5-Min Monday Macro, Crypto & AI: #71, 27th Jan

China and US Lock Horns Over AI and Cybersecurity

Hey!!!! It’s Monday again. Welcome to another fantastic week!

I spend hours reading, researching, and talking to the smartest founders and investors in macro, crypto, and AI every week. This is my attempt to give you a short 5-10 minute summary on how I am thinking about the macro and crypto markets and what lies ahead. Hundreds of hours summarized, so you don't have to.

For live updates, you can join our Telegram channel or listen to the experts that we bring on our podcast, 'Greed is Good'

Singer, songwriter, and actress Dolly Parton on gratitude:

"I make a point to appreciate all the little things in my life, because I learned early that if you don't, you get disappointed a lot. If you do, you might be pleasantly surprised quite often.

I go out and smell the air after a good, hard rain. I re-read passages from my favorite books. I hold the little treasures that somebody special gave me. By keeping my eyes open for unexpected joys, I find the world gives back more than we sometimes think."

Via James Clear

TL;DR

Zeitgeist - Markets on edge as Donald Trump takes the reins, sparking massive uncertainty.

Macro - Inflation remains sticky, job markets are shaky, all eyes on the FOMC on the 29th Jan

Stocks, Bonds, Fx - High uncertainty as markets await the next moves from both the Fed and global policy developments.

Crypto - Bloodbath continues, with Bitcoin going under $100K and altcoins struggling.

AI - DeepSeek rises as a powerful contender, challenging OpenAI’s dominance in the AI landscape.

The Macro Zeitgeist

Dictator of the World or Entertainer of the World?

Whatever is your version of THE man of the hour (and for next four years), one thing is certain - it’s going to be massively entertaining as he starts to deliver on his promises (and surprises)

From family coins to executive orders to a AI fund to tariffs, the movie has just started. Get your popcorn ready.

Meanwhile, no one is even talking about FED or bothered about next weeks important FED meeting. A meeting that could rather shape the entire trajectory for February. Something that we were so heavily reliant all of last year. Funny eh?

Boring Chopsolidation

Call it PTSD, call it OG distress signals, or call it my 6th senses. One thing Ive seen repeatedly in my 10 years of banking and now 12th year of crypto is when everybody is thinking on same lines, and then that thing doesn’t happen (or opposite happens), it not only crushes the markets, it crushes the traders SOUL sometimes. Very hard to come back from that. Monetary and mentally.

Look at China - you can stimulate all you want, but those crushing souls sitting on massive property and stock market losses will think 10 times before stepping back in. That is IF there is a recovery even.

As far as markets are concerned, welcome to chopsolidation. While, Trump has been keeping most of his promises, market is on it toes - because with Trump, you just don’t know. A great cabinet choice, Marc Uyeda as acting SEC chair, Commissioner Hester Peirce leading the new crypto task force, taking back SAB121, and Senator Lummis, now the chair of digital assets who wants her Bitcoin Strategic Reserve like yesterday. That is not a bad start. But threatening everyone with unknowns is act the market doesn’t like.

Macro - Risk Off till FED & Powell Provide Clarity

Most market players believe the central bank will keep rates unchanged at 4.25-4.50% – based on implied expectations from Fed funds futures. FED will keep focusing on its 2% inflation target and keep the rates just around here. But I don’t see any rate hikes in 2025. That means we will see animal spirits returning as soon as earnings are done, Trump is more settled and there is certainty with his policies. 2025 should be another favorable macro setup for risk assets this year in spite of all the Trump driven noise right now.

As for crypto, if FED confirms a gradual approach to rate cuts like the market expects, Bitcoin should remain stable. But if the post FOMC language is any more hawkish, we have instant headwinds towards $90K area. We are already seeing. glimpse of that as BTC has dropped off from ATH around $109K to around $99K currently. Keep your ears close to that post meeting communique.

GLOBAL MARKETS

What Matters Most - China vs US

China today leads in cybersecurity. And US is aware of that. They are also ahead in batteries, nuclear, robotics, any kind of manufacturing and now it seems AI as well with DeepSeek. More on that in the AI section below but DeepSeek shows China can “quickly adapt” and get ahead.

The question is how would US tackle the threats? It's easy to impose tariffs upon tariffs but longer term - both need each other and that is where I think this relationship is headed to. Equilibrium.

Which makes me kind of bullish on Chinese stocks, given where they are currently.

DATA TO WATCH

January 29 - U.S. FOMC Interest Rate Decision

January 31 - BTC CME December (BTCF25) Options Expiry

February 25 - FTX Preliminary Distribution Repayments Begin

MACRO SUMMARY

Macro looks stable, but FED is always there to shut down the party with hawkish comments this week.

