5-Min Monday Macro & Crypto: 10th June 2024

Inflation fears to growth fears, Stocks ATH, BTC range bound & Alts bleeding

Hello. Thanks for reading. I’m Sankalp. You can join our telegram channel here for more macro & crypto live updates

I spend hours reading, researching and talking to the smartest founders and investors every week. This is my attempt to give you a short 5-10 minutes summary on how I am thinking about Macro & Crypto markets and what lies ahead. Hundreds of hours summarised, so you don't have to.

We have a new podcast “Greed is Good” - with myself Sankalp Shangari & my co-host Geoffrey Chen. Make sure you tune in.

We will be releasing the podcast on a weekly basis to cover all things macro and crypto. You can listen first two episodes here on Spotify

“It's never the right time, but right now is usually the best time." - James Clear

1. The Big Macro Picture - Inflation Fear to Growth Fear

TLDR:

Economic Overview

Headline: Last week's non-farm payroll numbers were strong, but JOLTS and Kansas City indicators showed signs of weakness.

FED Outlook: We seek more clarity post FOMC minutes regarding potential rate cuts. The FED Dot Plot should reveal the extent of their dovish stance. More cuts indicate greater dovishness.

Prediction: Our base case is for the FED to hold rates steady but start sounding more dovish than before as economy starts to show signs of stress, implying rate cuts sooner rather than later. Recent rate cuts by the ECB and BoC bolster this view.

Market Response: Markets will be muted IMO and slowly grind and coil for rest of the summer.

Pre-FOMC Positioning:

Stocks: No great setup for stocks but buying cheap quality stocks

Crypto: Presents a better risk/reward ratio at current levels. Keep stops tight with BTC support at 66K.

Macro Commentary

Mixed Data: The US economic data was very mixed. On the bright side: sticky wages, resilient GDP (Atlanta FED at 3%), persistent global inflation, strong job growth (NFP at +272K, payrolls at +229K), and rising home prices (Case-Shiller at +7.4%). On the downside: falling ISM, weak consumer numbers from retail sales, fewer jobs via JOLTS, and higher delinquencies.

Conclusion: The economy is growing but slowing.

Upcoming Events:

10th June: Apple WWDC

12th June: FOMC meeting

12th June: US CPI release

Quick Macro Summary for TikTok Brains:

Slow growth but a strong economy favoring quality assets, awaiting direction post-FOMC.

What’s coming this week:

10th June: Apple WWDC

12th June: FOMC meeting

12th June: US CPI

Quick Macro Summary for the TikTok Brains:

Slow growth but strong economy favouring quality assets, awaiting direction post FOMC

Stocks - Kitty Roared and Bored, Cautious Optimism

Stock Market Shenanigans

Last week, stocks hit new all-time highs, buoyed by the belief that as long as Americans are employed, everything's peachy. People have jobs, so they'll keep borrowing, paying off debt, and spending their savings, even if interest rates are sky-high. But the big question is: how long can this merry-go-round keep spinning?

Roaring Kitty’s Wild Ride

Keith Gill, aka Roaring Kitty, made a splash with a $165 million position in GameStop (GME), sending the stock soaring. At one point, E-Trade, where Keith placed his trades, considered kicking him off the platform. I've never seen such a frenzy over a “deity” before. Even my non-crypto friends, who usually steer clear of such antics, were glued to his livestream with their own GME positions.

Kitty, who came onto the livestream seemingly tipsy, almost hit billionaire status if GME had touched $69. It peaked at $67.76 before crashing down to open at $38 the next day—a classic case of what we call a "rug pull" in crypto terms. Authorities were ready this time, and hedge funds had their defenses up. Keith might find his fan base shrinking as the allure of memes that don’t make you rich fades away, leaving many holding the bag, hoping for another surge.

Nvidia’s Nuances

What really has me worried is Nvidia’s CEO, Jensen Huang, who adopted the Rule 10b5-1 trading plan on March 14 to sell up to 600,000 shares through March 31, 2025. And now he’s out there signing boobs. Is this the peak for Nvidia and AI? Keep a close watch, book some profits if you're invested in AI, and play it safe until the dust settles.

