Hey!!!! It’s Monday again. Welcome to another fantastic week!

I spend hours reading, researching, and talking to the smartest founders and investors in macro, crypto, and AI every week. This is my attempt to give you a short 5-10 minute summary on how I am thinking about the macro and crypto markets and what lies ahead. Hundreds of hours summarized, so you don't have to.

For live updates, you can join our Telegram channel or listen to the experts that we bring on our podcast, 'Greed is Good'

Novelist Ernest Hemingway on acting with confidence while living with humility: "Be humble after but not during the action."

Source: The Art of the Short Story, The Paris Review Via James Clear

TL;DR

Zeitgeist - Animal spirits reined in, amid massive uncertainty as Donald Trump takes over

Macro - Inflation is stubborn, jobs are wobbling, and Hitman Powell shifts from "dovish" to "hawkish caution."

Stocks, Bonds, Fx - Uncertainty

Crypto - Bloodbath continues as US Govt. sells (or does it?)

AI - Unstoppable

The Market Zeitgeist

Tariffs, Trump & Triumph

Last week we covered in length on Tariffs. We said:

This seems like the perfect moment for Trump to dial down the rhetoric—a strategic move that could lend stability to the markets. That’s why his inauguration feels like more of a “buy the news” scenario, in my view. February holds the potential to be a standout month, likely driving the bulk of Q1 gains.

We also said that Trump is adding to uncertainty everywhere—that was evident with the launch of $Trump coin. More on that craziness later. As far as tariffs are concerned, we have three choices (again from last week).

Option 1: The Shock-and-Awe Strategy

Trump could surprise the world with sweeping, massive tariffs. While this isn’t my base case, such a move would send the markets into a tailspin. The DXY would skyrocket, while emerging markets would feel the pain and likely “scream” louder than a child denied dessert. It would be chaos—pure and simple.Option 2: The Gradual Sword (Base Case)

A more likely approach is a gradual or targeted implementation of tariffs. Trump might selectively apply increases to specific categories, keeping markets in a perpetual state of uncertainty. This is like living under the constant threat of a sword hanging by a thread—nerve-wracking and difficult to navigate. Trading in such an environment would feel like playing chess on a moving train.Option 3: The Art of the Bluff

Alternatively, Trump could do what he does best: keep everyone guessing. By issuing threats without immediate action, he may seek to unsettle adversaries and buy time. This would mirror his previous presidency, where summer surprises were the hallmark of his tariff strategy. In essence, it’s the geopolitical equivalent of tossing a lit firecracker into a room just to watch people jump.

The question is:

How to Play Tariff Day

First some basic observations:

As discussed over the last 6 months—MACRO IS GOOD. CPI came in softer last week, and the FED hinted at further cuts again. Remember, every nation wants a piece of the American pie—stocks, ventures, or retail consumption. That is a good negotiating start for Trump.

Trump is not only going after arch-rivals but also best friends in Canada, Mexico, and now the UK/Europe.

Trump needs more revenue and less deficit to become the president who solved the debt crisis. A legend.

It is easy to threaten Canada or Mexico when they are in deep debt, but China is a different beast. I suspect they have been selling bonds (hence yields are going up), and they can sell more to defend their CNY—which means expensive imports from China, a.k.a. inflation.

Based on above, my base case for Tariffs is:

Start with a global tariff on everyone of, say, 5% or 10%.

Gradually increase it for China, Canada, Europe, and Mexico (or whosoever has not supported him).

Consequences of such approach:

This will be generally bullish.

Everyone will come to the table and negotiate "something" within a month or two.

Yields will go down, and the USD will go down with it.

All this while, Trump is singing "How about 'Money, Money, Money'" or pumping another coin. :P

How to play these Tariffs then?

Long risk assets - stocks and crypto generally

Short USD, Long bonds (short yields)

Neutral Canada

Long China equities

Neutral to long Gold

DATA TO WATCH

January 20 - U.S. Presidential Inauguration

January 29 - U.S. FOMC Interest Rate Decision

January 31 - BTC CME December (BTCF25) Options Expiry

February 25 - FTX Preliminary Distribution Repayments Begin

MACRO SUMMARY

Market awaits tariff clarity - and direction

STOCKS, BONDS & FX

Not much to share in this section this time, but expect more updates in the next week.

CRYPTO

The Oval Office of Memecoin President

Just hours before Trump’s Inauguration Day, the President of the USA launched a memecoin called $TRUMP.

