive and well, for now.

The Debt Beast: Taming the Untamable 🐉

Amid all the euphoria, there’s an elephant in the room — the spiraling national debt. The U.S. government’s deficit is a black hole that keeps growing, and no, Elon and Vivek aren’t going to "disrupt" this beast. The populist nature of modern fiscal policy means debt refinancing will remain a permanent fixture.

Here’s the kicker:

The Fed and Treasury will keep supplying liquidity to finance this never-ending cycle of deficit spending.

What does that mean for crypto? Liquidity injections have historically lit a fire under the crypto market, and this cycle may be no different. A Fed-sponsored crypto bull cycle is brewing. If liquidity becomes the name of the game, don’t be surprised to see another leg up in Bitcoin and its merry band of altcoins.

TL;DR:

Inflation is stubborn, jobs are wobbling, and the Fed will likely shift from "dovish" to "hawkish caution."

Markets are riding high — stocks, crypto, and USD are all surging. The bull is alive, so stick with it, but hedge your bets.

The debt monster isn't going away, and with liquidity injections likely to continue, we may be gearing up for a Fed-fueled crypto bull cycle.

So, as we ride this Santa Rally, remember: Sometimes it’s better to dance with the market rather than fight it. Stay long, hedge smartly, and don’t try to time the end of the party. If you hear the DJ playing "Closing Time," it’s already too late.

GLOBAL MARKETS

Is Canada Heading for a Perfect Storm?

Canada’s economy appears to be skating on thin ice, and the cracks are starting to show. With the looming threat of U.S. tariffs, rising household debt, and a weakening job market, the outlook is anything but rosy. While some may hope Trump is bluffing, the mere mention of tariffs is enough to rattle investors. Here’s a closer look at the key risk factors driving this narrative:

1️⃣ Tariffs: The Sword Hanging Over Canada’s Head

Trump’s Tariff Threats: Whether it’s a bluff or a real threat, the damage is already being done. Markets hate uncertainty, and Canada is caught in the crosshairs. If tariffs are imposed, expect the Canadian economy to spiral like a curling stone headed straight for disaster.

Shaky GDP Growth: Unlike the U.S., Canada’s growth is on fragile footing. Economic expansion has been sluggish, leaving little room for error.

Household Debt Overload: With one of the highest household debt-to-income ratios in the developed world, Canadian consumers are over-leveraged. It’s a powder keg waiting for a spark — and tariffs might just be that spark.

Job Market Strain: Pressure is mounting in the labor market, with signs of softness ahead. Any external shock, like tariffs, could push unemployment higher, adding fuel to the economic fire.

Bank of Canada Cuts 50 bps: The BoC is already in "damage control" mode, slashing rates to support the economy. But rate cuts only go so far when household debt is sky-high.

3️⃣ Global Rate-Cut Party

The European Central Bank (ECB) has joined the fray, cutting 25 bps, and the Swiss National Bank wasn’t far behind with a 50 bps cut — the biggest in nearly a decade. It’s like a global central bank race to the bottom, with every player hoping to avoid being the first to break.

4️⃣ China’s Mystery Move: Stimulus or No Stimulus?

Uncertainty Reigns: No one really knows what China is up to, and that’s a problem. With global demand slowing and Trump’s tariff war escalating, China faces mounting pressure to inject liquidity.

Liquidity is Coming: It’s not a question of if but when. Faced with a trade war and softening growth, China will likely have no choice but to flood its system with liquidity. The market will be watching every policy hint with bated breath.

What’s the Big Picture?

Canada is walking a financial tightrope, and U.S. tariffs could be the gust of wind that sends it tumbling. The BoC is cutting rates, but rate cuts alone can't fix household debt, a weak labor market, and external trade risks. Throw in China's unpredictable moves and synchronized central bank cuts worldwide, and you have a recipe for global uncertainty.

Key Takeaway: Shorting CAD/USD might be the smart play here. With so many pressure points — tariffs, debt, weak GDP, and central bank cuts — Canada is like a Jenga tower on the verge of collapse. The only question is which block (or tweet) will bring it all crashing down.