Bonds, Fx & Rates -

Interest Rate Outlook:

Rate Cut Timing: With higher-than-expected NFP numbers, markets are not pricing in a June or July rate cut, and neither are we. We don't foresee a FED cut until at least Q3. NFP job gains are robust, and inflation is sticky but controlled. We are in a "higher for longer" regime for a few more months. The focus has shifted from inflation fears to growth fears. SOFR Rate cut expectations have been trimmed from 4 or 5 at the beginning of the year to 1 or 2 now. There is no recession but clearly growth is slowing.

FOMC Prediction: Powell is unlikely to change anything this week. However, weaker data, summer caution, election caution, and growth caution will likely lead markets to adopt a more defensive stance until more rate cuts are priced in.

Global Perspective: Central banks abroad have begun cutting rates (BoC, ECB), but sticky inflation may limit further cuts in the EU.As stated above, macro is a mixed signal. I am not sure which way we will go and I am ok with that sometimes not being sure of direction. We have plentiful data this week and that should give us a proper direction.

Rates Unchanged: Even after Friday NFP, nothing much has changed for bonds. I believe we have seen peak rates already.

Strong Dollar: DXY is still relatively strong, nut as the markets start to price rate cuts, we should see dollar trades lower and risk assets get a bid.

2. The Big Crypto Picture - Awaiting New Liquidity

Majors - Higher ETF inflows, but lower prices

Hedge Funds’ BTC ETF Manoeuvres

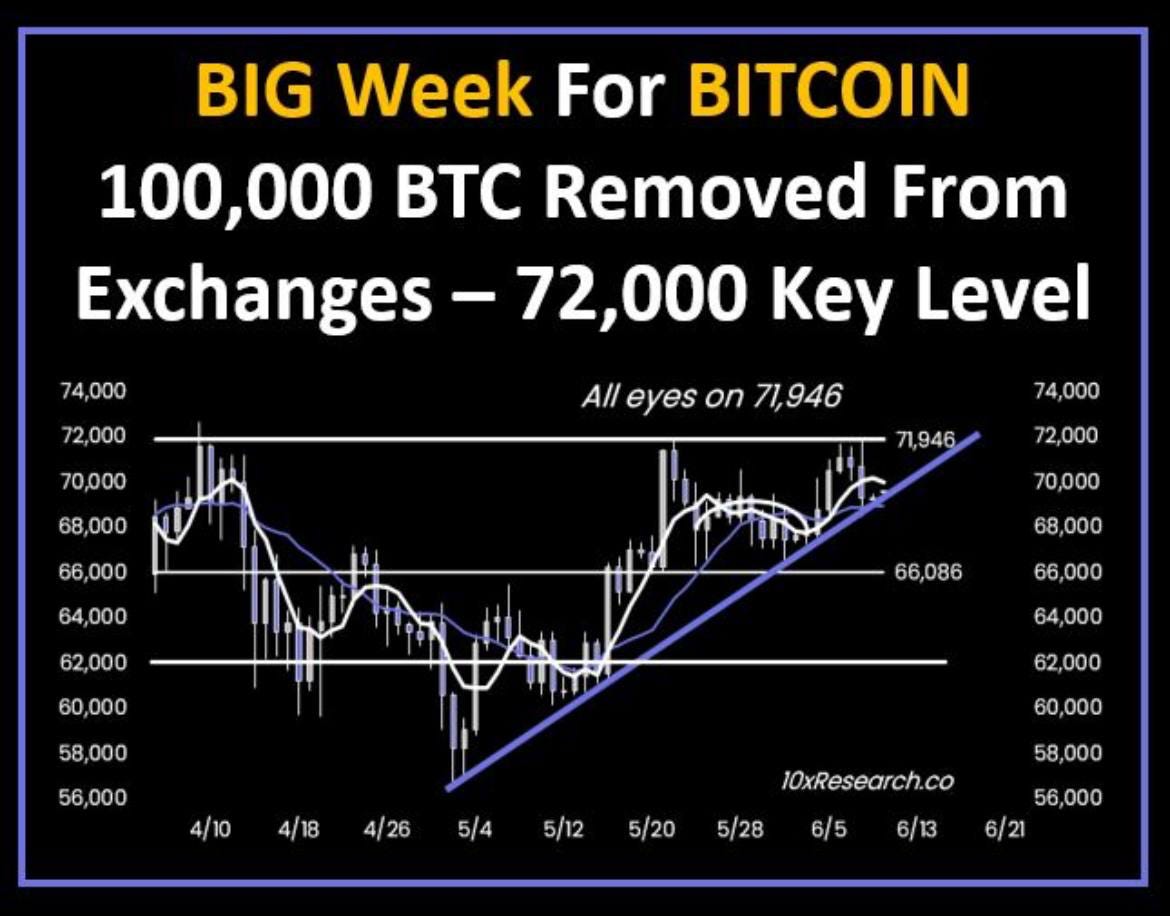

One thing that keeps me scratching my head is the record Bitcoin ETF inflows over the past month, yet the price remains stuck in a tight range between $66K and $71K.

What’s really going on here is a bit of financial gymnastics. Hedge funds are taking massive short positions to hedge their ETF longs, pulling in about 1% arbitrage per month, minus borrowing fees. In other words, these ETF flows aren’t what they seem.

As we edge closer to the FOMC meeting every month, with open interest in BTC futures at its peak, late longs are getting flushed out. Last week we saw BTC slide to $69K ($67.5K now as I write), triggering a wave of liquidations throughout the crypto world.

Once we get clear signals from the FED, I expect hedge funds to dive back in. Bitcoin remains a leveraged play on the NASDAQ, so institutional demand will stay robust as long as the NASDAQ is thriving. I predict the Fed will start cutting rates within the next 2-6 months, joined by other central banks. With that outlook, I’m not bearish on BTC. Instead, I plan to buy cheap out-of-the-money calls when volatility is low.