STOCKS, BONDS & FX

Goldilocks & Stay Invested

We are a few days after the inauguration. Markets reached ATH before risking off for FED’s next meeting on 29th.

What next? Since macro looks healthy, earnings look good, deregulation coming and inflation under control, I retreat what I said above - 2025 should be a decent upside year. And remember, US equity markets are the most sought after equity markets. That is not changing soon. Moreover, I think Trump & Xi wan to reach a deal as soon as possible.

Bonds & Fx

A 0.5% rate hike in Japan might sound like a rounding error, but for a country that’s been allergic to rate hikes for decades, this was seismic. Expect whispers of "more hikes to come," even if that’s wishful thinking.

China PMI & Property Woes: Vanke bonds rallied 15 points on restructuring hope, then promptly lost 8 points when everyone remembered they’re still, well, Vanke. PMI data? Uninspiring, but at least it wasn’t apocalyptic.

CRYPTO

Past Cycle vs New Cycle - What’s Next for Bitcoin?

Bitcoin has had a bit of a rollercoaster lately—more of a "sell the news" moment than a full-on selloff, though things have certainly been wobbly. Once the dust settles, we can take a clearer look at where it's heading.

Whales are still at it, gobbling up BTC like it's an all-you-can-eat buffet, with MicroStrategy leading the charge by snagging over 10,000 more Bitcoin at a cool $1.1 billion. It’s like watching someone hoard pizza slices, never worrying about leftovers.

Chokepoint has been Choked

Meanwhile, President Trump’s executive orders have stirred up the crypto pot, signaling a halt to Operation Chokepoint 2.0 and boosting digital financial tech leadership. While world leaders were schmoozing in Davos, crypto markets stayed spicy, especially with those Trump-themed memecoins. Few of the highlights:

Create a crypto working group led by David Sacks to develop federal crypto regulations and assess a "national digital asset stockpile."

Ban the creation of a central bank digital currency (CBDC) by any US agency.

Revoke Biden's Executive Order 14067 and the Treasury's "Framework for International Engagement on Digital Assets."

Protect banking services for law-abiding individuals and private-sector entities, effectively ending Operation Chokepoint 2.0.

"I go to bed at night worrying I don't have enough. Not that I have too much." - Joe Bryan

Reflecting on Bitcoin's unique position as an asymmetric bet that's often misunderstood by traditional markets. He emphasized that Bitcoin's risk-reward profile is unmatched, with holder conviction only growing stronger as prices rise—an inversion of typical market psychology.

With Bitcoin's fixed supply and increasing adoption, the Bitcoin-to-gold ratio has hit all-time highs, reinforcing its status as one of the greatest asymmetric opportunities in financial history.

Massacre in ALTS as BTC Topples

The altcoin market is getting hammered, with many coins down 10-40%, but this steep correction is also presenting some great entry points for long-term investors. $VIRTUAL, in particular, is standing out as an exciting play, especially with its deep integration into the Base ecosystem. As Coinbase’s success hinges more and more on the Base network, $VIRTAUL is becoming a strong proxy for Base’s future growth.

Alongside $VIRTUAL, other AI tokens such as AI16Z, $GRIFFAIN, and $AIXBT show great potential, positioning themselves for significant upside when the market rebounds. This dip presents an excellent opportunity to accumulate these assets and increase exposure for future gains.

Hyperliquid Stays Strong Amid Market Turmoil

Despite market turbulence, Hyperliquid has proven resilient as its ecosystem continues to expand. The platform's recent all-time high of $21B in daily trading volume and its dominance in the perpetuals market, with 64.8% market share, underline its strength. As the protocol's influence grows and its ecosystem matures, Hyperliquid remains a robust force, even in a challenging market environment.

Hyperliquid's market share surged, reducing Binance's dominance from 90% to 57.8% by January 2025, highlighting its growing influence in the perpetuals market. Following its volume record, Hyperliquid also set a new high with $4.42M in daily revenue, reflecting its rising popularity in decentralized markets.

AI - DeepSeek's Challenge to OpenAI's Dominance

DeepSeek: A Game-Changer in AI

DeepSeek, DeepSeek, a new AI model developed with just a $6MM investment by a China-based hedge fund, is posing a significant challenge to OpenAI’s dominance. Its open-source model, DeepSeek-R1, rivals OpenAI’s offerings at a lower cost, with transparent access that sets it apart from other LLMs. As the AI landscape becomes more competitive, DeepSeek’s free and accessible technology raises the stakes for major players like OpenAI.

For OpenAI investors, this development is concerning. A competitor with minimal investment has created a comparable model, putting pressure on OpenAI to keep up. With DeepSeek’s low-cost, easily accessible model, the switch to it is almost seamless, and this threatens OpenAI's market position. If this trend continues, OpenAI could face dilution and pricing pressure, particularly as it looks to fund its ambitious $500B Stargate project.