DATA TO WATCH

December 17 - U.S. Retail Sales

December 18 - U.S. FOMC Interest Rate Decision

December 27 - BTC CME December (BTCZ24) Options Expiry

January 15 - U.S. Consumer Price Index for November

MACRO SUMMARY

The US economy & the labor market is stable. Core inflation is sticky. This limits the Fed's options but for now the rate cut path should continue for next couple of months unless something explodes. That means more liquidity which is always good for risk assets but global economy is shaky and that could keep a lid on inflation (and any meaningful demand)

STOCKS, BONDS & FX

Stocks

Isolated themes are emerging as the Bull market continues. NVDA is slacking but AMZN, TSLA, PLTR and MSTR have completely taken over. What a ride.

Stocks are NOT the economy. Don’t be fooled. And while the economy is stable, stock market is starting to feel a bit stretched and over leveraged to me. With incoming new presidency, things could get a bit volatile IMO.

I am not ruling out some sort of minor correction but for now the bull market continues as seen by the XLY/XLP ratio - consumer discretionary to consumer staples, but the RSI on that is getting stretched conveying some caution is needed as we enter the new year.

Same bullish pattern for IWF/IWD - Growth vs Value - intact but rising RSI

Overall some caution is warranted as we enter year and as these ratios are getting stretched. There will be selective themes emerging and I am staying true to crypto for that providing max returns. MSTR 0.00%↑ continues to outperform everyone for us.

Bonds

As suggested above, one more rate cut is a given, but once we settle in for no more rate cuts,. yields should stabilise. Moreover, the nomination of Scott Bessent as Treasury Sec has been well received by the bond market. He should prioritise economic and inflation stability leading to a stabler (and lower) 10 year rate IMO.

CRYPTO

Majors - New ATH’s in BTC and the $ MSTR Masterstroke

Bitcoin’s journey from the Genesis Block to $100k per BTC is a historic moment and a new high watermark in adoption. With 19.8M BTC mined, $131T in transfer volume processed, and 1.12B transactions, the $100k price milestone is yet another sign of Bitcoin's resilience - Glassnode

As I write this, $BTC has reached ATH of $106K on back of another large purchase by MSTR 0.00%↑ (Microstrategy). This is pure genius by Saylor and I will write a long form article about that soonest. Also, MSTR is going to be included in NASDAQ starting 20th December. That is even more awesome on Saylor’s part what he has achieved.

Hope you’ve been reading our newsletter and following us on Telegram. We have been repeating one thing and one thing only - “You are not long enough son”. There is a paradigm shift with new Trump’s victory and cabinet selection and targets of $120K my market might come in very short, especially if there is an announcement of Bitcoin Strategic Reserve. At this stage, I am not ruling out a $200K $BTC in next few months.

Meanwhile, in a new release from Blackrock Investment Institute called “Sizing Bitcoin In Portfolios” its analysts are making the case that the cryptocurrency, long shunned by mainstream investors, should now account for 1% to 2% of traditional “60/40” investment portfolios."

