Hello. Thanks for reading. I’m Sankalp. You can join our telegram channel here for more macro & crypto live updates

I spend hours reading, researching and talking to the smartest founders and investors every week. This is my attempt to give you a short 5-10 minutes summary on how I am thinking about Macro & Crypto markets and what lies ahead. Hundreds of hours summarised, so you don't have to.

You can also hear more detailed thoughts on our podcast “Greed is Good” - with myself Sankalp Shangari & my co-host Geoffrey Chen. Make sure you tune in.

Don't sit down and wait for the opportunities to come. Get up and make them." — Madam C.J. Walker

TLDR;

Macro: Jobs data revised, looking bad

Stocks & Bonds: Tech is ripping

Crypto Majors: Selling & consolidation, time to DCA

Altcoins: Pick winners, and their betas

Crypto Narratives: Exhausted for now

1️⃣ The Big Macro Picture

Economy is Slowing but we have FED to save us

Last week we highlighted that only two numbers matter to FED: Core PCE and Jobs.

While things look rosy on the surface, jobs are dealing at a massive pace. If you read between the lines, its even worse with May jobs revised downward from 272K to 218K and April from 165K to 108K.

Thats utter nonsense if you ask me. As if numbers means nothing. Let's revise them when after 3 months no one is looking.

Bottomline: Unemployment is rising fast.

However, fear not, FED knows that. And we stick with our base case of first rate cuts in September, just before the elections. With every passing day, we are getting more sure. While that will not help the jobs conditions right away, but markets have a habit of running ahead of it self. And that is when you go all in.

July 11th - U.S. CPI forecast is for 0.1% M/M rise in inflation, while the annual core inflation rate is expected to be unchanged at 3.4%.