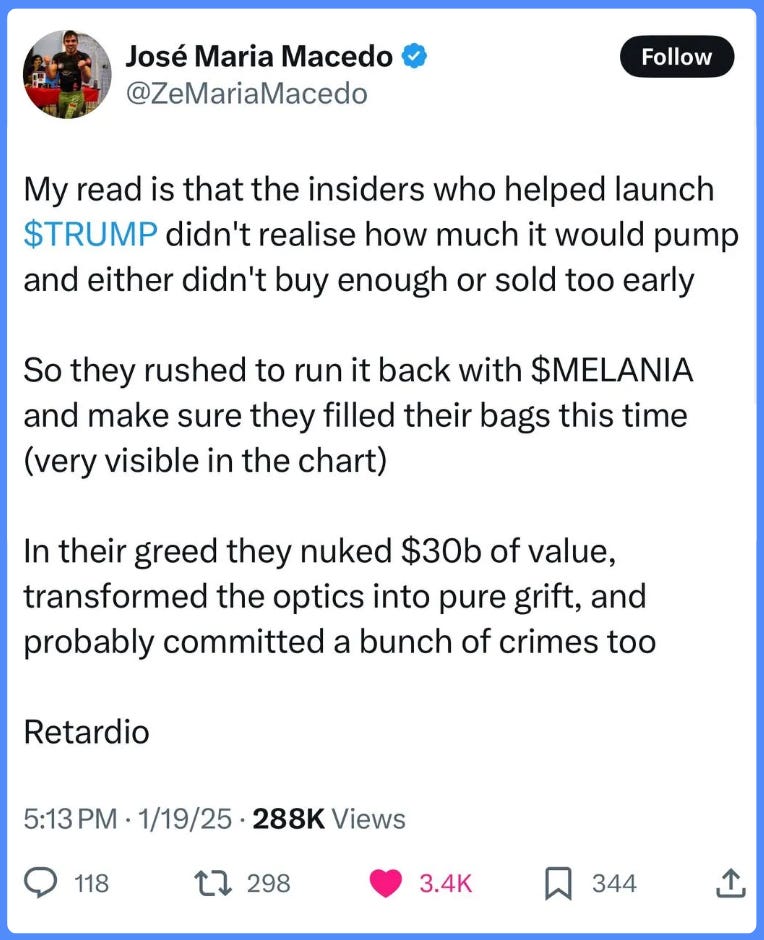

For those who have not seen it yet, Trump launched his own meme coin that exploded right out of the gate and reached a market cap of over 80 billion USD before insiders took profits and it tanked to USD 50 billion, thanks in part to his sweetheart launching another coin and liquidity flowing to $Melinia.

It will certainly drive polarization and volatility within the crypto space.

It already is driving Coinbase app downloads all over the world.

This also clearly demonstrates that we are not in a bear market, and also not very close. We might be close to the top, but there is no evidence yet.

Usually, the highest-risk assets don't pump into the top; they get shot down one by one, and the indexes keep grinding higher because of big market cap names.

At least that's how 2000 and 2021 played out.