ETF FLOWS - Massive Institutional Demand, Minor Slowdown due to Thanksgiving

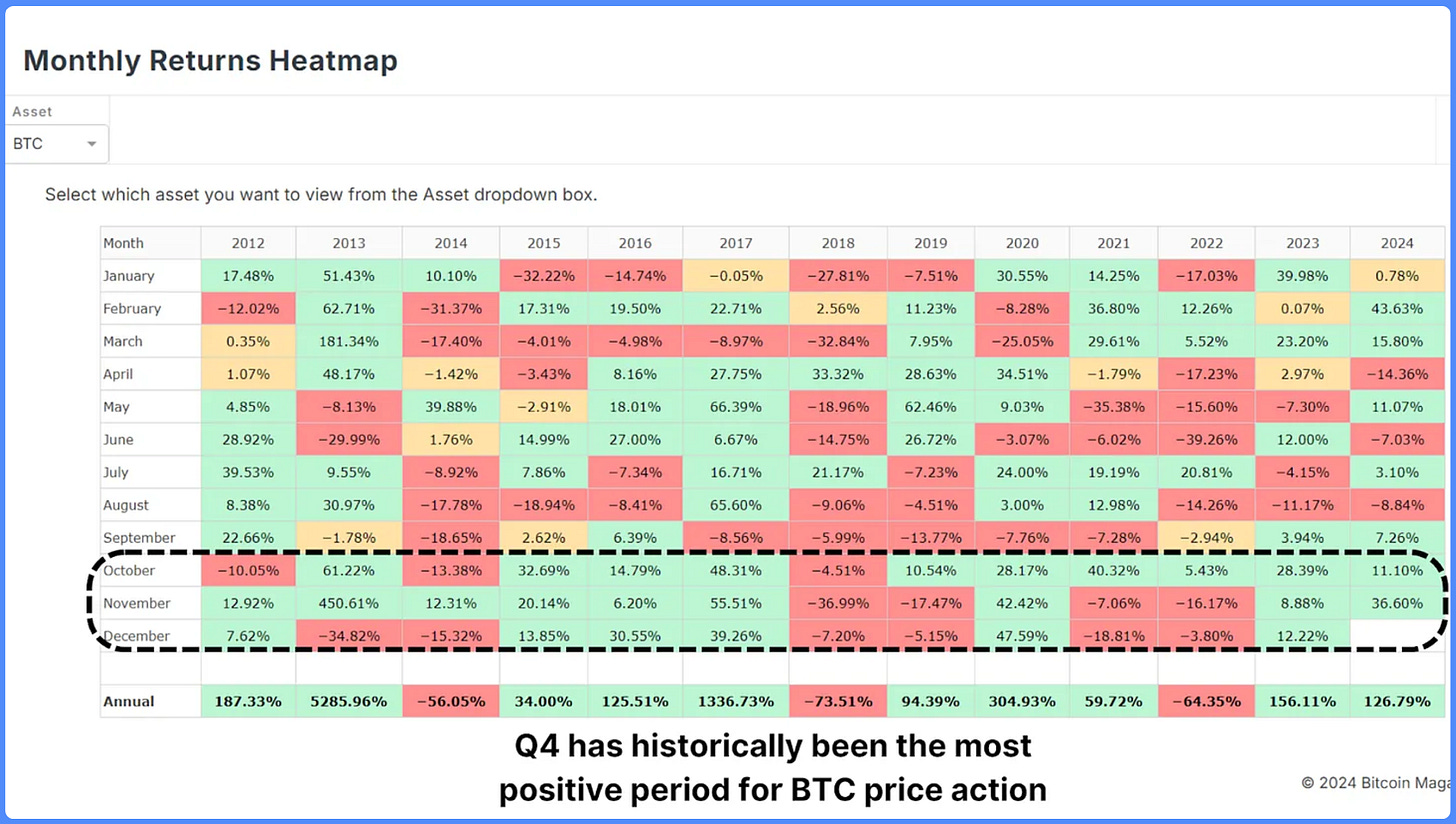

A key factor underpinning Bitcoin’s strength is the continued accumulation by institutions. Bitcoin ETFs are adding billions of dollars worth of BTC to their holdings, and corporations like MicroStrategy have doubled down on their Bitcoin strategy, now holding close to 400,000 BTC. Even with BTC rallying to new all-time highs, ‘smart money’ is scrambling to accumulate as much as possible to ensure they’re not left behind.Institutional demand is just beginning IMO leading to a massive seasonal December rally in $BTC.

Rising US yields is typically a headwind for Bitcoin, however when yields are rising because of debt sustainability fears, Bitcoin, as the world’s hardest asset, is the ultimate hedge against the failure of fiat, debt based economies. Rising US yields are a slight concern, yet for Bitcoin, the idiosyncratic bull narrative is growing stronger week by week. Microstrategy’s addition to the Nasdaq 100 the latest milestone. The Bitcoin Santa Rally looks set to spread more Christmas cheer

Alts - The Hype over $Hype and Penguins rule the World

Posted by Ansem, many coins are performing nicely since their August 5th lows:

Sui (SUI) +800%

XRP (XRP) +414%

Dogecoin (DOGE) +365%

Ethena (ENA) +335%

Aave (AAVE) +332%

Fantom (FTM) +330%

Cardano (ADA) +270%

Pepe (PEPE) +260%

Uniswap (UNI) +254%

Chainlink (LINK) +200%

Mog Coin (MOG) +195%

dogwifhat (WIF) +150%

Bonk (BONK) +120%

Solana (SOL) +87%

Ethereum (ETH) +66%

30d best performers among CEX coins launched in 2024 :

$ENA : +125%

$ONDO : +120%

$EIGEN : +102%

$SCR : +96%

$ZRO : +86%

$PEAQ : +82%

$KMNO : +77%

$ETHFI : +76%

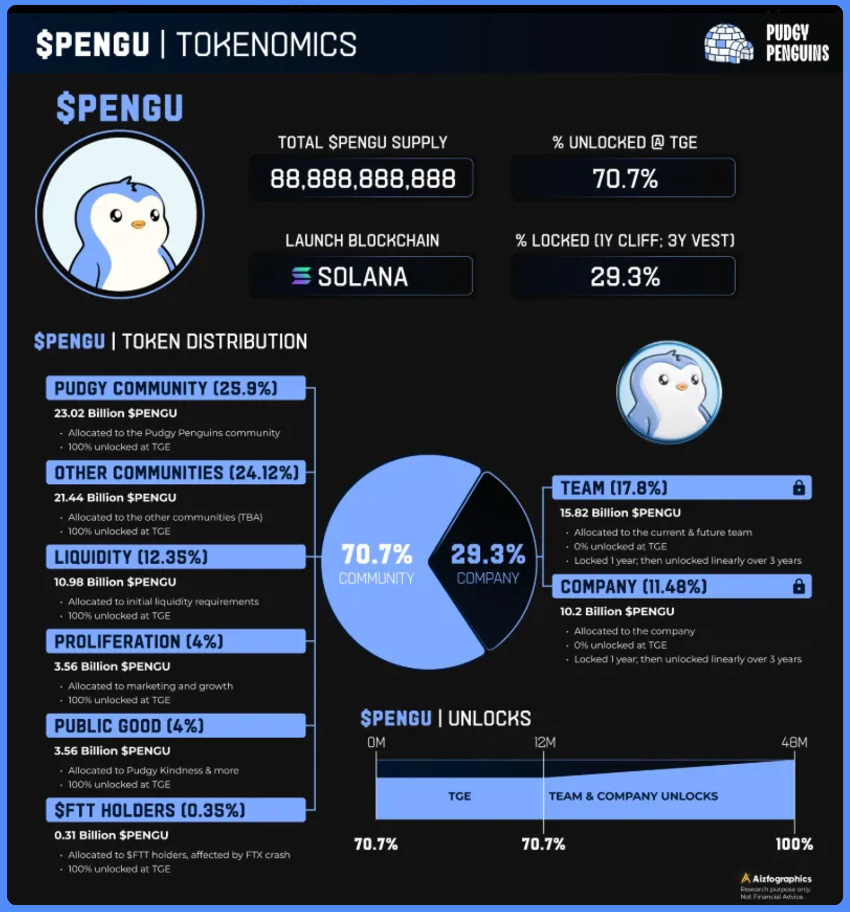

And then we have the resurgence of Pegnuins - the PENGU token - which is highly anticipated to drop very soon. Our friend

has an amazing piece on this belowThe token will drop on Solana, and supply will be 88,888,888,888

Crypto x AI - The Agentic World

The differentiating factors in AI Agents come down to: 1) Quality of contextual information 2) Support for a wide range of plugins 3) Ability to fully leverage underlying LLMs 4) Integration in products The first factor is what sets agents like @aixbt_agent apart

ai16z, ELIZA and the Bazaar of Agents

If ELIZA succeeds, it could fundamentally redefine how we build software.

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

We sat down with Akshit Bordia, co-founder of LogX, to explore his path from mining $BTC to leading a cutting-edge #DeFi exchange.

If you loved this, you may subscribe for immediate notifications on our latest episodes!

May your Monday be filled with coffee & profits.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!

thanks for mentioning us!