2️⃣ Stocks, Bonds & FX

Stocks - Markets are pricing a Trump win

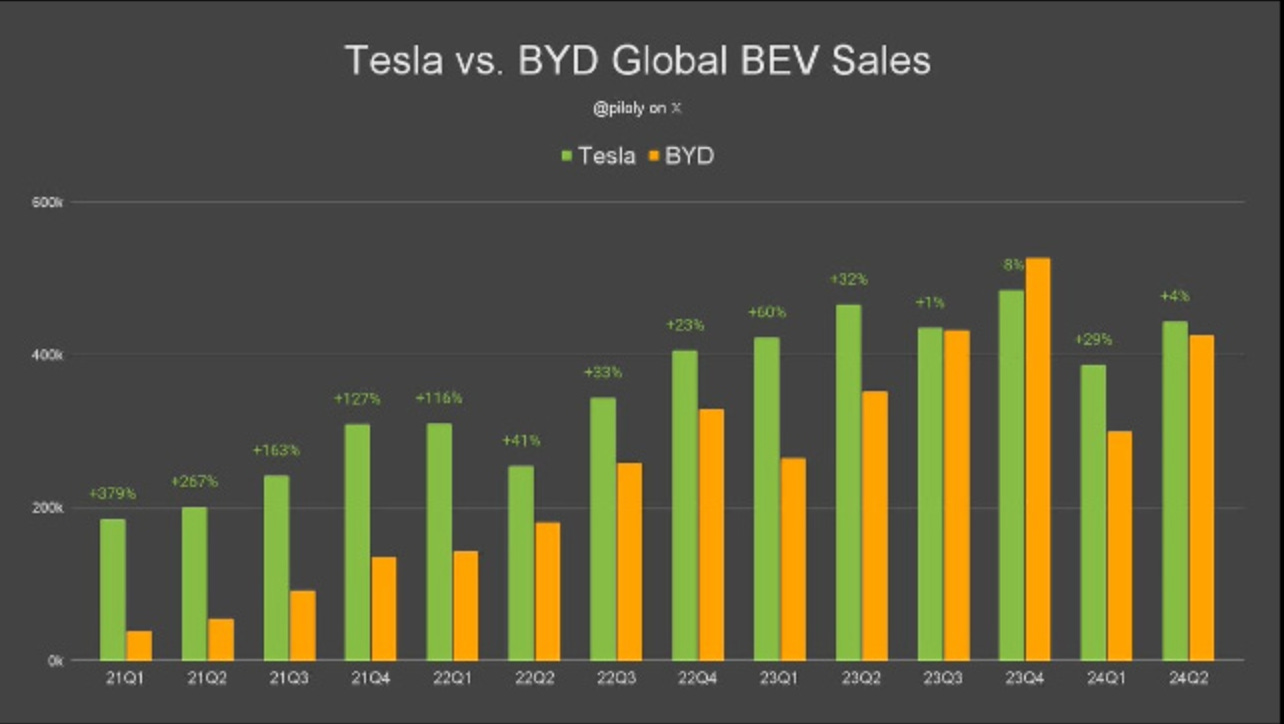

With losing out to BYD only in the last quarter of 2023. Tesla has bounced back up and taken charge in the Global EV sales in the first two quarters of 2024. Leading to huge price rally for Tesla recovering all the loses for this year from going down to $148 in mid April to crossing the year opening price of $248

If NVDA was a country it would be the biggest country by market size in the whole Europe. The only countries with national stock markets worth more than Nvidia were India, Japan, China, and, of course, the U.S.

Debt- US Debt is still rising faster than GDP growth, even in good economic times.

Even Fed Chairman Jay Powell is starting to publicly worry about this:

“You can’t run these levels [of deficit] in good economic time for very long” and “[there are risks in] running a very large deficit at a time when we are at full employment”.

The government appears to be trading increased debt for economic growth. Providing a short-term economic boost, but raises concerns about long-term financial stability. How sustainable is this strategy? What are the risks of it ultimately leading to a dead-end?

And the yields are rising continuously……..

3️⃣ The Big Crypto Picture

Time to DCA

Bitcoin nose-dived as Germany, the US, and Mt. Gox dumped - atleast that is what the highlights made your believe. We are around 55K, that is 25% below its ATH. This caused one of the largest BTC Liquidation, totaling over 13,000 Bitcoin.

Along with BTC every other coin has taken double digit hit in the last week with global crypto market cap falling to 2.1T

SOL being the only outlier, it continues not to fall as fast as others, and it rebounds faster.

On the technical front, $58,500 has now become the new resistance for this week and in the longer term time frame new supports stands at 52,500

Ethereum ETFs are set to go live this week. Thea German government, Mt. Gox, and the US government hold no $ETH. The supply on exchanges is consistently falling with no sell pressure from miners. This could have a significant positive impact on the price of ETH once the ETF launches.

Remember, not financial advice, do your own research (DYOR). You know the drill.

Altcoins - You get down, you get up again, you cannot keep me down

Over the last seven days, it has been red across the board, with the exception of Tron.

KAS has emerged as one of the top-performing coins in the top 100. It recently reached a new all-time high but was once again rejected just below $0.20.

Apart from Shiba Inu & Dogecoin all the memes are down in double digits, so could be a good buying opportunity to start DCAing in memes like WIF, PEPE, BRETT

During last week's market downturn, SOL demonstrated the most strength. DCAing SOL beta plays could be a good play in projects like Raydium, Jito and Pyth Network.

TON looks to be one of the best pick where most of the market is down 20%, TON has only 1.92% in last month. TON & it’s ecosystem plays could be great bet as the demand of TON ecosystem keeps on increasing.

AVAX has shown unexpected strength this week, possibly influenced by SOL's strong performance and the potential for an ETF. While an ETF for SOL is unlikely, its success could pave the way for AVAX as a potential candidate.

Crypto Narratives

With the market in shambles last week no new narratives have emerged still Degens are gambling money into Memes yet again. Kamala Harris memecoin surged 250% amid calls for Biden to boy out.

Infinex, created by the founder of Synthetix, has become the latest hotspot for degens. Since its launch, it has a TVL of $124 million.

SOL is the only coin that could drive the narrative of this bull cycle. Whether it will or not remains to be seen.