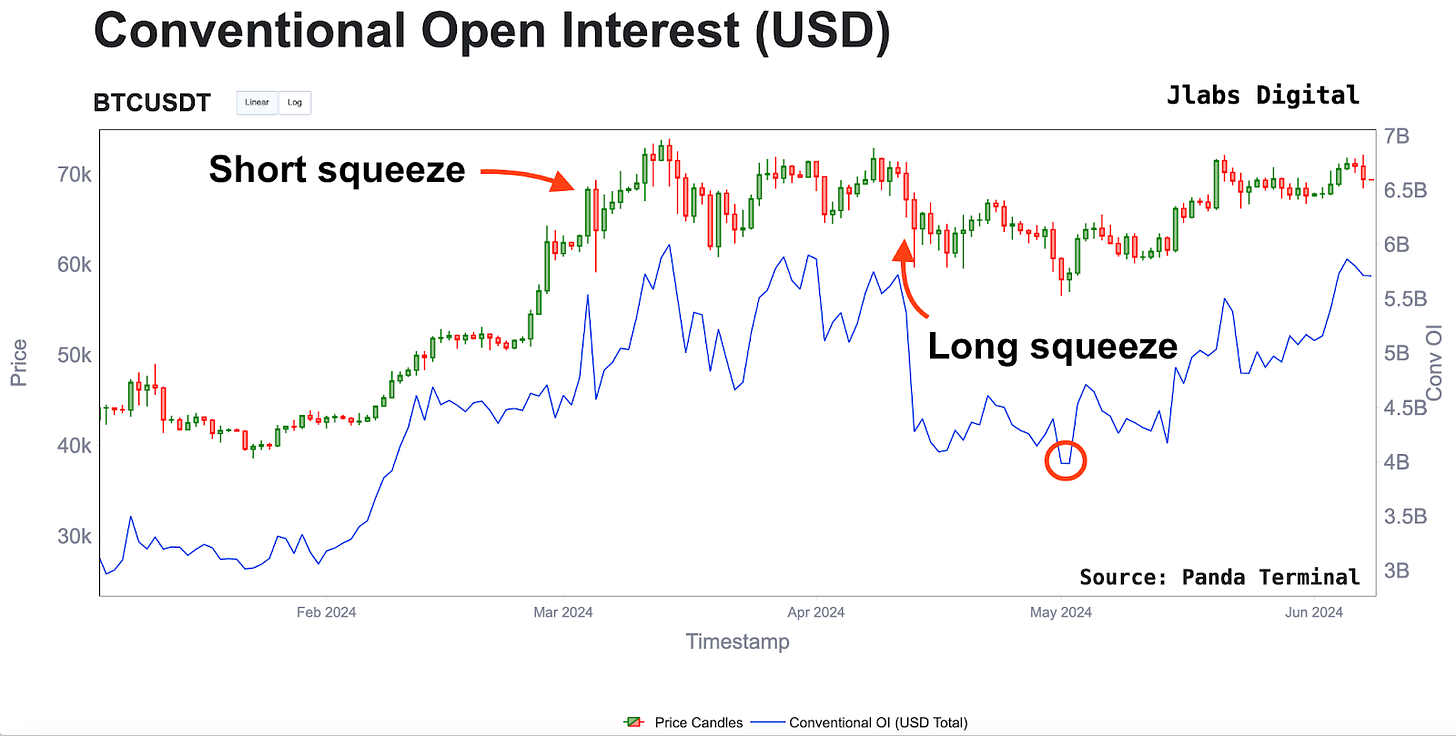

Check out a great piece from our friends at JLabs, highlighted in their newsletter Espresso, that delves into this phenomenon in detail.

It says:

Due to this overall lack of demand in both directions the options market has turned into a one-way street.

Many are looking to sell options and harvest premiums, and very few are willing to take the other side of that as directional owners of volatility.

This is surprising.

In fact, we don’t see a single contract, even the furthest dated ones for March 2025, trading above 70. We can see this in the term structure chart below which plots the IV for contracts at the money for each expiry.

ETH Enthusiasm and the Staking Conundrum

Something that's been bugging me is the over-the-top excitement around ETH ETFs. Why would ETH holders, who are comfortably earning 3-4% from staking and even more from restaking, shift to ETH ETFs and forgo that juicy 5-7% yield? ETH ETFs don’t offer those dividends—at least not yet. I’m sure BlackRock and their pals, working with Coinbase, will find a way to skim off that yield as a proxy, without passing it on to ETF holders, as long as they can. That means ETH ETFs are coming sooner than you think, but initial euphoria will die down once smart money realises that they

I’m open to ideas here, so please share your thoughts. I get that ETH ETFs are a shiny new product and easy to trade, but smart money doesn’t let even 10 basis points slip through their fingers, let alone 500 basis points. When the ETH ETF launches, it might just be a classic "sell the news" event.

Feel free to reach out with your thoughts on this! Let's figure out if there's something we're missing or if this enthusiasm is just hot air.

Alts & Narratives - Kicked but await BTC direction

Current narratives: Celebrity memecoins on SOL $MOTHER & and Andrew Tate’s coin $RNT

$BRETT on Base hit 1bn this week

$BNB reached a new ATH at $720 and now down by $100 to $620. Crazy perps

RWA coins like $ONDO, $PENDLE are good spot buys at these levels IMO. NFA, DYOR

3. Trades & Positioning

Long on Quality Stocks

Long on BTC & Majors

Keeping some cash handy for quality mid-caps and altcoin opportunities in the next 30 days.

Until the liquidity faucets start flowing again, my game plan is to stick with high-quality stocks, top-tier crypto majors, and a select few quality altcoins or memes. Especially if the sale continues over the next month.

Why do I think this?