If DeepSeek’s low-cost models keep catching on, Meta and Google might find themselves laughing all the way to the bank, with reduced capex and juicier profits. Meanwhile, Nvidia could feel like the guy at a party who thought he was the life of it, only to find out everyone’s suddenly dancing to a different beat. If things keep rolling for DeepSeek, the hyperscalers might just waltz right past Nvidia in the AI race.

Note: Just to be clear—this isn’t the base case. Hyperscalers aren’t about to hit the brakes on their capex spending anytime soon.

But hey, anything’s possible.

DeepSeek's approach is mind-blowing, take a look at the tweet below!

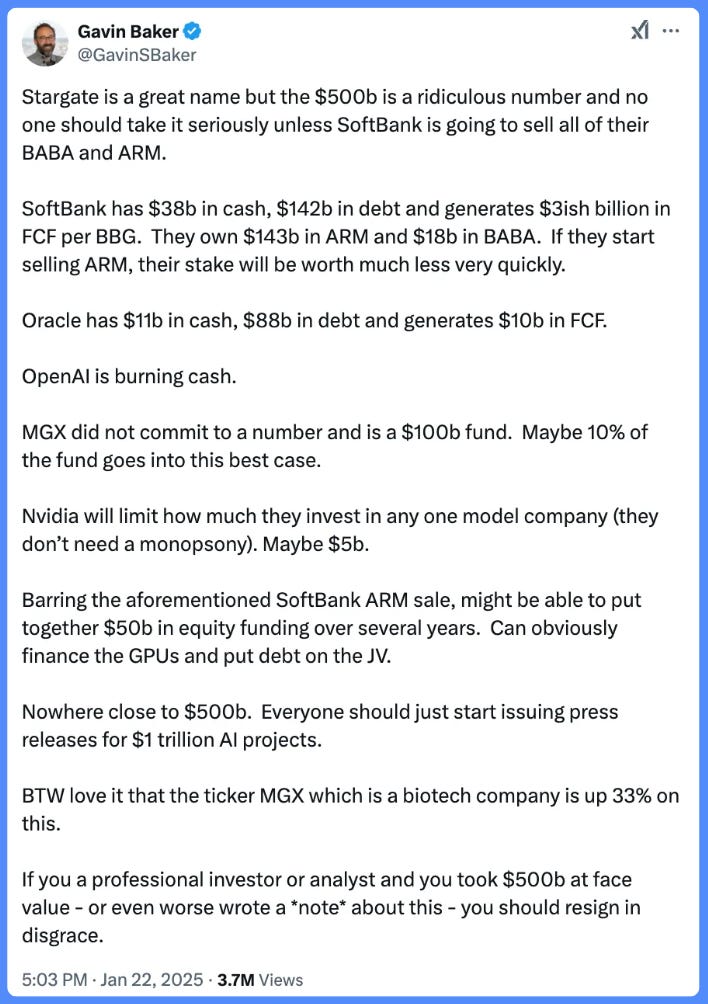

Stargate: OpenAI’s $500B Infrastructure Bet

OpenAI’s announcement of the $500B "Stargate" AI infrastructure project, with $100B to be deployed immediately, has raised eyebrows. Tech collaborators like ARM, Microsoft, NVIDIA, and Oracle are involved, with SoftBank leading the funding. The goal is to build U.S.-based AI infrastructure to boost re-industrialization, national security, and job creation. The project will begin in Texas, with plans for expansion.

OpenAI says, "This will drive innovation in AI and AGI for humanity’s benefit."

However, the $500B figure seems unrealistic. SoftBank, with its $38B in cash, $142B in debt, and substantial stakes in ARM and Alibaba, would need to sell off assets to fund such a massive venture. Oracle and Nvidia also face limits on how much they can contribute. Realistically, they may only manage $50B in equity over several years, making the $500B target highly questionable.

In the grand scheme, the hype around such enormous AI projects is exaggerated, with industry experts skeptical of the true feasibility of these numbers. Instead of chasing billion-dollar press releases, investors should focus on more grounded opportunities.

The Trade Deficit and SoftBank’s US Dollar Game

SoftBank's ability to fund projects like Stargate is heavily tied to the US trade deficit. When foreign countries buy American exports, they accumulate US dollars. In turn, these dollars are invested back into US assets, creating a virtuous cycle that benefits both the US and foreign investors. While some see the US trade deficit as a negative, it essentially strengthens US dollar dominance globally, making it a key driver of capital investment and liquidity.

Through this trade surplus, the US enjoys a favorable position, receiving goods like Toyota cars today, while offering promises of future returns in the form of stocks and bonds. This ongoing flow of foreign capital keeps the US economy humming and drives up asset values.

May your Monday be filled with coffee & profits.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!