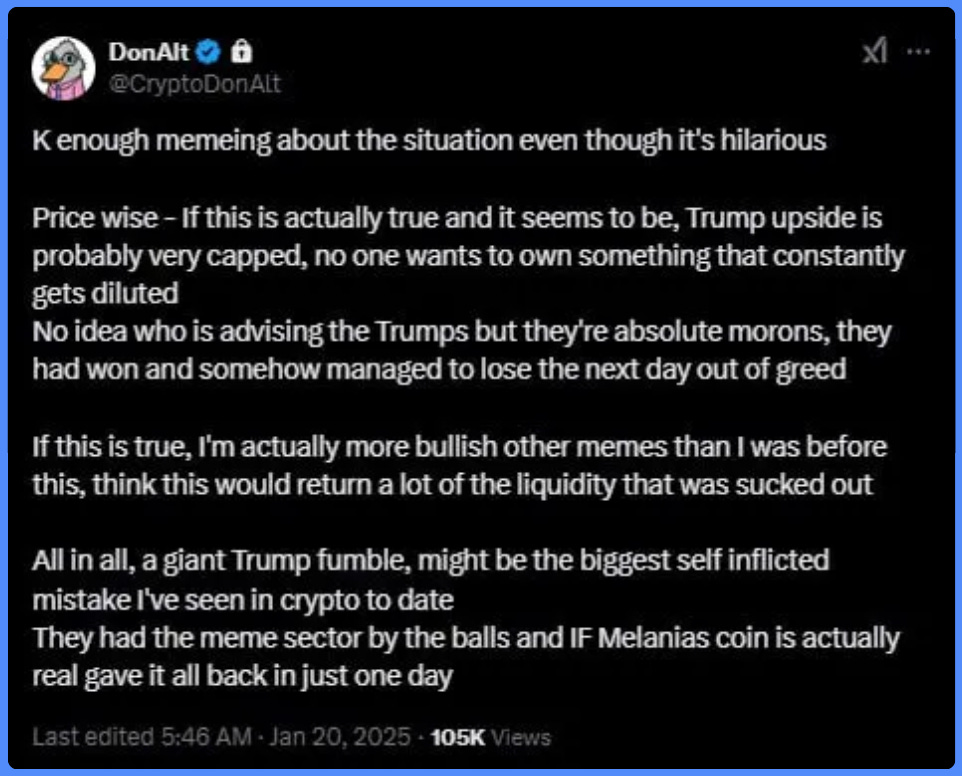

CT is split on this—some calling it the most absurd moment in crypto, and some rejoicing about how bullish this is for crypto. We are enjoying it on the sidelines as $Trump was followed by $Melinia, and now I hear $Barron, $Ivanka, $Tiffany, and what not. LOL

My first reaction was, this cannot be true. A US president cannot just launch a coin, but then we have been listening to several conspiracy theories—some present here.

Meanwhile, this is how most crypto degens are feeling right now. Not even funny

Bitcoin Strategic Reserve

Before we get onto those coins, though, let's have a quick look at something that people are expecting to hit the news soon. I'm talking about none other than a US Bitcoin strategic reserve.

There are now multiple news outlets and reports going around saying that Donald Trump is going to issue multiple executive orders on day one. Many expect one of these to be related to crypto, and specifically the creation of such a Bitcoin strategic reserve.

Would that be a good thing for the industry?

Of course, it would be a good thing; it would solidify the legitimacy of Bitcoin and potentially the whole of crypto worldwide as more countries pile in to follow the trend and make their own. What happens after that, though, is anybody's guess. Some are saying that major news is a top signal and we are approaching the end of the cycle. But at the same time, it's one of the biggest things that's ever happened to crypto…

So, let’s think back. What was the biggest thing that happened to crypto in the last cycle?

Most would agree that it was Tesla (TSLA) announcing that they had bought Bitcoin, putting it on their balance sheet, which opened everyone's eyes to the New World where companies would flood in and buy the orange giant. The bull market was sent on a euphoric trajectory, which inevitably led to its collapse. Sure, there was one more pump at the end of the year to send it all off, but inevitably, it came to an end. Let's have a quick look at the timeline of Tesla buying.

Feb 2021: Bitcoin surged past $44,000 post-Tesla's $1.5B buy.

March 2021: Hit $60,000+ with institutional interest.

April 2021: Peaked at $64,895, then volatility set in.

May 2021: Dropped to $30,000 after Tesla's payment halt and China's crackdown.

June-July 2021: Fluctuated between $30,000-$40,000.

Nov 2021: Reached new highs near $68,789 with ETF anticipation.

Q2 2022: Tesla sold 75% of holdings; Bitcoin at $18,700 amid downturn.

So, as you see, things peaked in April before tumbling down in May. Let's not forget there's also the whole "sell in May and go away" thesis, which seemed to play out very nicely (or badly, depending on your perspective) in May 2024, leading to multiple months of sideways action. So:

Could ‘the countries will all FOMO in’ be the new ‘the companies will all FOMO in’?

Will history rhyme, with the bullishness dying out come May?

Some food for thought there. Then again, that's just a hypothesis after an examination of past data, and none of this is financial advice. You all need to do your own research.

A US Bitcoin strategic reserve would see the country purchase about 1 million coins over five years, according to what we know up to now. The idea has gained support from the industry, including Brian Armstrong, the CEO of Coinbase (COIN).

But with everybody expecting it to happen, what will be the case if it does not get announced? I think you know where I'm going with this.

All eyes will be on Donald Trump's inauguration as the next US president today, and they will be gripping onto his every single word. The crypto community will be expecting cryptocurrency to be mentioned, and others with their own interests will be expecting theirs to be spoken about. Not everything revolves around crypto, after all.

It's interesting to think about whether Satoshi Nakamoto could've ever dreamed of this day coming when he created Bitcoin. He would probably be proud; however, he might not be so proud of the following…

LET ME GIVE YOU MY TWO PENCE HERE - THIS IS ALL VERY BULLISH FOR CRYPTO, AND YOU CAN SEE THAT IN THE PRICE OF $BTC AND $SOL - OUR TWO LARGEST HOLDINGS. JANUARY HAS ALREADY BEEN A GOOD MONTH. NFA, DYOR.

Narratives vs Fundamentals - Good thread

West World x AI

I strongly recommend you watch Westworld on HBO Max. I am watching it for the third time. How robots are going to take over the world. #westworld

Discovered a great newsletter this week—worth a read!

Macro Mornings is a must-read if you want to understand how macroeconomic trends shape the markets and your investments. Highly recommended!

May your Monday be filled with coffee & profits.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!