After six months of market euphoria, I suspect we’re in for a bit of a bumpy ride. Valuations are sky-high, the economy is slowing, and a summer correction is always lurking around like a nosy neighbour.

Remember how we were all freaking out about inflation back in January? Well, now we’ve moved on to fearing a growth slowdown. The market’s "animal spirits" are getting a bit weary, and buzzwords like Memecoins and AI are starting to cluster around just a few big names. Better to buy them cheap instead and think long-term.

No new capital is likely to enter until the Fed eases up. Earnings expectations are through the roof, but nominal GDP could slow to a crawl.

Don’t freak out. There’s no major crash or drastic pullback on the horizon, just a bit of cautious optimism. We’re still in an overall bull market, but the risk-reward ratio isn’t as sweet as it was six months ago.

So, keep calm, invest wisely, and maybe treat yourself to a little ice cream while you watch the markets. It’s going to be an interesting ride!

4. Most Interesting Stuff This Week

Rollup dot wtf (rollup.wtf) and displays a list of active rollups and their respective metrics (stuff like TPS and block count). Top three rollups by TPS are Arbitrum One, Base and ProofOfPlay. I dont know that last one

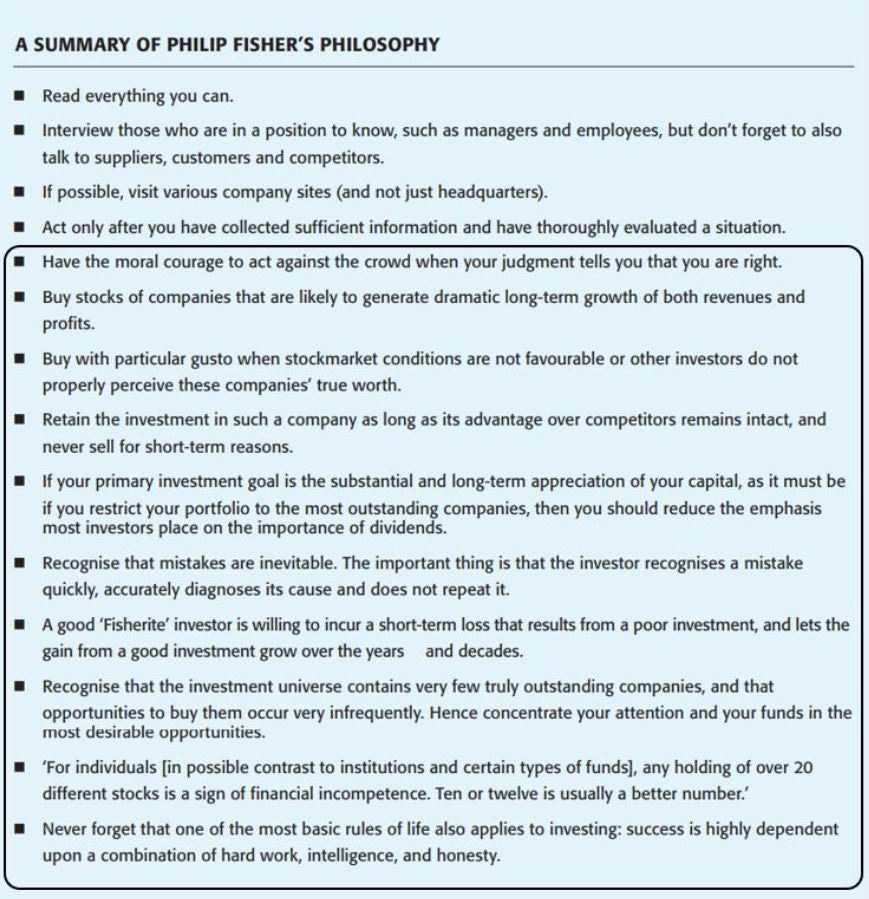

Phil Fisher’s’ Investing Philosophy

Have a fun week. Drop me a line if you have any questions on Macro or Crypto.